Some big upcoming restrictions on new home loan lending, combined with banks’ natural desire to keep growing their book is going to mean that credit is going to look for a home elsewhere.

We think it’s going to be Agri.

So let’s set the scene with some recent bank jargon for you that is going to be talked about more and more.

- CCCFA regulations

- New DTI’s

- LVR restrictions

- Tax deductibility changes

- Brightline tests

The last three you would have all heard, but the first two are yet to impact. I’ll touch on them shortly – but to start with - guess what all of these measures have in common?

Well, they’re all designed to take the heat out of the residential market given the drastic house price increases of late plus win back the political football that housing has become of late.

And guess what - they’re starting to bite.

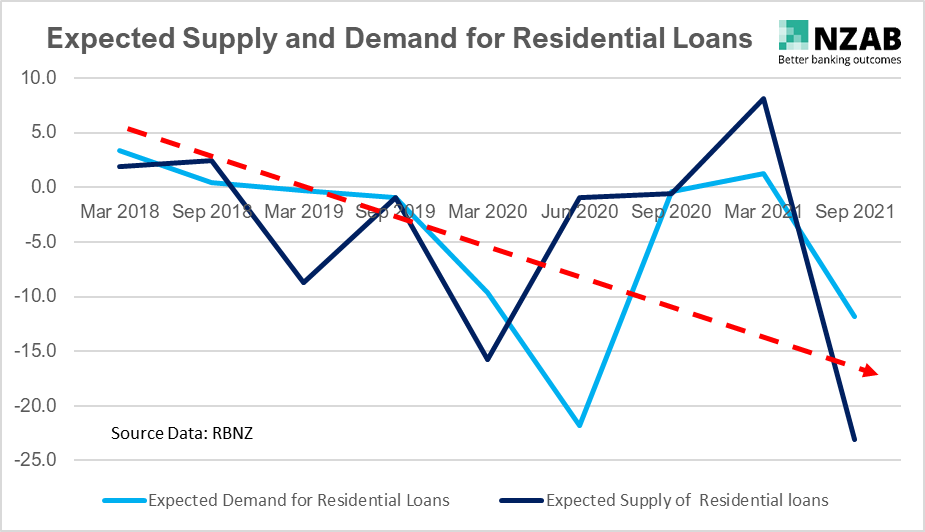

Whilst credit growth in the home loan sector is still increasing month on month it’s useful to look ahead at expectations for change in future.

One of the best gauges for those future expectations is the “Credit Conditions Survey”, conducted every six months by the RBNZ.

This survey is relatively simple the RBNZ asks banks what they expect both the demand and supply of credit in each of their lending sectors (residential, consumer, SME, Agri, Corporate) will be over the next six months.

They are sentiment based questions but given the banks do control the puppet strings of capital availability, its pays to take notice.

And the results are starting to show some very stark trends. The expected demand and more importantly, the expected supply of capital to the home loan sector is expected to significantly pare back over the next six months.

The data is a bit lumpy, particularly dating back to the initial confidence sapping of the first Covid lockdown in March 2020 (sharply down due to high economic uncertainty) and then the subsequent money printing that followed (sharply up due to increased supply of capital) – but the overall trend line is now sharply down.

So, why do the banks think that credit demand and supply is finally going to drop when all we’ve seen is the opposite in the last 12 months?

This is particularly noticeable given excitement and house price growth in the housing market is still at rampant levels and this is despite the removal of tax deductibility for housing investment and restrictions on LVR’s?

An easy answer might be that interest rates are going up.

Or it might be that the cure for high prices is simply high prices.

Or that FOMO (fear of missing out) is turning to FOPTM (fear of paying too much).

Whilst those things are definitely contributing, we think there are two more things that are about to bite much, much more over the coming year.

Firstly, “CCCFA” regulations (Credit Contracts and Consumer Finance Act) are finally starting to bite along with an outcome of those regulations being “DTI’s” (debt to income ratios).

Broadly, recent amendments to the CCCFA require from October 1 2021, lenders to place a much closer microscope over their prospective retail borrowers affordability of the loan.

Getting this wrong means significant fines for the lender.

In short, this means that when banks assess home and other consumer lending, there’s going to be a fine tooth comb over the applicants past spending. The outcome of which may mean the bank declines the loan, even if the LVR is very low.

A further outcome aligned to this is the introduction of broad-brush maximum debt to income ratios (DTI’s).

At least one bank has already introduced these into their home lending assessments, meaning that they are highly unlikely to support a home loan that is more than six times the gross income of the applicant.

For example, say you’re buying a house in Auckland for $1.5m and you have a household gross income of $100,000

Say you even have $750,000 cash (a whopping 50% deposit) to put towards it.

Despite your very low LVR, the bank is only going to give you a max of $600,000 to go towards it. Now that’s pretty limiting isn’t it?

But there’s an upshot to all this. As we know, Bank’s like to continue to grow – they’re a business like anyone else so fair enough.

So, if Banks are already having internal discussions and policy changes as result of this, what is going to be the impact on other sectors they lend to?

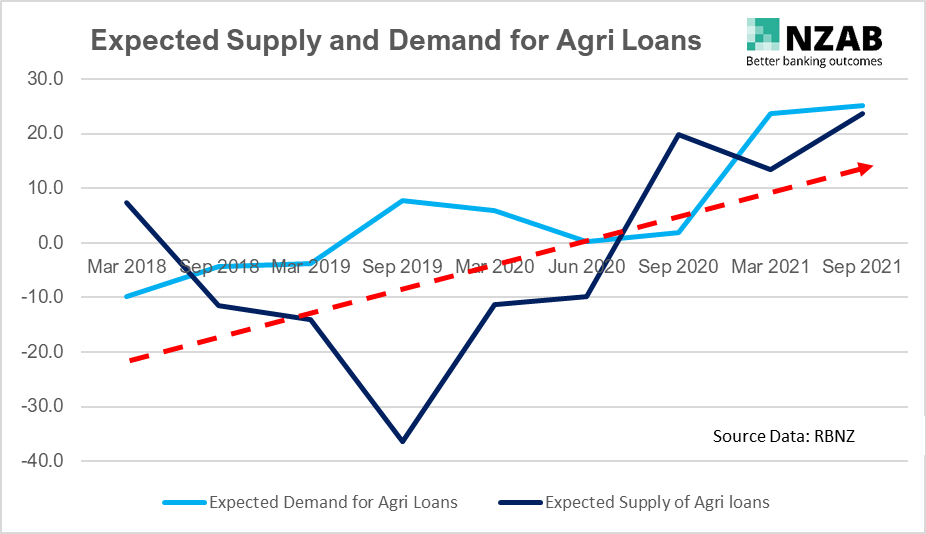

Well, take a look at the same expectations from the same credit conditions survey that the banks have in the Agri Sector:

Almost the opposite of the home lending sector isn’t it?

Looking at the same supply and data for corporate and institutional lending, we see the same trend.

Probably unsurprisingly, the SME business lending supply and demand is flat. The impact of ongoing Covid restrictions countering any increased availability of capital to this sector.

After a protracted period of low credit appetite in Agri, it’s once again becoming vogue.

Sure, the sector is also doing well from a profitability perspective which also provides this with a nudge.

But the real reason is that internal bank portfolio re-balancing yet again.

Squeeze the balloon, and it’ll pop out somewhere else.

Make no mistake - this is a good thing for the Agri sector.

This will encourage investment into the sector for both productivity enhancement and ongoing environmental sustainability.

It will encourage more younger people to the sector as capital flows more freely.

It’ll mean more competition for a new or existing loan, driving down costs and improving service.

All good things, we think.