The underpinning Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

We help manage some c. $3bn of NZ Farming and business loans across NZ so we get to see the picture across all the banks and other funding sources. This gets our customers the best outcome for their farm or business funding.

With all our customers, we are continuously having discussions about managing their interest rates. In particular, this involves managing the drivers of that; the big ones being credit quality, market competition for their loans and also underlying base rate movement.

When we talk about “base rate movements”, we’re talking about the movement in swaps (being the general underpinning of a fixed rate) and the movement in the 90-day bill (being the general underpinning of a floating rate)

There’s a heck of a lot of change in both at present (check out our earlier article on the significant fixed rate differences we were observing between banks) so it’s always worth looking into some of the interesting things happening out there at present.

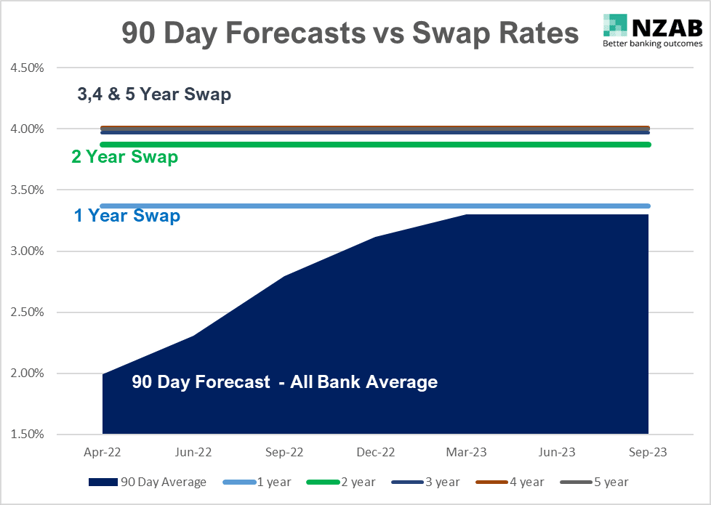

Case in point is this graph below.

This is a graph that shows the average of all of the four main bank’s forecasts (Westpac, ANZ, BNZ and ASB) for the 90 day bill out to September 2023 – at this point all bank’s think this will be the peak of the 90 day bill (The spread of the peak that makes up the average ranges from 3.10% to 3.60%).

We have then compared this to the swap rates for different terms from 1- 5years.

First, an explainer

- A fixed rate is made up of the underlying swap rate plus a bank margin.

- A floating rate is made up of an underlying 90-day bill (or sometimes, 30- or 60-day bills) plus a bank margin.

There are plenty more nuances than that, but let’s just keep this simple for now.

So, in a world where the bank margin is the same for both fixed rates and for floating rates (*1) then we can compare the two together to examine whether fixing versus floating is a good idea.

The other thing that is “generally” true about fixed interest rates is that they are often based on expectations about where the market for floating might eventually get to.

What’s really interesting about this graph is this:

Even though the floating rate (90 day) is forecast to peak (on average) at 3.30%, not one fixing option is lower than that peak.

The 1-year swap just starts intersecting with the forecast 90-day rate in 10 months’ time and the 2 – 5 year rates are much higher.

So why is this happening?

Well, reading recent snippets from bank’s' treasury departments, they commentate that there is a lack of liquidity in the market between buyers and sellers of these underlying fixed rate instruments.

To make them attractive enough to then be purchased, the swap rate then goes up – it’s a market after all.

But this inherent shortage of buyers means that the swaps market is becoming somewhat decoupled from future expectations for interest rates in the market.

And in turn, very expensive.

Keep in mind that the opposite could also be true

The flipside is that the bank’s forecasts may not have adequately priced in enough future interest rate increases. Effectively the swaps market is pricing in interest rates going to 4%- not 3.3% as per current bank forecast guidance.

This is an interesting time indeed – On the face of it, it would suggest (with all other things held equal) that fixing would be uneconomic.

If (and keep in mind this “if” is always a large “if” with any forecasts) the 90-day rate is forecast to peak under every one of those fixed rate options – why would you take a fixed rate at all?

However, whoever believed a forecast?

And please bear in mind this important message about interest rate risk management

Fixing interest rates is not about “picking” the best interest rate, it is also about risk management. Every borrower should complete a detailed risk management assessment before considering any fixed rate decisions – these assessments will be unique to each business.

*1 – Margins between fixing and floating products can vary – particularly longer dated fixed rates where they can be higher as banks can add more margin to manage uncertainty in their own future funding costs – see this article for more on this

If any of you would like a discussion on this or other things, including what we’re seeing in the interest rate markets between banks, feel free to drop us an email or call one of us on 0800 NZAB12

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz