Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

The latest financial stability report from the RBNZ brings back to the surface a hot topic for us and our farming and business customers – that being the significantly greater amounts of capital that the RBNZ requires banks to hold when they lend to a farmer or business versus a homeowner.

The main trading banks are required to hold vastly more of their own equity capital against a farming or business loan making those loans much less profitable to make. This leads directly to less lending and higher interest cost margins in those sectors versus home lending.

We warned about the flow of capital going straight to home lending back in 2020 when the RBNZ started its “Funding for Lending” and “Large Scale Asset Purchases” programmes (i.e printing money). You can find that article here.

Earlier, in this article, we actively called for RBNZ to proactively make capital changes to help the New Zealand Primary Sector.

It was clear back then that the RBNZ’s capital rules were (and still are) set up to encourage home lending and discourage farm and business lending.

So back to the latest report from the RBNZ

(you can find the full copy here)

Here are some direct quotes from that report:

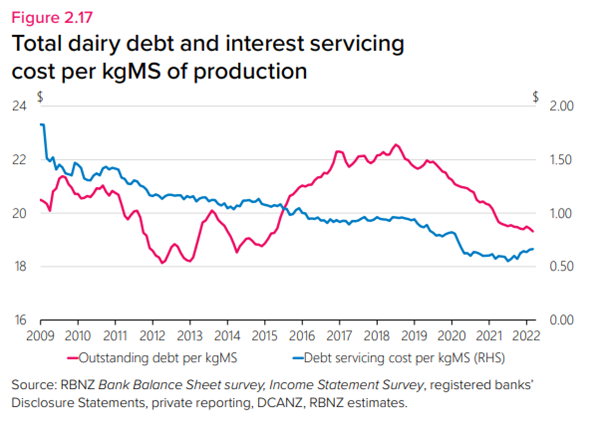

“Overall, risks to the financial system from the dairy sector have diminished considerably in recent years”

“On average, dairy farmers have repaid around $3 of bank debt per kgMS in recent years”

“Total dairy sector debt has declined by around 12 percent ($5b) since its peak level in 2018”

“[On the Ukraine Crisis]… higher food prices should also benefit agricultural exporters. New Zealand’s dairy and meat stocks are predominantly pasture-fed, and should fare better than overseas grain-fed competitors”

The following graph, produced by the RBNZ, best shows the significant repayments made in the sector and the strong position they’re now in.

In addition to the above points, farmland values are rising, meaning that debt leverage has not just lowered versus income, but also versus their asset value as well.

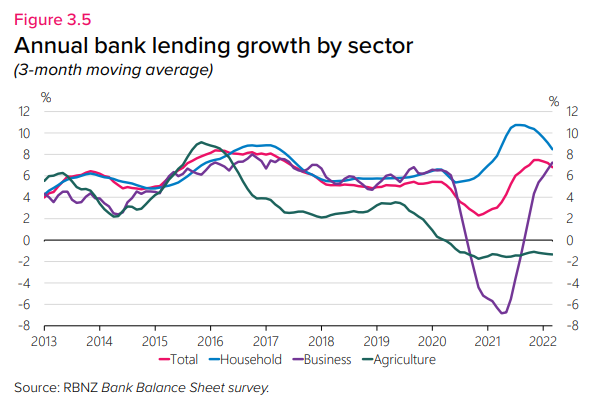

Despite all this and despite farm profitability now being good for almost five years (see this article for payout metrics over the last 30 years), we have seen a complete retraction of farm lending - all to the benefit of the housing sector.

See the below graph, again from the RBNZ emphasising this point. It is, however, good to see business lending rebounding.

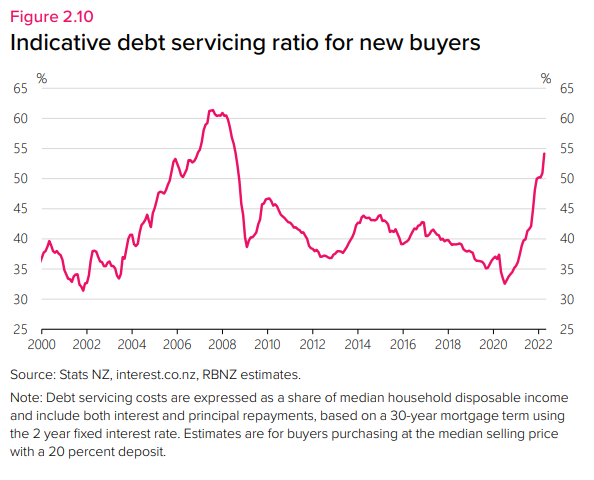

So conversely, lets now look at the home loan sector and take a look at how viability metrics (i.e. a homeowners’ ability to meet their debt servicing commitments) are now stacking up.

There are a number of graphs from the RBNZ on this topic, but this one below shows it best for us- it’s the proportion of a new home buyer’s income that they are paying towards their interest bill.

That line is starting to look a bit scary, isn’t it?

And take this direct quote (with our added emphasis):

“House prices remain above sustainable levels despite recent declines. While a gradual adjustment to a more sustainable level is desirable for the stability of the financial system, a larger correction remains a possibility. Recent buyers with limited equity are particularly vulnerable to house price declines. Furthermore, a large fall in house prices would significantly reduce housing wealth and could lead to a contraction in consumer spending. Some recent mortgage borrowers could face difficulty servicing their debts as interest rates rise alongside higher living costs”.

So when you step back and look at it – why does the RBNZ continue to ask for significantly more capital against farm loans than home loans?

We know that this is not a black and white discussion

We know those capital ratios should not be 100% reversed nor should capital ratios only be designed to be at a “point in time”. A longer-term outlook and a consistent approach are definitely required when setting these ratios so lenders can be consistent when lending longer term. Additionally farming/ business loans are, by their nature, riskier than home loans.

But you can’t argue that the current dials that drive this system are set correctly - certainly when all new capital flows find themselves in the home loan sector.

And despite all the new rules put in place to curtail home loan growth; this will keep going until the RBNZ addresses the capital ratio rules – these are the fundamental drivers of bank profit – these will dictate where that money goes.

Banks and the RBNZ have the strength to consider changes like this, best summed up by this quote from RBNZ; “Banks’ capital buffers remain high and are expected to increase further”.

And what are the benefits of getting those settings right?

Firstly, we would see greater encouragement from banks to lend into our primary and business sectors.

Those sectors are full of enterprising individuals looking to make themselves, their families, their communities and in turn New Zealand, more prosperous. Wouldn’t we want to see more capital paired alongside that energy, creating export dollars and/or GDP for New Zealand?

And if those dials were turned, even just a fraction, how many more people would we see get into business and kick that flywheel into gear even further?

All good things, we believe.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz