After our last article discussing two of the larger drivers of land value change over time (payout and debt availability – you can find it here), we had a bit of discussion about the payout data going back over time.

I thought I’d just pick up on this point with a couple of graphs.

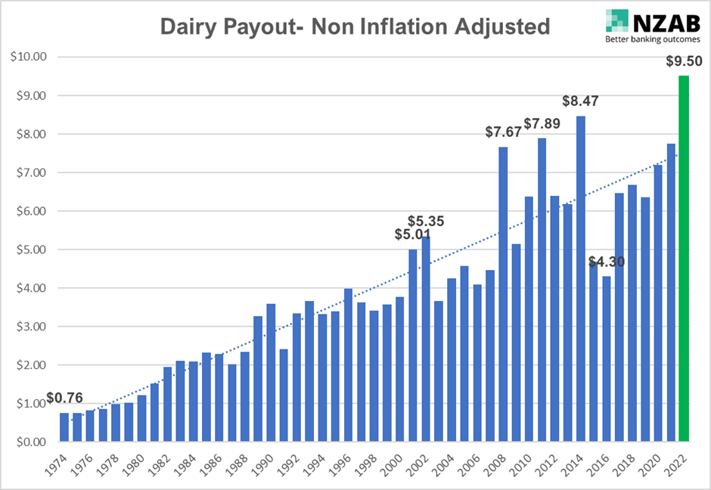

Here is our payout graph (with data sourced from LIC), which makes for interesting reading.

I’ve highlighted some of the larger payout years in history.

On the face of it, its clear that dairy payout increases over time with each new peak being higher than the last. No surprises there.

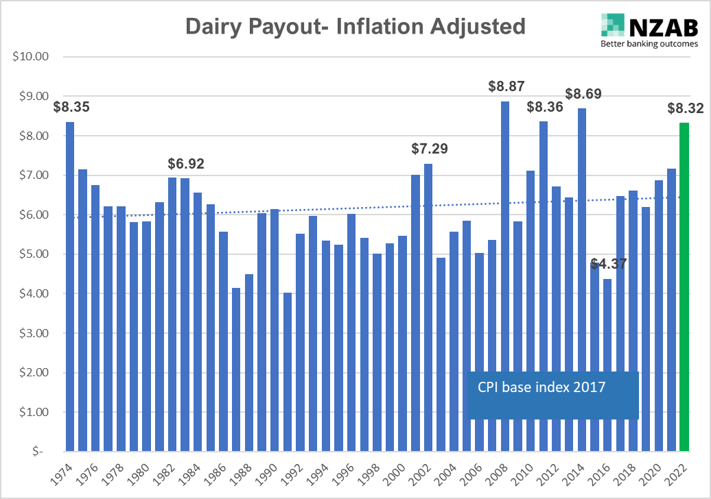

But that doesn’t take into account inflation. Take a look at the next graph, now adjusted for inflation (via the CPI index, source: Stats NZ).

All of a sudden, whilst this year’s payout is good, it’s not quite as stratospheric as it would seem. Now relegated to the 5th highest in history, all due to higher inflation.

Also, this data is sensitised to CPI inflation, not farm inflation, which is wearing a much bigger brunt of imported inflationary costs such as fertiliser and oil prices, as well as labour shortages. These all weigh very heavy on the sector.

Whilst CPI is running at 6.9% annualised for the March quarter, most farming businesses are seeing >10% for FY 22; with more impacts yet to be seen in FY 23 as some of these input costs are yet to be felt (e.g. the first half of the year had lower input costs, winter grazing costs are not yet incurred).

This does not take away from a very good year the industry is having. But it does put it into a bit more perspective, doesn’t it?

It also speaks to the importance of managing the cost increase – have a review of Chris Laming’s earlier article on this topic for tips on how to find the right balance here.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz