Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

With the RBNZ about to embark on their five-yearly review, which follows a report titled How Central Bank Mistakes after 2019 Led to Inflation, we thought we’d add our small voice to the conversation.

If you recall, the RBNZ went in to bat (with a very big bat) during Covid to ensure the economy didn’t tip over and the credit/banking system remained functional.

It did this with three broad tools:

- Aggressively cut the “OCR” to stimulate borrowing (this is “Reserve Bank 101” for stimulating an economy during shock or recession).

- Devised and then embarked on the “LSAP” (Large Scale Asset Purchase Programme) – this is a sophisticated way of saying “printing money” as the RBNZ purchased government bonds in the secondary market to stimulate more purchasing demand for newly released (and additional) government bonds – to support new government spending during this time.

- Devised and then embarked on the FLP (Funding for Lending Programme) – where the banks had access to large additional facilities at RBNZ at the cost of the OCR at the time.

All of these had the impact of providing a significant amount of new money into the banking sector.

What wasn't thought about at the time, was how the banks would then use that money.

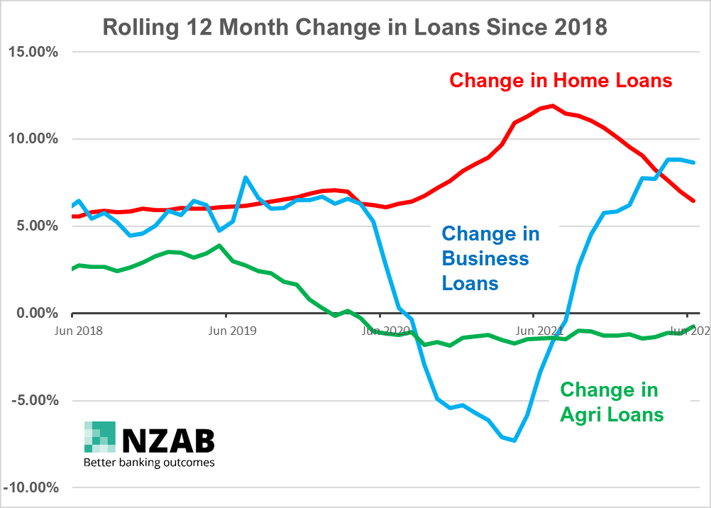

The graph below shows the rolling 12 month change in Home, Business and Agriculture lending, with source data from RBNZ. It covers the period before, during and after those programmes.

Overwhelmingly the data shows that during the time of those stimulus activities, the new capital flowed to the home loan sector. This caused the spike to house prices and even worse, caused credit to dry up in our productive sectors.

Fundamentally, the NZ banks have regulations imposed on them that reward them for lending more to the home loan sector above others.

For the uninitiated, the RBNZ does this by making home loans more profitable for banks, a result of the requirements to hold more of their own capital against perceived riskier loans in Agri and Commercial.

At the true core of the reactor for New Zealand banks, this is what drives profit for them - how much or how little of their own equity needs to be placed against a different loan type.

Added to this is the lower cost nature of home lending. It takes a lot less credit assessment and time to work out a loan based on a salary and an online valuation than a business or farming loan.

It’s a bit like an electrical circuit with different sized resistors in it – pump up current and it’s always going to go down the path of least resistance. Furthermore, its probably going to fry the circuit board as well.

We have argued this point before. But when is it going to change?

Whilst it does appear that normal service has resumed (the obvious bright spot with business lending returning), what happens next time we get a massive stimulus from either the government or the RBNZ? It’s hard to see how banks won’t continue to feed any excess capital down the path of least resistance.

Sustainable change on these issues will require a re-think in the way the RBNZ looks at capital requirements for each sector. We would love to see this added to the agenda with the upcoming 5 year review of RBNZ policy.

Address that and you will see immediate change in the way banks lend.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz