Recent Posts

Strengthening the Future of Agri Capital: NZAB Welcomes John Janssen

Dec 9, 2025 1:22:03 PM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

What we need is more competition right?

Feb 20, 2025 7:33:57 PM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

The future of Banking has started

Dec 24, 2024 11:38:30 AM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

You are paying too much interest. Who is to blame?

Feb 20, 2024 11:53:21 AM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

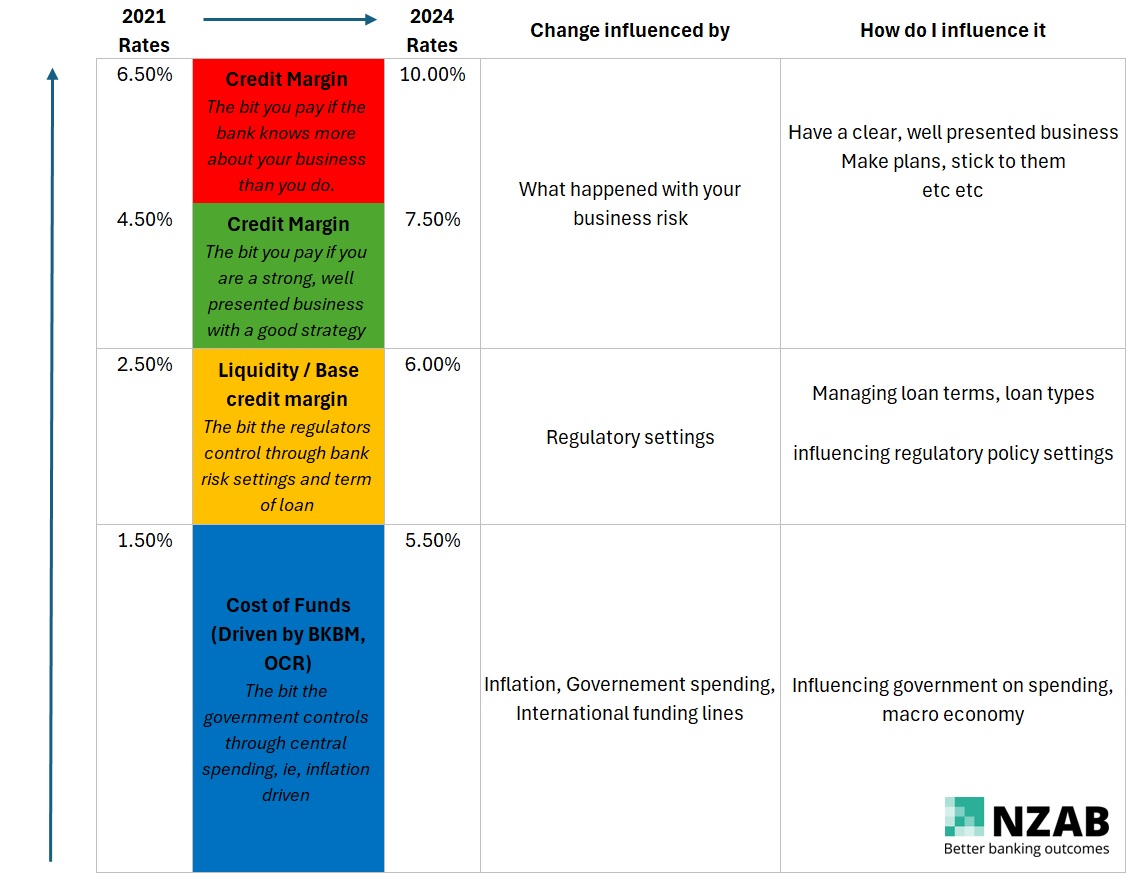

We all want to pay the lowest interest rate possible. It makes perfect sense. Two years ago our budgets had good allowances for principal and tax, but this year those amounts have all but rolled into the interest line.

Contrary to some opinions on this subject, I think that one of the greatest aspects of being a farm borrower is that you can get a rate based on how good you are, rather than a one size fits all rate like those buying a house. It gives you an element of control and brings in to focus the things that are important when you are presenting your business to a bank. The key is knowing how to access these benefits.

Rates are high again, and that's always when the question of fairness arises. They're not the highest they have been, but they are a lot higher than they have been for the last few years. To be honest we were pretty lucky that rates went as low as they did during the downturn in the dairy sector otherwise things would have been a lot worse for us as an industry. With the current challenges in the red meat sector, it makes sense to be looking hard at these costs.

So, what’s driving the increases?

Payout Pain: Focusing on what makes a difference!

Aug 22, 2023 1:55:04 PM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

Following on from our article last week on being proactive around payout, we have been asked to share some of our observations around what has and hasn’t worked in the past. We’ve been here before after all!

Let me reiterate, a good business going into a tough year is still a good business. It’s not so much about getting through (although that is the first priority!), it’s about positioning your business and your mindset to be able to bounce strongly forward when profits return.

They say never let a downturn go to waste, and these environments are opportunities to showcase to your bank how effective your management and governance really is. The banks do a lot of stress testing of what might happen in certain circumstances, and this year may well be one of those years that looks like the stress test scenario.

What works:

- Facing into the realities of your situation as early as possible.

- Being honest with your bank and keeping communication lines wide open

- Challenge everything. Treat each dollar like a prisoner!

- There is a big difference between being optimistic, pessimistic and realistic. Being realistic is the key. This is not the year to target levels you haven't yet achieved.

- Go back to basics. Are you using the physical resources around you to the best of your ability?

- Get positioned for opportunity. What can you do differently if the payout jumps back up later in the season to capture more profit, but also defend the line if that doesn’t happen?

- If you don’t have experts around you, seek them out. It can be as simple as tapping into a neighbouring farmer who you think does things well.

- Selling ‘non-core’ assets can help. These are assets that don’t contribute to profit in any way. But there are often lots of reasons why we have these assets other than profit alone, so be realistic!

What doesn’t work:

- Blaming the bank. Yes, interest rates are back to some of the highest we have seen in recent times, and if they weren’t then we would be likely still making a profit this year, but that’s not something that’s in your control. Yes, interest rates are negotiable, but from a position of strength not weakness. (ie, if you need a lower rate in order to be viable, the bank isn’t likely to see that as a good risk for them).

- Putting farms or blocks of land up for sale that you don’t intend to sell. We saw a lot of this in 2016/17. It was a strategy to keep the banks happy, and it probably worked for a few for a while. But then the blocks didn’t sell, and the relationship got tougher. If it’s not a genuine option, don’t go there.

- Setting tight timeframes on assets you do wish to sell. (And this is aimed at the banks as well!) Clearly, the farm real estate market will be slower this year. If funding approvals are based on requiring a farm property sold within this season, there is a very high chance that strategy will fail, so be realistic!

- Focusing on production over profit. This may well be the year to produce a lot less milk and reduce the loss rather than maximise the output. But the answer to that lies in a clear understanding of your key drivers of profit and longer term strategy.

- Relying on Farm Debt Mediation as a way to solve any problems. Mediation is not a place to air grievances or negotiate a strategy, despite what you may think. It is a place where a ‘very final’ plan gets negotiated and agreed. You should never go to mediation without a clear plan that is 90% already agreed with the bank, or you’ll find yourself backed into a corner. And for the banks, don’t use mediation as a tool to force a predetermined outcome!

Putting it all in context is important:

Milk price margins do return to average.

If you need re-assurance on this, take a look at our analysis of the last 20 years milk price margins. Click here to read our recent article on this We have had some great years, some horrible years, but the average is consistent.

Costs do retreat too!

We are seeing fertiliser in full flight downwards, as are core feed supplies. Take a look at this article where we looked back at where costs retreated after previously high levels brought about by high payout. Farmers are very responsive to managing costs in the light of falling returns.

Build a medium term forecast.

With the above in mind, once you have dealt with the short term realities its time to start making a medium term plan for the business. Lean heavily on your advisors to help with this. How will the business return to more normal profit levels? what funding do you need to get there? What changes could you make to how you operate?

Show your working.

One of the best things you can do to gain confidence from your bank is to show them in detail what changes you have considered, especially the ones you didn't think were worth moving forward with. It demonstrates that you are thinking about all of the possibilities, and you are able to make clear decisions.

We are here to help. NZAB has a team of over 30 banking experts ready to help you work through this next period. If you would like to discuss any of the above, please get in touch.

We’d love to help. We’re all about better banking outcomes, so if you want to review your business to understand where you might sit, drop us a line today on 0800 692 212, email us directly, or fill out this form and we’ll be in touch.

Payout Pain: Get Proactive!

Aug 11, 2023 11:31:31 AM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

Most of us in the industry are again catching our breath and digesting the impacts of a significant reduction in dairy payout for this season. The impacts of this are quite real.

But we have been here before. Ironically, this has become a bit easier to navigate now, because we have gone from an environment where only a few farmers were struggling to make the budget work, to one where most will require additional financial support. This is now an industry-wide issue.

The Banks are continuing to support their clients but need to see a proactive approach to managing costs and minimising losses. You can assist this by demonstrating that you’re in control and are making quality and timely decisions.

Fundamentally, good businesses will remain good businesses. We’ve already seen significant reductions in costs from where they were earlier in the year, and we expect to see businesses bounce back quickly from this.

But for now, here’s the plan of attack:

- Face the realities. Reforecast the cashflow now and get a clear understanding of the impacts. The first critical piece of information required is ‘do we have enough cash’? If not, when do you run short, and by how much? Get this in front of the bank as soon as possible. You’re not looking to have all the answers at this point but getting the ‘worst case’ out on the table quickly helps to frame up the size of the challenge in front of you.

- Make a list of the areas to investigate where you might be able to cut or defer costs. Turn this into an action plan. What are you considering, what could it save in the short term, what are the long-term implications of making these changes? Give this to the bank along with the cashflow above.

