It’s that time of year when we’re finalising budgets for FY 22 and the ultimate question on all dairy farmers lips is: “what payout do we use for budgeting next year?”

It is a much different landscape entering into FY 22 than it was in FY 21. This time a year ago we were knee deep in COVID-19 and incredible uncertainty was evident in all parts of the world economy. A common trend amongst most bank economists were milk price forecasts leading with $5 in front of it. When Fonterra finally delivered their opening forecast of $6.00+, it was met with mild jubilation (albeit noting the very wide range offered).

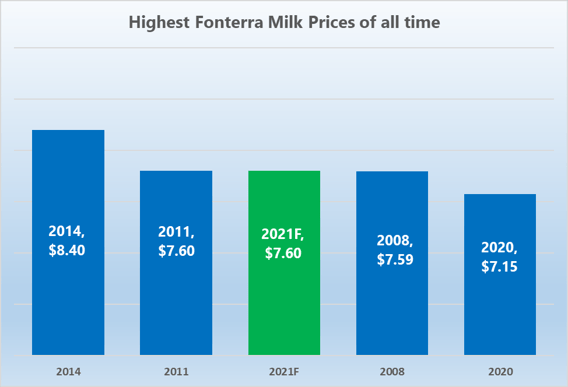

What a turnaround it has ended up being. At $7.60, being the current mid-point (milk only) with a sense of some upside potential, its going to be the second equal payout of all time.

Interestingly, it's also the second "high payout" in a row, something we haven’t seen before. When we had $7.59 in 2008, $4.75 the next year. When we had $7.60 in 2011 we had $6.08 to follow. The whopper of $8.40 in 2014 saw the brutal $4.40 (then $3.90) follow with a thud.

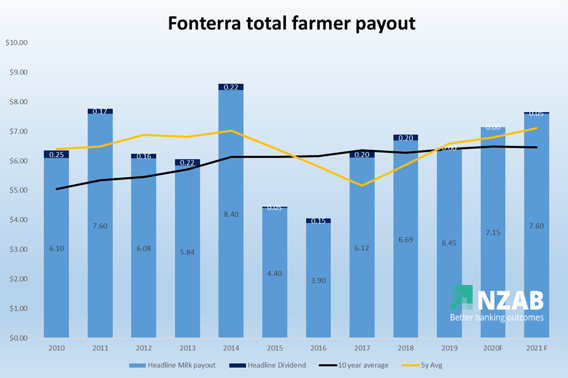

The below graph is a nice visual of milk price and dividend over the last 10 years for Fonterra. Cutting through those bars is both the rolling 10-year average (in blue) and the rolling 5-year average (in yellow).

Our first couple of reference points are both the rolling 5 and 10 years averages.

The rolling 10-year average is mighty steady now, even taking into account those two horror years in 2015 and 2016. It now sits at $6.26 with a further 20c/share for dividend making $6.46 for a fully shared farmer.

The 5-year data set is a bit more volatile. It is now $6.80, with a further 13c per share taking us to $6.93 for a 5-year average – the highest point ever, equal to what we saw back at the height of 2008.

Our second reference point might be current market data.

This data can come from both economists and actual GDT trades. There seems to be plenty of economists outgunning each other with numbers north of $8 being mooted. It's fair enough given the fundamentals at play - a bundle of milk products currently being sold on the GDT at between $9.50 and $10 and then converted back to NZD. That’s pretty extraordinary!

But I’m going to pause and change tack at this point, because this article is not about picking next years payout - It's about challenging what is used for budgeting purposes. And they are two very different things.

Setting your annual budget is best described as your "financial bible" for the year ahead.

Your budget should be one of the most important planning and governance activities in your calendar with so many operational and governance activities that follow on the back of it. Milk price is by far the largest variable in your budget and the one that can change so much throughout the year. How much profit you generate flows from this, which then allows you to make decisions on the more discretionary items, including investment, debt repayment and drawings.

And importantly, it’s a key measure for your financier. Confidence (and appetite), lending facilities and conditions are often all set from this budget.

Suffice to say, getting this part right is important. But it's a balancing act between being too conservative and overly optimistic. Both have consequences

Our normal approach with budgeting is to use the 10-year average, with a close eye on the 5-year average alongside.

This means a budget payout of somewhere between $6.20 and $6.80, or a mid-point of $6.50. We’re not here to tell you exactly what number you should use and your own views should be added to this. If you’re a bit of a conservative, then something at the lower end would be your number and vice versa.

Before you shout out “that’s way off current pricing!” bear in mind three things:

- Milk payout is a volatile thing and there has been sufficient evidence in history with low payouts following high payouts. I’ve heard “it’s different this time because of x,y,z” so many times but it never has ended up being so yet. But maybe its different this time...

- This is your budget - you can “reforecast” at any time given the flexibility of management reporting software. A reforecast may even happen as soon as June or July – your “forecast” will change regularly but your budget will not.

- In our experience, it’s much better to have a “sea of green” with your variance reporting than the “dreaded red” everywhere. If Stakeholders are aware and have agreed to where your business is headed based on the assumptions at hand, you can then set amortisation at achievable levels and you have flex in your system. The reverse is awful.

- As the year progresses and payout certainty increases, you can start to rely more on your “reforecast” and less on your budget. That’s the time for getting more serious about locking down those more discretionary items.

As always, bear in mind the “cashflow effect” of deferred milk from FY 21 and advance of FY 22.

The 10 year average for advance payment as a % of final payment is 82% (5 years is 80%). Applying the mid point of 81% of $6.50 above means an “advance to May (April production, paid May) of $5.27.

With deferred payments rolling through from FY21 produced milk, (as currently scheduled) of c. $1.70 , the cash payout received in FY 22 would build out to be $6.97, despite using that $6.50 headline milk price.

A final point to note on credit ratings.

There are one or two banks that can still include this year’s coming forecast when refreshing your credit ratings. It's wise to have a discussion with your banker about whether choosing a lower payout will materially impact on your credit rating (and then whether that in turn has any impact on pricing or terms).

This is where the balancing act of being too pessimistic or overly optimistic can have material impacts on your banking outcome.

For assistance in navigating this and understanding what it can all mean for your business and its banking outcomes, please call one of our team members today to have a no obligations chat.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for four years now and we’re right across New Zealand. For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz