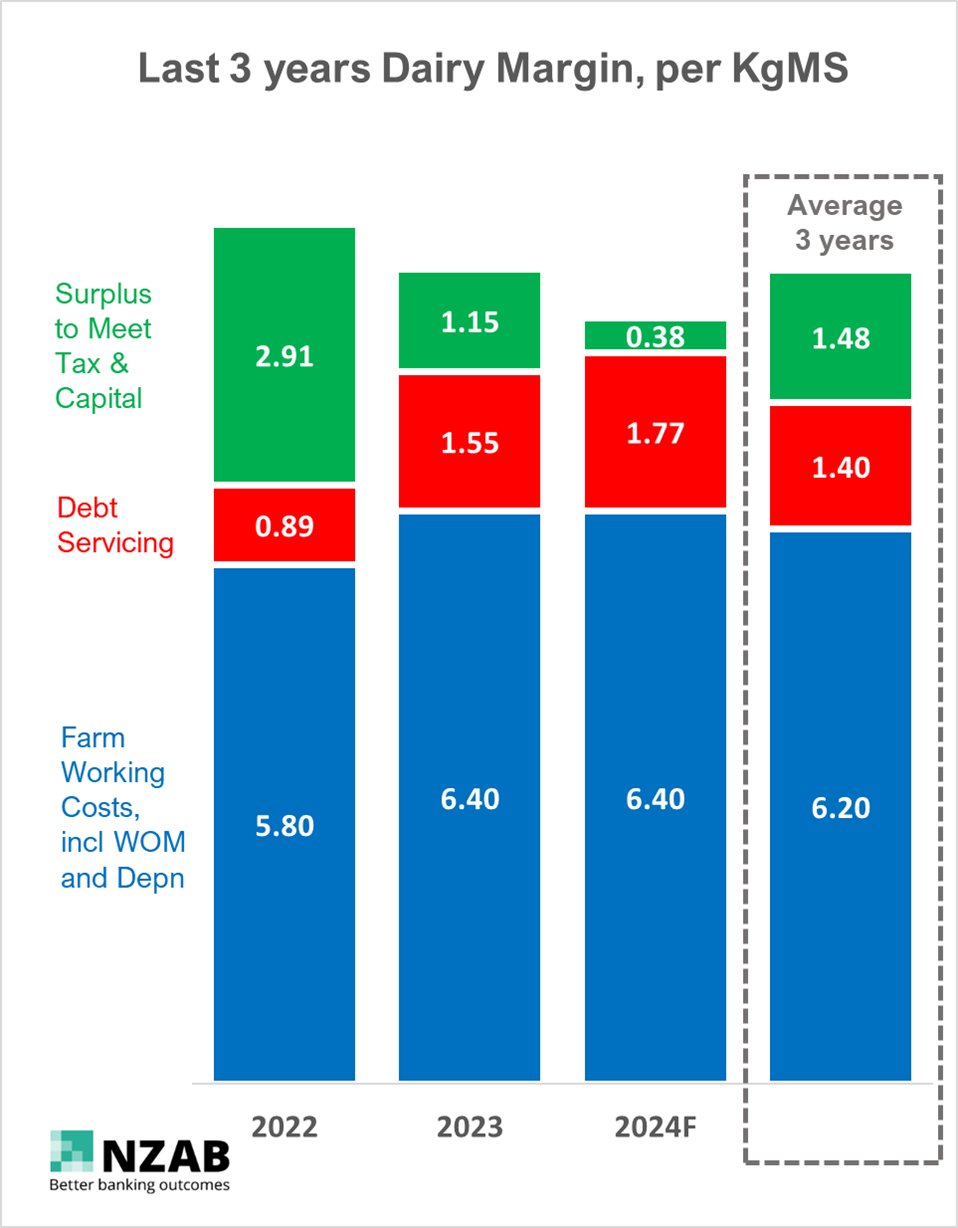

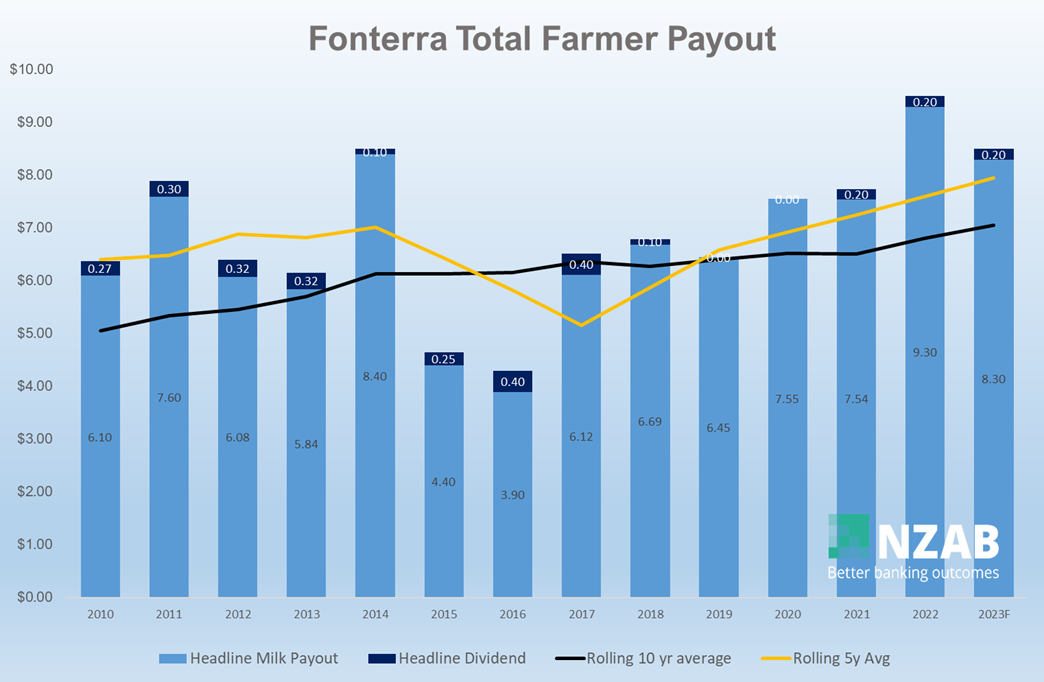

Most of us in the industry are again catching our breath and digesting the impacts of a significant reduction in dairy payout for this season. The impacts of this are quite real.

But we have been here before. Ironically, this has become a bit easier to navigate now, because we have gone from an environment where only a few farmers were struggling to make the budget work, to one where most will require additional financial support. This is now an industry-wide issue.

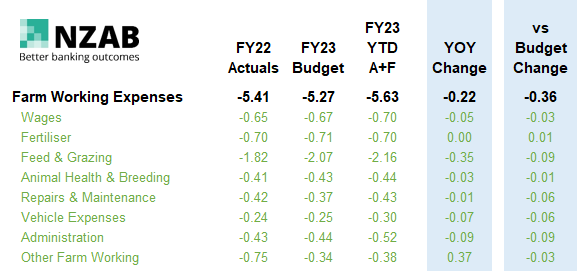

The Banks are continuing to support their clients but need to see a proactive approach to managing costs and minimising losses. You can assist this by demonstrating that you’re in control and are making quality and timely decisions.

Fundamentally, good businesses will remain good businesses. We’ve already seen significant reductions in costs from where they were earlier in the year, and we expect to see businesses bounce back quickly from this.

But for now, here’s the plan of attack:

- Face the realities. Reforecast the cashflow now and get a clear understanding of the impacts. The first critical piece of information required is ‘do we have enough cash’? If not, when do you run short, and by how much? Get this in front of the bank as soon as possible. You’re not looking to have all the answers at this point but getting the ‘worst case’ out on the table quickly helps to frame up the size of the challenge in front of you.

- Make a list of the areas to investigate where you might be able to cut or defer costs. Turn this into an action plan. What are you considering, what could it save in the short term, what are the long-term implications of making these changes? Give this to the bank along with the cashflow above.

- Keep acting with confidence. We know that the payout and market conditions can change quickly, so you need to keep focusing on the key activities to ensure we are positioned to spring forward out of this situation when the opportunity arises.

- Once you’ve developed a more detailed plan, sit down with the bank, and review it. The bank will take comfort from this process and will be able to best support you knowing that you’ve considered all the options and developed a logical plan.

- Keep it all in context. Most dairy farmers have made significant inroads into principal repayments over the last 3 – 4 years. Make sure you outline the cash required this year in the context of your overall progress in the last few years.

We know that these major shifts in payout and profitability are massively unsettling. There’s enough out there in farming right now to challenge us without the overlay of making a loss. The most important thing to do is look after yourself, your family and your fellow farmers. Everyone deals with these challenges differently, but make sure you support each other.

If you’re not sure how to cope, or what you can do to manage this situation, reach out for help. Ultimately, we will get through this and out the other side, and we’ll learn a few new skills along the way.

We’d love to help. We’re all about better banking outcomes, so if you want to review your business to understand where you might sit, drop us a line today on 0800 692 212, email us directly, or fill out this form and we’ll be in touch.