Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

Welcome back all - it’s been a wee while since I’ve put an article out to you all – July involved a bit of skiing and a bit of offshore sun but it’s great to be back with spring just around the corner.

What’s not so spring-like is the fear of increasing interest rates – ostensibly being driven by the RBNZ to head off seemingly out of control inflation.

Inflation and whether it goes up or down is primarily about two things - the amount of excess demand in an economy versus the capacity (supply) of the economy to meet that demand.

In layman’s terms, it could be described as the amount of spare cash floating around, coupled with an individual’s willingness to spend it versus the amount of goods or services available. Too much demand and too little supply and prices go up. And then so do interest rates to ensure things don’t get out of control

And it’s not just about that supply/demand dynamic as of right now – its also about how people feel about their future that will dictate that imbalance – if people think things will get worse in the future they’re more likely to shut up shop with their spending now - that’s why customer sentiment surveys are so important as a “lead indicator” for what inflation might do.

However, we’re all human right?

Sometimes its actually the physical impact of a lack of money - actually feeling it, that is required, before people actually change their spending habits. In other words, people have to touch the fire before they change.

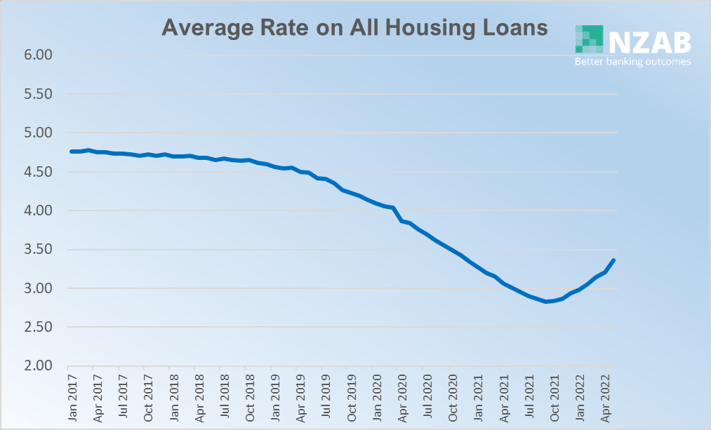

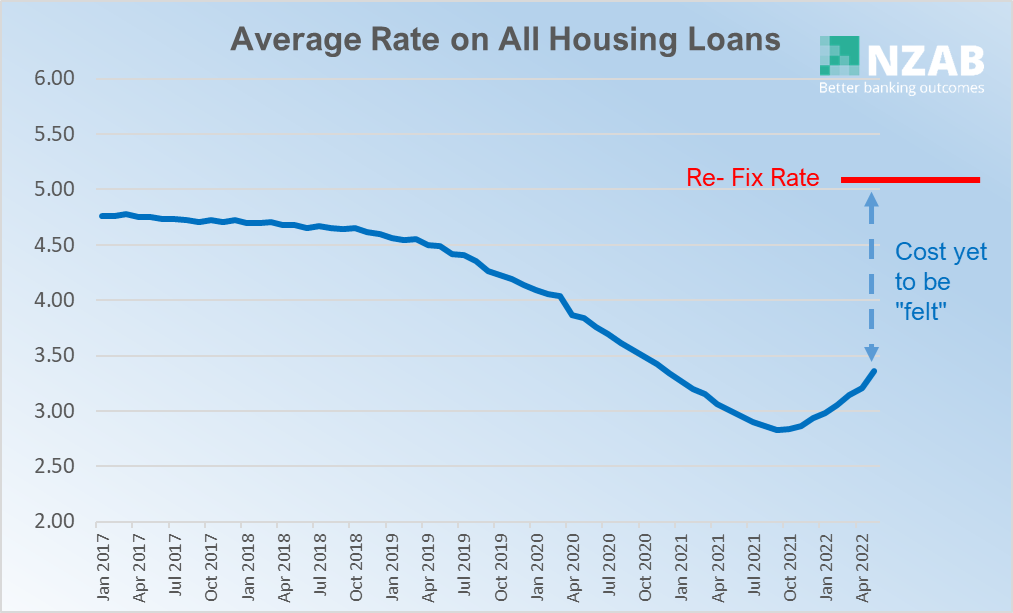

Which brings me to a really interesting data set we’ve pulled from the RBNZ. The below graph is the actual average rate that people are paying on their home loans right now (to the end of May 2022).

Right now, people are only paying an average of 3.36% on their home loans. That’s surprisingly low, isn’t it?

That’s miles below the re-fix rate for the cheapest rate on the market right now – the 1 year fixed home loan rate is hovering around 5% - significantly more than what the average customer is paying on their borrowing.

So that’s a big old gap between what people are actually paying and what they might be paying in upcoming months.

That’s simply due to homeowners still having lower fixed rates that are yet to mature onto those higher rates.

So let’s explore how quickly this might then change. Let’s couple this data with how “fixed” the home loan book is:

- As of June, there is $338bn of housing loans via banks (finance companies and non-bank lenders on top of this)

- 57% of this will expire within the next 1 year

- 83% will expire within the next 2 years

Jeepers…

So, in the next year, it would be fair to say that almost $200bn (home loans only) will be subject to an increase of 1.5-2% - and more importantly this is not yet “felt” as of today’s date. It’s still to impact on consumers wallets.

Assuming similar pro rata levels in Business and Agri, this would be a further c. $100bn getting re-priced as well.

So, overall, there is at least $300bn of borrowing, that over next 12 months, will face a 1.5-2% lift. That’s $4-6bn less availability of money in spenders pockets.

Let’s contextualise this further.

NZ GDP is $350bn. This is almost 1.5% of GDP.

Now depositors/ savers would get some of the benefit of this as this is a transfer of returns from borrower to deposit, however its generally accepted that that group aren’t spenders and are typically going to keep that additional return in the bank.

So, going back to the start of this article - have people felt the fire yet? Not by a long way.

And what will that mean for the demand side of the inflation equation? Based on this data, it’s hard to argue that consumers are still yet to feel the very real impact of increasing interest rates - and when they do, this will place a serious drag on their spending horsepower in the very near future.

When that ultimately hits will also come down the level of cash buffers they have.

But needless to say, the “demand” side of the inflation equation has a big reset coming.

Please note that Inflation is a complex beast and driven by many different factors and I’ve only picked out one factor of the equation in this article, but it’s a big one.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz