This is a quick note after reading the results of the latest Federated Farmers confidence survey.

You can find it here.

I found the outcomes fascinating.

In summary:

- There was a 10.1% decline in farmers who considered current economic conditions good

- A net 64% of farmers believed general economic conditions would deteriorate in the next 12m – a 25% decline since the July-21 survey

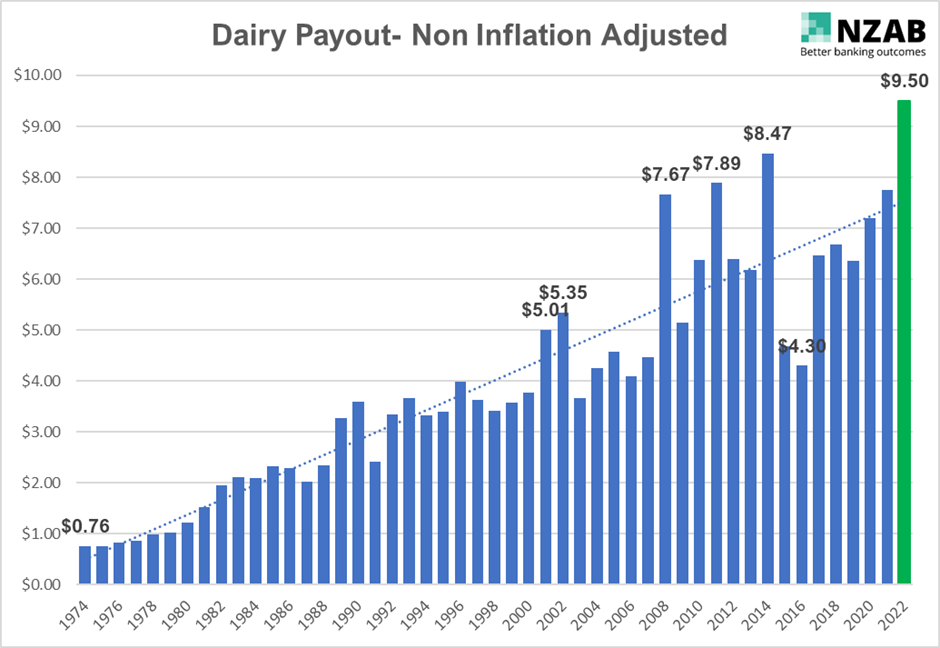

These results are in an environment where milk futures for FY23 just topped $10, lamb and beef returns are strong and global wheat prices just increased 40% in a week!

Whilst it is important to recognise the impact of inflation on operating costs, the ongoing issues in the labor market and continued influence of regulatory requirements (not to mention the threat of escalating war in Eastern Europe), one could argue that from a profitability perspective we have rarely seen things so good.

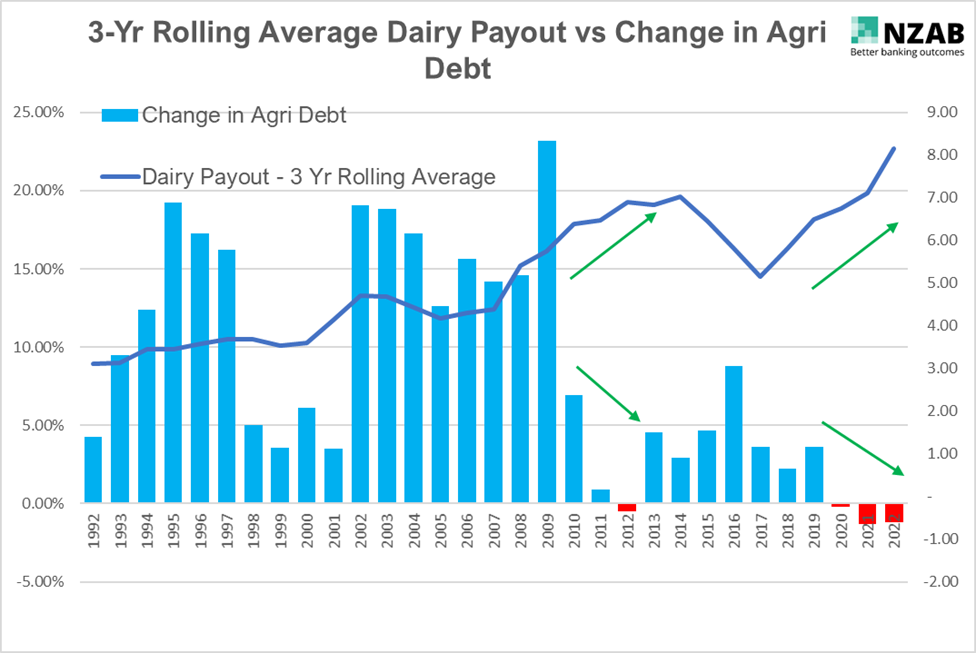

Yes, history says that the usual fix for high prices is high prices, and that the higher the high the more precipitous the fall.

But what if prices don’t drop? What if this period of high commodity prices is sustained (and in fact we have been through a period over the last 3-4 years of minimal volatility and general upside)?

I think it’s an interesting thought process to go through to test what your business would do strategically (and maybe operationally) should high product prices be sustained.

That could well be nothing different – pay down debt, pay a dividend, reinvest on a as needed basis…..or could it mean that certain elements of your strategy are accelerated or reshaped?

Is this the time to bring forward infrastructure spending? Is this a great opportunity to investigate and invest in environmental management and mitigation? Could you bring forward elements of your succession process?

History says that not only do higher commodity prices lead to better profitability, they also get capitalised into land values. What would an improving balance sheet mean for your business and your decision making?

It seems to me that if we were staring down the barrel of lower product prices, we would be focusing pretty hard on business strategy in order to manage through that period.

So why not flip that and do the same sort of process, but through the lens of sustained higher price? The old saying says “hope for the best and plan for the worst”.

Let’s flip that and “plan for the best….and plan for the worst”! There will be nothing lost and everything to gain by making sure you position your business to take full advantage of the current tailwinds in profitability.

I would say the process would be great for improving your confidence levels too!