Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

There has been no shortage of noise in agriculture over the last few years- interest rates, regulation, climate, politics and whipsawing commodity prices. But when you strip that away and look at the fundamentals, 2026 is shaping up as the start of one of the most interesting periods for farming businesses in more than a decade.

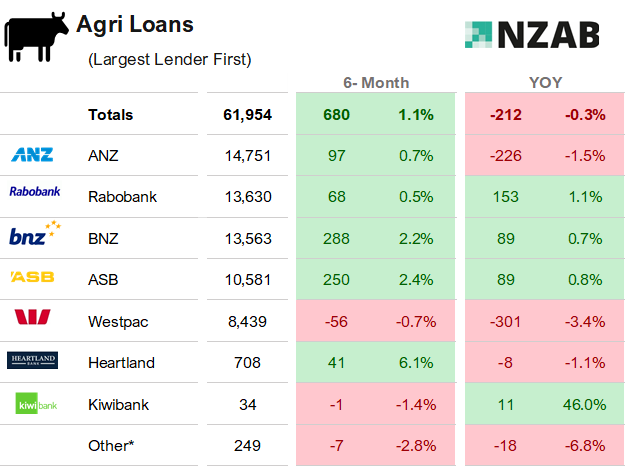

Balance sheets are stronger than most realise. The cost of capital has materially reset. Bank appetite is back. Non-bank capital is finally paying attention. And succession, long considered one of the most challenging issues in farming, is starting to be solved with better tools and innovative thinking.

Here are some of our key reasons for optimism:

1. Balance sheets are getting seriously strong.

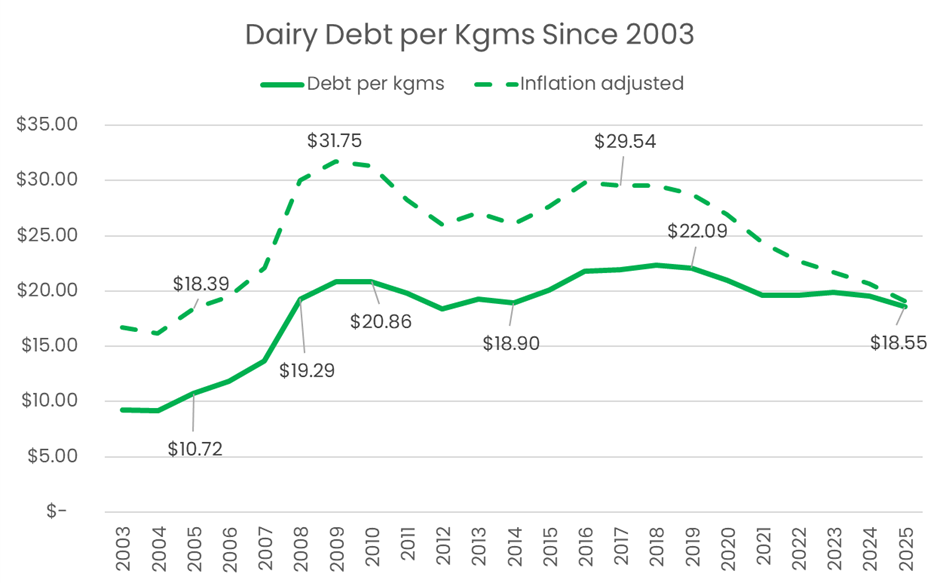

From a dairy perspective, the last 3–5 years have generated substantial cash across most systems. Dairy debt has fallen to around $18.50/kgMS, down from a peak of approximately $22/kgMS. Adjusted for inflation, the reduction in real leverage is even more pronounced.