- Keep acting with confidence. We know that the payout and market conditions can change quickly, so you need to keep focusing on the key activities to ensure we are positioned to spring forward out of this situation when the opportunity arises.

- Once you’ve developed a more detailed plan, sit down with the bank, and review it. The bank will take comfort from this process and will be able to best support you knowing that you’ve considered all the options and developed a logical plan.

- Keep it all in context. Most dairy farmers have made significant inroads into principal repayments over the last 3 – 4 years. Make sure you outline the cash required this year in the context of your overall progress in the last few years.

We know that these major shifts in payout and profitability are massively unsettling. There’s enough out there in farming right now to challenge us without the overlay of making a loss. The most important thing to do is look after yourself, your family and your fellow farmers. Everyone deals with these challenges differently, but make sure you support each other.

If you’re not sure how to cope, or what you can do to manage this situation, reach out for help. Ultimately, we will get through this and out the other side, and we’ll learn a few new skills along the way.

We’d love to help. We’re all about better banking outcomes, so if you want to review your business to understand where you might sit, drop us a line today on 0800 692 212, email us directly, or fill out this form and we’ll be in touch.

The 2023 Dairy season. Where's the cash??

Feb 14, 2023 4:17:36 PM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

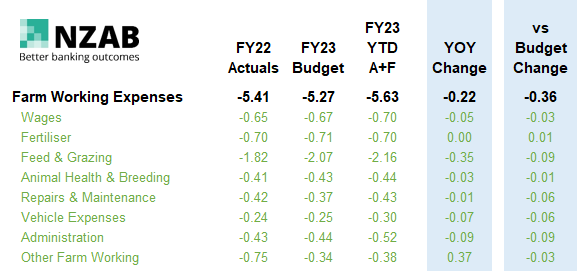

Last year we introduced our new analytics platform with some early insights as to what was going on with cost inflation in the dairy sector. That was really exciting for us and our clients as it provided real time information that could be used to understand what was going on and what was likely to happen next. It also proved useful for the banking sector and we had many positive and constructive meetings with banking teams where we collectively worked through understanding the information and planning to support our mutual clients.

After a good break over Christmas, one trend is now undeniable. Cash is disappearing. If you haven't yet revised your cashflow this season or found that your plans for tax, principal and business investment have had to change then you are certainly in the minority!

So, what's going on out there? The following charts are what we are seeing as things change on a monthly basis.

Production is down on forecast:

NZAB Welcomes New Partners

Sep 22, 2022 10:10:28 PM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy

It gives me great delight to announce that Nick Bell, Chris Laming, Mike Parr and Michael McKenzie have joined the founders of NZAB in becoming part owners.

At NZAB, we have sought to create to create an environment where the best bankers and business professionals can find a home, working directly for the farmer. We wanted them to stay deeply involved and grow commercially with the sector, deploying their significant experience for the benefit of the farmer.

Since we started NZAB, we have had a strategy to create a culture and a business model that allows those who believe what we believe to invest and grow alongside our vision. It's exciting to see that start to come to fruition.

Over time, we want more of our staff to do the same so they can continue to come to work each day feeling even more empowered to help their farmers get what they deserve.

Please join us in congratulating Nick, Chris, Mike and Michael!

In doing so, we thank you for your support. Without your ongoing business, or you telling your other farming peers about us, we wouldn’t be where we are today.

For those of you that don’t know them, you can find out a bit more about these great people below.

The 2022 Dairy season in Review: Where has all the money gone?

May 19, 2022 8:25:02 AM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy, Graduate

Welcome to the first in a series of articles reviewing the financial results of the 2022 Dairy season.

At NZAB, we've got a large data set now as a result of significant investment in a data analytics platform which we use to support our clients with real time insights. We're able to use this platform to look at the trends that we are seeing in the dairy industry and provide real time insights rather than having to wait a year for the benchmarking systems to catch up.

Given most farmers are starting to think about setting budgets for next season, it's important to have a bit of a guide as to what is happening to costs so that we can make informed decisions. But it is also critical that our bankers understand what's going on here, as many covenants are set around variances on costs, many of which are outside of farmer control.

So this first article covers our high level insights. Following this we will dive deeper into the individual trends and particular insights we take from it.

This is also an interactive series. So please get in touch with your questions, and we will publish a Q&A alongside our upcoming articles.

Milk Production and Revenue:

Our Growth Story Update

Apr 8, 2022 7:58:57 AM / by Scott Wishart posted in Debt, Action, Planning, Budget, Banking, Strategy, Graduate

Our NZAB journey has hit a new milestone, with our 25th new employee joining us last month. It is truly an exciting time to be part of this industry, with more and more farmers trusting us to help them articulate their strategy and plan for the future.

We are still very much in growth mode across New Zealand, with key roles to be advertised shortly, so if you're interested in what we do or how we do it, please get in touch!

In the meantime, It gives me great delight to introduce to you three new staff members, plus a deserved promotion for a long standing NZAB employee.

See you out there!