Ever had that feeling of utter and total business confidence? When you know that your business is humming, profits are good, and you’ve got a great team of people in all your key roles?

Chances are, you probably felt quite bullish about expansion or further investment.

Chances are you probably felt emotionally very good as well.

Of course, you probably have. Although as a farmer, up until recently, you’ve probably been feeling a little bit of the opposite. Weighed down by previously lower commodity prices, then resultant bank pressure and all wrapped up in increasing environmental and social pressure, confidence in the Agri sector has been distinctly uncommon.

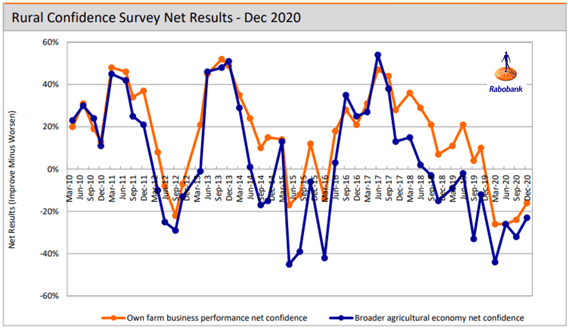

In fact, “broader agricultural economy net confidence” (source: Rabobank economic survey, last version Dec 2020) has been net negative since early 2018. That’s a heck of a long time despite commodity prices during this time increasing to near record highs.

This article is not about why we are where we are with confidence – but instead about how we get it back and why it’s so important.

First of all- what is business confidence?

Put really simply, it means that your expectations about the future of your business and your industry are more positive about where you are today.

And this simple statement is so important for an economy and for your business.

Because how you feel, often drives how much you invest or spend. And if you invest or spend more (particularly “business capital” investment, not consumer spending), it probably means that the economy (and in turn your business) will be expanding.

This is likely to mean more profit, increased balance sheet and more shareholder wealth.

It also means you can probably reward your staff more, thereby attracting better talent. This, in turn, increases both the levels of your business performance and your staff engagement and so on. It’s an ever-increasing circle.

The other aspect of confidence is the confidence that your stakeholders have in you – and in particular, your bank.

Given the high degree of subjectivity in the banking process, the confidence a bank has in a customer is so critical as to whether they provide you with more capital to invest – or even worse – ask for it back in a seemingly unreasonable manner.

And that can have a massive impact to both businesses and shareholder wealth.

At its best, it might mean the ability to purchase another farm or not.

At it’s worst, it can mean the difference between holding or selling that asset. History has shown that those decisions are usually made at the worst possible time, with not just your bank’s confidence being low, but the sector probably will be too.

Meaning that asset probably isn’t going to sell well.

It’s worth noting the difference between confidence and overconfidence in a sector and in business.

Confidence means that you’re continuing to invest to grow and sustain the business.

Where confidence turns into over confidence is where a participant may have a too rosy view on the future. This can often lead to not recognising risk adequately due to a fear of missing out (FOMO), leading to unsustainable investment decisions being made – enter a subsequent and prolonged period of low confidence where yesterday’s excesses/poor investment decisions take years to make back.

When you’re overconfident, you’re not investing, you’re gambling. It can lead to arrogance and loss.

Being counter-intuitive with confidence is also a consideration.

When confidence is running high in a sector, asset prices are elevated as businesses seek to expand against a backdrop of excess demand for assets and limited supply.

When confidence is low, the opposite happens and better “value” can be achieved when investing or expanding.

Suffice to say, confidence (and importantly - steady confidence, not over confidence) is one of the most important aspects of your business

This goes for both your own confidence and the confidence that your bank has in you.

So how do you remain confident (but not too confident) in an uncertain world?

- Have a clear vision and strategy for your business. Don’t underestimate the importance of having a “vision” – i.e. that unifying picture of the future that keeps you focused in both the good and bad times. Vision evolves into strategy – put simply, this is understanding what you’re good at doing more of it (your sustainable competitive advantage) and alongside that, shoring up your weak spots – things that might stop you being successful in the future. And wrap that into strategic objectives that have designated actions to achieve – all prioritised, measurable and delegated. And don’t keep this to yourself, articulate it really well and share it with your bank and your senior business team.

- Have a fit for purpose balance sheet. To cope with the volatility so inherent in farming businesses (weather and product prices to name a couple!), you need retained earnings. This doesn’t necessarily mean you’ll have a bucket full of cash somewhere to access when things go down, but it does mean you have a reasonable likelihood of accessing more capital (probably from your bank) when these events occur.

- Stress test your business against all possibilities – this means running an actual scenario of lower product prices and lower asset values. What does this scenario mean for losses and/or need to access capital? This process might sound negative, but think how confident you’ll feel about investing if you know what the impact will be at “xx” low payout and what plan you will roll out (as you’ve already built for it).

- Remember history. “Past history is not a predictor of future results”.. yes, but the cycles do tend to be predictive if you’re in a commodity game. The old saying of “the only cure for high prices is.. high prices” is very true in purchasing decisions with commodities. When prices go up, it can stimulate supply, decrease consumption, encourage investment into substitute production and increase consumption into substitute products. I’ve heard the saying “its different this time” far too many times now.

- Consult widely: What I mean here is not making your investment decisions based off your bank’s settings. Their settings are, at least in part, appetite statements – in other words, whether they want to increase or decrease Agri loans. They should never be a proxy for your investment decision making.

- Use specialists. The world is far too complex these days to employ “generalists” with your advice. The best businesses (and this is the same for advice) focus on one part for the supply chain and do it really well. I know my builder will know a heap about stormwater drains, but I’m not going to get him to put them in. I’m going to get the plumber.

- Keep an eye on future trends, but don’t get paranoid. It’s very easy at present with the rate of technological change to think that an industry might be gone in a few years because of X, Y or Z. And whilst it is important to stay abreast of this, look to point 4.

- Remain agile: Things change, and they can do so quickly. At a base level, this mean you have to be regularly assessing the impacts of these changes with your cashflow and your operating model. At a higher level, this might also mean changes to your strategy. Your strategy is not cast in stone, so be flexible with changes to this as the environment changes around you. But at the same time, don’t run a knee-jerk business – refer point 4 again!

- Communicate: With your whole team, including your advisors, your bank and most of all your family - The power of “collegiality” (having everyone on the same page) is so important, its almost worth another article.

These are just a few things that you might want to do to keep your confidence in an uncertain world. If you have other things that you do, we would love to hear about them from you.

At NZAB, we love to help our customers grow great family businesses, being confident yet considered in their approach – and most of all, happy with what they do and how they do it.

Please feel free to pick up the phone and have a chat at any time.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for four years now and we’re right across New Zealand. For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz