As you know we are very interested in the “why” when banks show differing levels of appetite in the Agri Sector.

By understanding the “why” from a bank perspective allows farmers to better understand how they should navigate their credit and negotiation processes with their bank.

Knowing this allows our farmers to more effectively separate their strategy from what is good for their business and what is good for their bank which can, at times, be quite different things.

This short article looks at the impact of differing bank strategies since 2007 when lending took off quite aggressively in the Agri sector with the first “whole milk powder boom” and the very challenging volatility that followed.

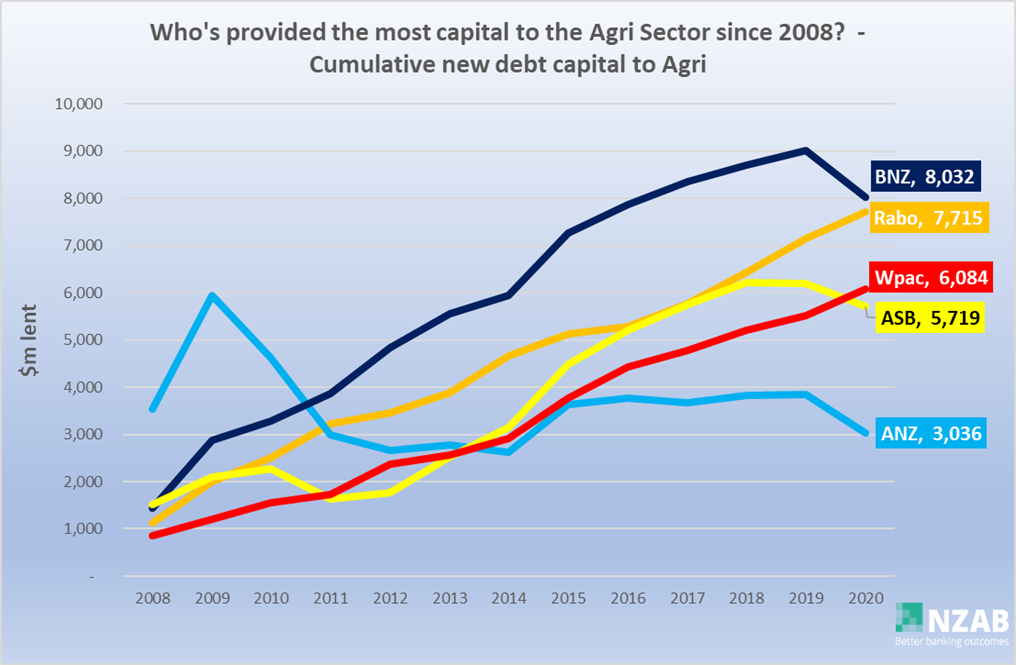

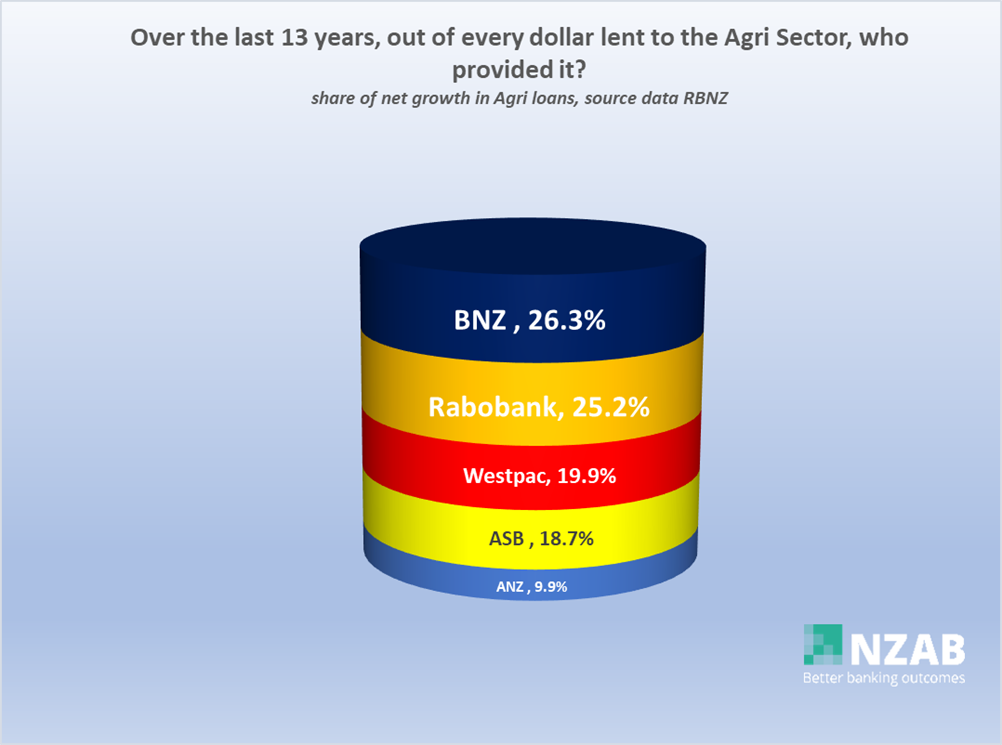

These first graphs show how much capital each bank has leant to the Agri Sector (in total), since 2008.

A couple of points to note first:

A couple of points to note first:

- This is whole numbers, not scaled to market share (i.e. You would expect a bigger market share bank to have lent a greater share of the $ growth and vice versa)

- This is from bank disclosure statements, not all have the same balance date so are a few months out from each other in any point in time.

The biggest amount of capital provided has been from BNZ and Rabo, but with BNZ ramping back significantly over the last year.

Conversely Rabo has been steadily accumulating in a very consistent fashion, right through the period examined – as has Westpac.

ANZ contributed significant capital from 2007-2009, then promptly sought to reduce all of that lending (and some) over the proceeding 3 years and hasn’t really grown (in $) at all since that period.

ASB’s growth is also inconsistent with significant growth then flattening, significant growth then flattening.

One might argue that the most supportive banks during this period have been the ones with the consistent growth lines (Westpac and Rabo). However that would not tell the full story as bank’s with larger market shares (such as ANZ and more latterly BNZ) sought to offload market share to balance their own internal portfolio’s and to get better returns in the less capital intensive home loan sector.

Interesting stuff, but also potentially difficult if you’re a farmer looking for a stable growth strategy over time.

But are historical results a great driver of future behaviour?

Well, not necessarily - and BNZ is a case in point – if we’d looked at this data back in 2018, you would have said that they would have been the most capital supportive participant - only to then have subsequent retrenchment based on portfolio re-balancing from 2019 onwards. That could easily happen to any other bank in the future as well, regardless of current trajectory.

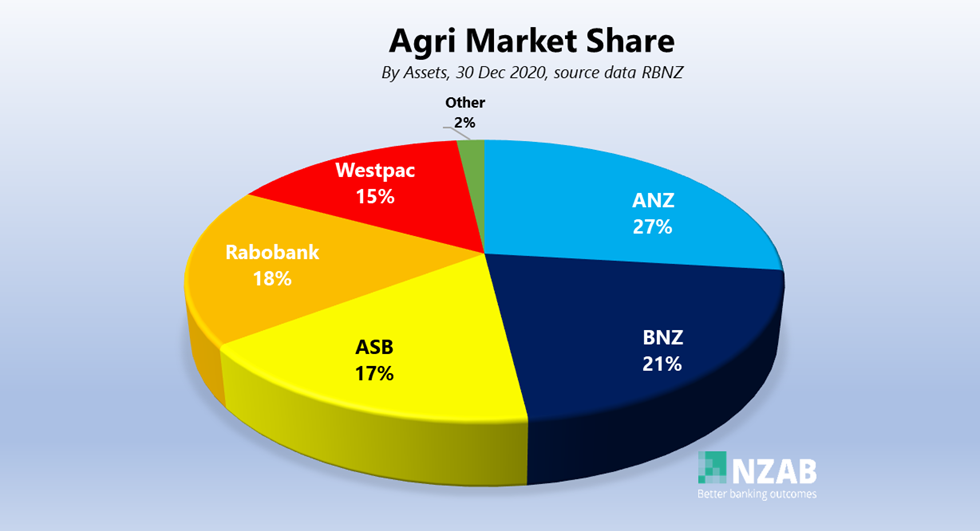

All of this culminates into the following current market share levels.

Now more than ever, we’re seeing a more balanced split of Agri debt between all banks (although this does not account for relative size of each bank – for example BNZ’s Agri lending as a % of their overall lending is much higher than that of ANZ’s).

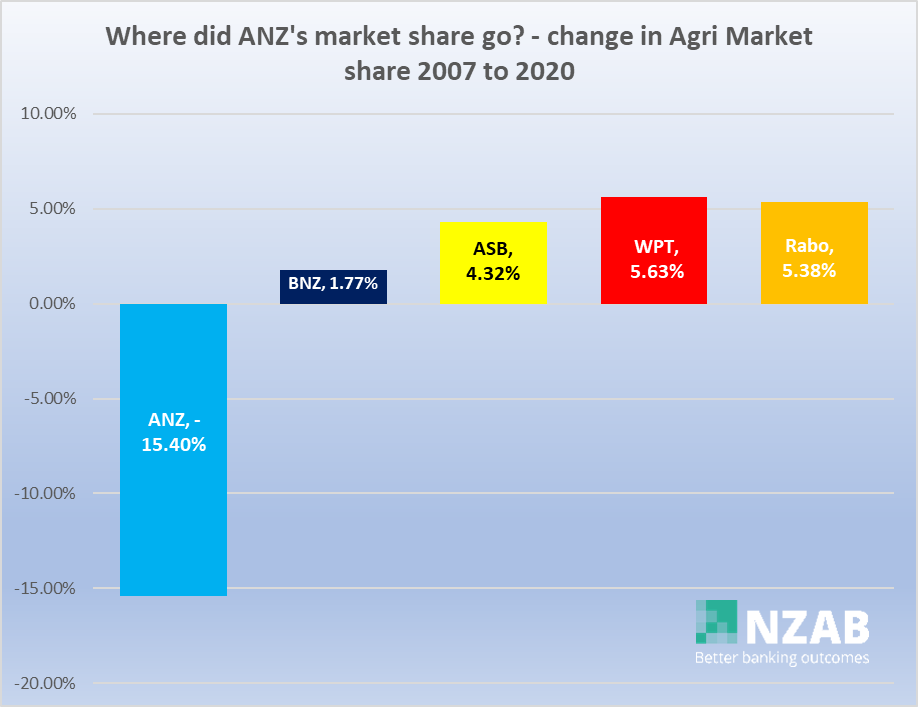

More interesting is the change we’ve seen in market share - this graph shows the change in market share over that same period (2007 -2020).

So why is this information useful?

There are many more conclusions to draw from the data here – but the main one is to be very cautious around setting your business strategy in line with what your bank is saying about your industry.

That works both ways – if your bank is in growth mode, they may be overly supportive of a position that might not be reflective of the actual “commercial” risk position. Likewise, if they’re in retrenchment, very little growth would be supported, weighing on confidence to invest and expand, regardless of risk.

These changes in appetite, if understood well, can have big benefits to farmers with:

- how they set their strategy,

- how they access their capital and,

- how they use all of that to get the best interest rates and terms for their loans.

As we enter a period where banks are gradually starting to shift the appetite dial up again, it’s timely to remember this.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for four years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz