Welcome to the first in a series of articles reviewing the financial results of the 2022 Dairy season.

At NZAB, we've got a large data set now as a result of significant investment in a data analytics platform which we use to support our clients with real time insights. We're able to use this platform to look at the trends that we are seeing in the dairy industry and provide real time insights rather than having to wait a year for the benchmarking systems to catch up.

Given most farmers are starting to think about setting budgets for next season, it's important to have a bit of a guide as to what is happening to costs so that we can make informed decisions. But it is also critical that our bankers understand what's going on here, as many covenants are set around variances on costs, many of which are outside of farmer control.

So this first article covers our high level insights. Following this we will dive deeper into the individual trends and particular insights we take from it.

This is also an interactive series. So please get in touch with your questions, and we will publish a Q&A alongside our upcoming articles.

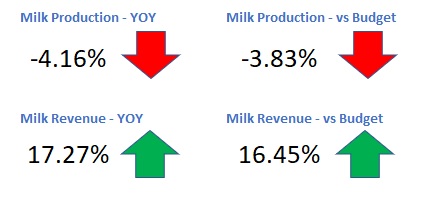

Milk Production and Revenue:

We've already seen from Fonterra's 2022 interim results that milk production was back by 4% year to date. Our data matches that trend. That shows that our farmers were largely budgeting for production to remain constant from last year.

However, cash receipts for the FY22 year are up by over 17% YOY, which recognises the impact of the higher farm gate milk price, and suggests that budgets were set at payout levels more in line with historical averages.

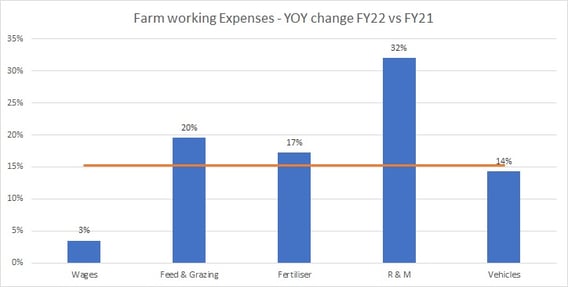

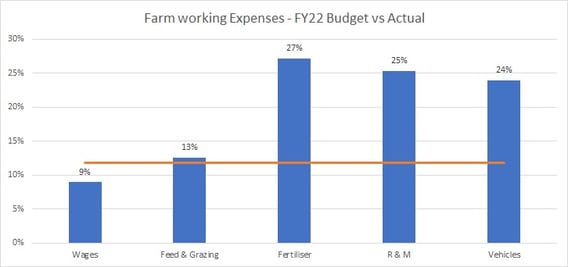

Farm Expenditure:

We've been hearing a lot lately about cost inflation. Well, the numbers are in and overall our farm working expenses have risen by 15%. That's more than twice the measured inflation in the New Zealand CPI which was 6.9%.

On a per KgMS basis, the increase is 18% due to the impact of production being below last year's levels. These are significant lifts.

The devil is in the detail, so we will unpick these numbers in the coming weeks. Clearly there's discretionary spend in the R&M numbers which is no surprise given the payout, so the headline number is a bit simplistic, but we will unpick that in upcoming articles.

Looking at expenses vs budget, over all the variance is 12%. The impacts of price rises vs what our farmers expected to spend are clearly evident.

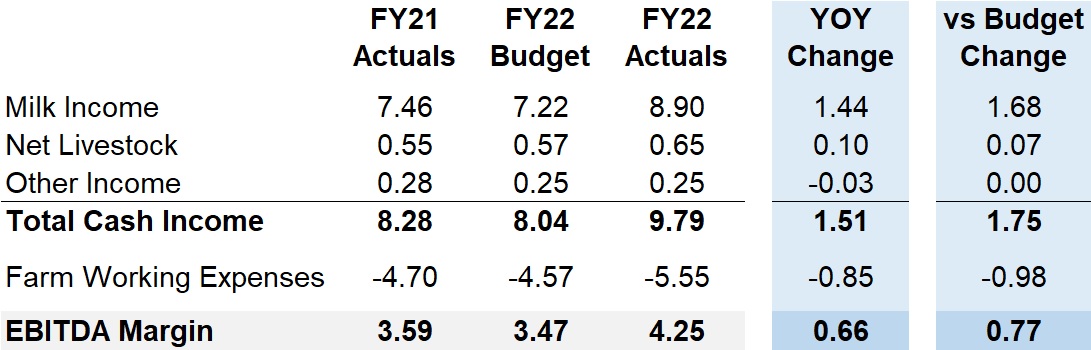

EBITDA Margin:

The margin over costs (EBITDA Margin) has increased significantly this year as shown in the table below.

Our $8.90 differs from the headline Fonterra numbers due to production changes from year to year, and also these numbers are net of sharemilker / contract milker costs and levies.

This EBITDA margin is going to be one of the highest on record for the dairy sector this year. But not as high as we might have thought with the $1.51 of extra revenue being reduced by the $0.85 of increased costs.

Next Week:

We will cover The underlying trends in the 5 key expense categories. Get your questions through to us by clicking here

We hope you find these insights helpful!

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz