By now you will have probably heard about the RBNZ’s “funding for lending programme” (“FLP”). Put simply, this is a mechanism the RBNZ is going to use to allow the banks to borrow new (freshly minted) money directly off the RBNZ at whatever the OCR is at the time. At time of writing this is currently being forecast to drop to as low as -0.5%.

The reason RBNZ wants to do this is to stimulate growth in the economy with lower rates.

At present our Reserve Bank Governor cannot guarantee that low OCR levels will be effectively "passed on" with current RBNZ tools.

These days the OCR rate is not linked to the cost of bank funding as it depends on where the market for customer deposits is at. Which have of late been much higher than the OCR– driven by the laws of supply and demand and the regulations that require banks to seek most of their funding from NZ customer deposits or longer dated offshore lending.

So a currently low OCR does not equal a banks own funding costs. Which means it does not equal low cost lending (well, not “low enough”). The FLP is designed to get cheaper funding directly into the market, which by default should lower all forms of funding for the banks.

So in short, Mr Orr wants cheap money out in the NZ economy to get things humming again. Sounds great right?

Well, that depends on where it goes.

So far, the RBNZ has been deliberately non-descriptive about where banks have to place that $50bn . FLP programmes around the world are not uncommon and learning has shown that the less rules placed on the banks for the “direction of funds”, the more likely that bank’s will use it ( a recent example of this going wrong was the govt guarantee scheme for bank funding -too many initial rules meant very little was leant out initially ).

The FLP may include incentives to encourage banks to use the funds to expand new lending. In other countries, banks have been given a more favourable interest rate or higher funding caps if new lending growth expands. However, the risk of the RBNZ being too prescriptive is that Banks see too much red-tape or complexity making access to the new funding too onerous.

In order to predict where funds might flow, let’s step back and consider all the current elements of our banking system in NZ.

- We have central bank rules that mean home lending is much more profitable for banks than Agri or commercial loans (Banks have to put far less capital against a home loan = much better return on this investment)

- We have banks that are looking to lower overall costs, in particular the cost of their processing. More, simple deals, more deals that fit into a box, less analysis of complex P&L statements all mean lower cost AI type lending decisioning.

- We have banks that are commercially owned. Naturally they want to maximise profit and return to shareholders.

So put these elements together with $50bn of newly minted low cost funding thrown into the mix? I think we can already see that the vast majority of the new funding will be going directly to new house loans.

We’re already seeing this happening in the market, before this scheme has even started. We can see it in the streets and in the news. Lines of people at open homes, frequent outlandish examples of auction prices going for above CV and a real air of FOMO with buying houses again.

It's self-perpetuating- more lending to a sector in itself makes the initial lending less risky for the bank. Chuck more capital liquidity at a market and asset prices will rise. NZ housing has benefitted significantly from this over a very long time - no different to what Farmland values did when we had double digit increases in farm debt over 2000-2014 (with a break in between for the GFC).

Don’t get me wrong, higher house prices will stimulate the economy. Higher house prices will make everyone feel better again, spend money, keep jobs. It’ll encourage the construction sector plus all those allied to it. Also, many businesses borrow against their homes as a cheap source of funding.

But can’t we do a little better than this?

Come back to Agri. This is a sector that is currently experiencing near record profits. Farm cash yields are now averaging 6-8%, way above their long-term trends and way above alternative investments. Its exporting real stuff. Stuff that other countries buy and give us money for. Export receipts. Absolute gold in a world with significant domestic consumption risks and where our key tourism sector looks like it will be in the doldrums for some time to come.

But guess what – Asset prices in Agri have fallen. And guess why? In large part due to reticence from Banks to provide more capital to the sector, due to banking regulations that have been inadvertently set up to discourage lending to the sector because of a perception of higher long term risk.

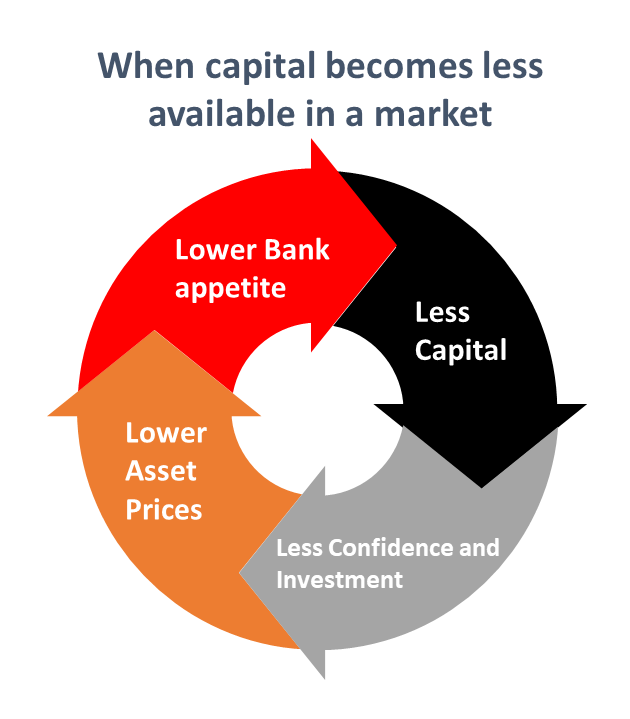

And just like the housing market, this becomes self-fulfilling, but in a negative way. Less capital to the sector = lower asset prices.

This means less confidence in the Agri sector, less investment and a short term focus - putting the aims, objectives and strategies of farming families at risk with their ongoing access to funding. Not just that, it means income and investment that should be flowing into regional towns isn’t – that’s a double whammy for the economy at a time we can least afford it.

As we touched on in a previous article, there is another factor at play here too that should be acknowledged. Environmental regulatory change is putting some uncertainty into the farming model and does weigh on capital availability from banks.

However, the vast majority of farmers are getting themselves well prepared for upcoming changes and as a result are likely to see muted impact on their profitability.

Numerous studies have shown a $1 investment in increasing productivity in agriculture normally has about a $6-$10-flow on affect in “allied industries” – that’s the communities we all live in.

We have a buoyant agri sector at the moment, one that has come through the uncertainty of the last few months in great shape.

We know the rural sector plays a massive role in our economy, and that every dollar invested in the sector feeds vitality and growth right through the economy.

The sector is not without its risks, but what we see every day is farmers managing those risks, investing in the right infrastructure, technology and expertise to ensure they are well placed moving forward.

What we can’t have, for our nations wellbeing, is a sector constrained by capital.

The Reserve bank is about to issue $50bn of new funding. Where would you like to see it go?

Please feel free to share this to any of your network.

* ANZ bank has put together a comprehensive summary of the FLP program if you would like to explore in more depth.