Right, so we all know what Chinese Whispers is don’t we?

It’s a kids game where players form a line or circle, and the first player comes up with a message and whispers it to the ear of the second person in the line.

The second player repeats the message to the third player, and so on.

When the last player is reached, they announce the message they heard to the entire group. The first person then compares the original message with the final version.

Mistakes often accumulate along the way, so the last player’s reading differs significantly from that of the first player, usually with quite amusing or humorous effect.

Unfortunately, this can also happen in the Agri credit process.

And the effect is not humorous nor amusing. It can be downright devastating.

Credit approvals in Agri all have significant consequences – they are the difference between getting further investment capital or not (which can have significant wealth accumulation opportunities in the future) and at the other end of the spectrum, they could mean the difference between paying significantly more in interest, or even worse, having to divest a farm at the wrong time.

Suffice to say, the stakes are high.

So what has all of this got to do with Chinese whispers? Well, the Agri credit chain is not a band of one.

Very rarely does the frontline banker have the sole discretion to make a lending decision. In nearly all cases, this decision will be referred to another authority.

Often, it goes through at least two other parties – sometimes further.

All along that journey there is risk that the message evolves, changes or weakens.

And guess what the most important link is – you the farmer – and your start point with what you provide to the frontline banker.

How and what you provide, frame, analyse and present is a significant determinant to the success of that credit process – and whether you accumulate more wealth in the future, or don’t.

But the best part about this, is that its easy to control if you know how.

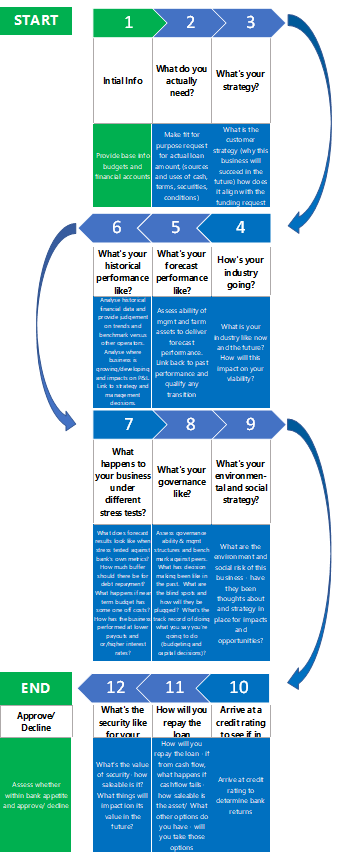

Let’s start by understanding some of the assessment factors that a bank goes through with the credit process.

Now, to the uninitiated eye, a typical credit process looks like this: Have a meeting with the bank, maybe have a tour of the physical assets, provide your past financial statements and your future budgets and make your request.