There are always some terrific ads at half time in the Super Bowl.

Arguably the most prime time spot in American TV advertising, the cost of securing a timeslot is enormous. This year, a 30-second commercial for Super Bowl 54 in 2020 cost about $5.6 million. I don’t think you’ll ever see NZAB with an ad at the Super Bowl but who knows, we should dream big!

So, if you’re a company that’s up for that you’ve got to have a catchy ad. Some of the ads are comic genius, featuring some big-name actors along to boot.

Take one of this year’s ads from “Rocket Mortgages” – it was a cracker. The theme of “certain is better” was really simple and it resonated with us a lot.

It starts with a couple about to bid on their first home before wondering out loud: “I’m pretty sure we can afford this?”.

Cue the entrance to a big-name comedian who then goes through various humorous analogies of the limitations of the statement “how can you be sure?”.

You can see the whole clip here

Change your thinking from “can I afford it?” to “is this the right decision for my business?”

The key difference for us versus this clip is that we view decision making as less about “what can we afford?” (as in the clip) and more about “is this decision right for my business and my stakeholders?”. To be fair, home loans are generally about what you can afford, you are buying your house after all.

But business is not like that - and gee, there are a lot of factors to consider when you’re assessing that question. But it doesn't need to be hard, if you follow a good process.

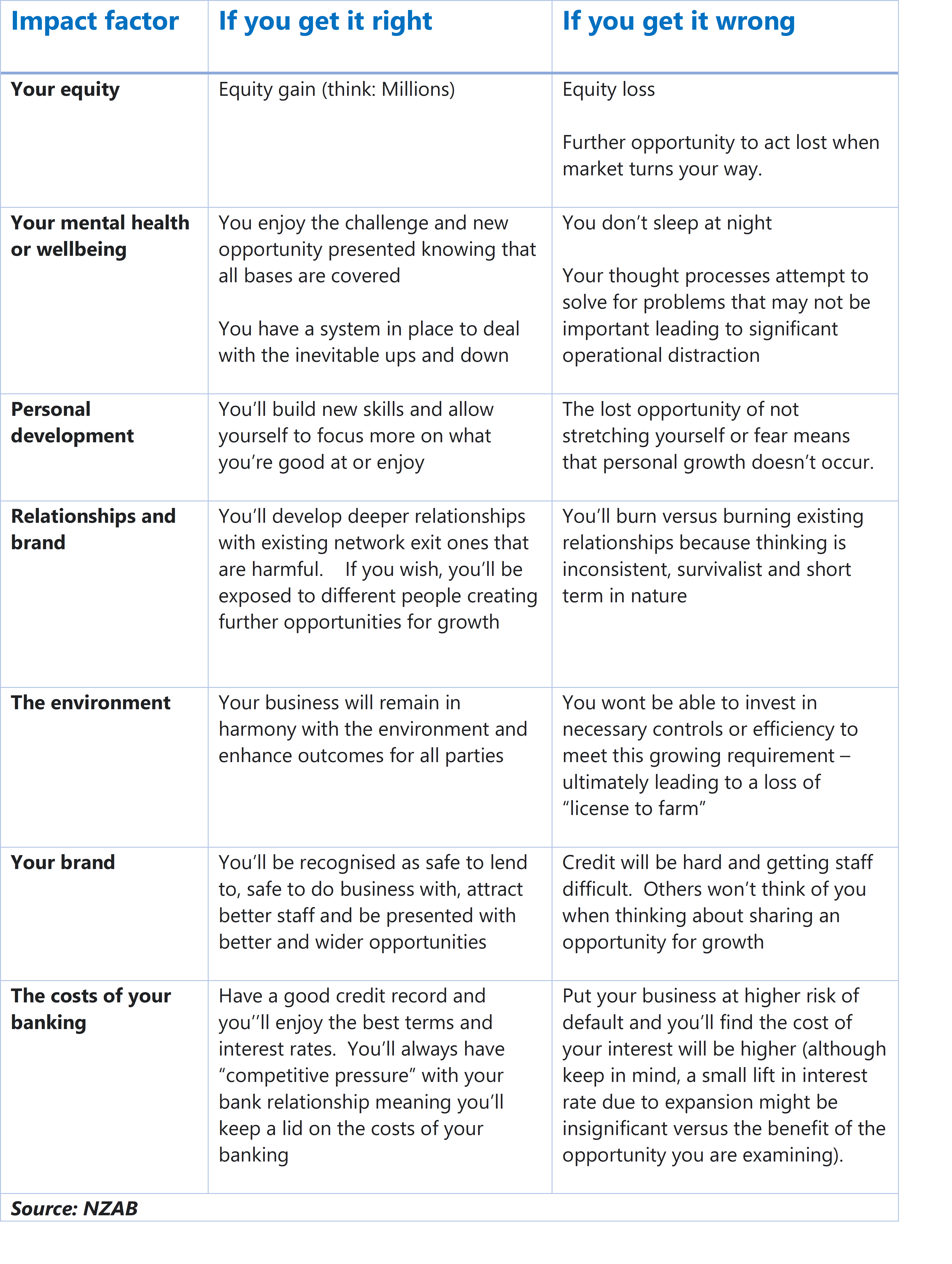

First of all, its worth considering the implications of getting the answer right or wrong.

So how can you turn “pretty sure” into “we’re absolutely certain” for that life changing capital decision or finance application?

(please note the following are just a few parts of the process, and it will be different for everybody).

Strategic Fit

Does this acquisition or divestment fit with your strategy?

Do you even have a strategy?

Your strategy should be about capitalising on your “sustainable competitive advantage” (definition: what you are better at than most and can keep replicating time and time again to make a profit), whilst shoring up any blind spots you might have.

This is not a small topic - if you don’t have a predefined strategy, make this your first step, before examining whether or not this is a fit.

Develop some investment/divestment criteria.

Ideally, before the next opportunity comes along, your strategy would have distilled into you a set of criteria you want to meet before agreeing on your next capital move.

Profit, balance sheet implications, workforce, geography, industry and asset quality are just some of the factors that you will have a criteria against.

But at the same time, don’t let your criteria make you narrow minded. Having a criteria means that you can act really decisively when the time comes – and that is not just about purchasing, but selling too.

This takes time and planning, but its definitely worth it when the opportunity finally arises.

Get all your stakeholders on board beforehand – the power of collegiality.

Your stakeholders can cover a wide range of groups, but typically this is going to be your family (or shareholders), your bank and your key staff (but will also include environment, community and the like).

Obviously your strategic plan is the best forum for getting everyone on board, having your strategic or business plan well-articulated and agreed PRIOR to that major decision means the process has a much greater chance of success and significantly less wear and tear on relationships.

That's "collegiality" and when you've got it, your business goes up a gear. It’ll also be much more rewarding too.

The same goes for the credit process when you're about to seek finance. Often you don’t get a second chance to go through a credit approval process if you get it wrong the first time!

Scan the current macro environment (outside your farm gate/business door) for what’s happening right now.

Man alive, business changes fast these days! What you were thinking last year is bound to be different than this year.

Ideally you should have had a pretty in depth and recent scan of all the current forces at play in the wider macro-economic environment and how they will play out in the future. Don’t just sit on them - what do these mean to you and how are you going to capitalise on them or protect against them?

At the same time, you’re potentially making an intergenerational investment so assessing which of those forces is short term or here to stay is vital.

Work out what happens to you and your business when various economic shocks occur.

You’re going to need to stress test your business here. We don’t necessarily mean the bank’s criteria, but either way you need to test your new business with some scenarios that could happen.

What would happen to your cashflow is the payout was $4.50 or lamb was $3.50 for the year. What is the impact on P&L and balance sheet and how would you fund any loss created?

What’s the impact on your own resilience and your family if that event occurred?

What buffer would you need to build in that scenario if it meant business or family implosion?

This risk works both ways too. What happens if the metrics stay very favorable for longer? What will this mean for your investment timing if your strategy has growth in it? Not acting could end up costing you too.

Ask yourself if your organisational structure will cope or be enhanced by this?

How your current people resource is structured (leadership and workforce) needs to be critically examined under business expansion.

This could be the opportunity to invest into more specialist leadership in certain parts of your business meaning that the investment gives you benefits to the existing business as well.

Likewise, if governing a much larger workforce, do you have the required skills and headspace to cope?

Be ruthless with following your process and demand the same from your advisers.

If your current process for making major decisions in your farm doesn’t include at least some of the above factors, then you’re at risk. Risk of losing serious or risk of missing out.

Likewise, if your current advice is only focusing on whether you can afford it or not, that’s flawed and you need to change it up.

These decisions will literally cost or earn you millions down the track.

Getting the best advice is absolutely chicken feed versus that.

NZAB in the Media

Last week’s article received quite a bit of attention through various channels and ended up being printed in this week’s Farmers Weekly. If you haven’t read it yet, the link to the digital version in Farmers Weekly is here

Give us a call on 0800 NZAB 12 or email info@nzab.co.nz. We’d love to hear from you.