Right, so we all know what Chinese Whispers is don’t we?

It’s a kids game where players form a line or circle, and the first player comes up with a message and whispers it to the ear of the second person in the line.

The second player repeats the message to the third player, and so on.

When the last player is reached, they announce the message they heard to the entire group. The first person then compares the original message with the final version.

Mistakes often accumulate along the way, so the last player’s reading differs significantly from that of the first player, usually with quite amusing or humorous effect.

Unfortunately, this can also happen in the Agri credit process.

And the effect is not humorous nor amusing. It can be downright devastating.

Credit approvals in Agri all have significant consequences – they are the difference between getting further investment capital or not (which can have significant wealth accumulation opportunities in the future) and at the other end of the spectrum, they could mean the difference between paying significantly more in interest, or even worse, having to divest a farm at the wrong time.

Suffice to say, the stakes are high.

So what has all of this got to do with Chinese whispers? Well, the Agri credit chain is not a band of one.

Very rarely does the frontline banker have the sole discretion to make a lending decision. In nearly all cases, this decision will be referred to another authority.

Often, it goes through at least two other parties – sometimes further.

All along that journey there is risk that the message evolves, changes or weakens.

And guess what the most important link is – you the farmer – and your start point with what you provide to the frontline banker.

How and what you provide, frame, analyse and present is a significant determinant to the success of that credit process – and whether you accumulate more wealth in the future, or don’t.

But the best part about this, is that its easy to control if you know how.

Let’s start by understanding some of the assessment factors that a bank goes through with the credit process.

Now, to the uninitiated eye, a typical credit process looks like this: Have a meeting with the bank, maybe have a tour of the physical assets, provide your past financial statements and your future budgets and make your request.

After a period of time and more than likely quite a few other questions, you will get an answer back from the bank, which is going to be a yes or a no.

Or it might be a yes with some conditions that are really hard or risky.

Or it might be a yes but with an increase in price.

Lots of potential outcomes here and a lot of the process left to chance.

So, lets pull back the curtains a bit on what actually happens in between.

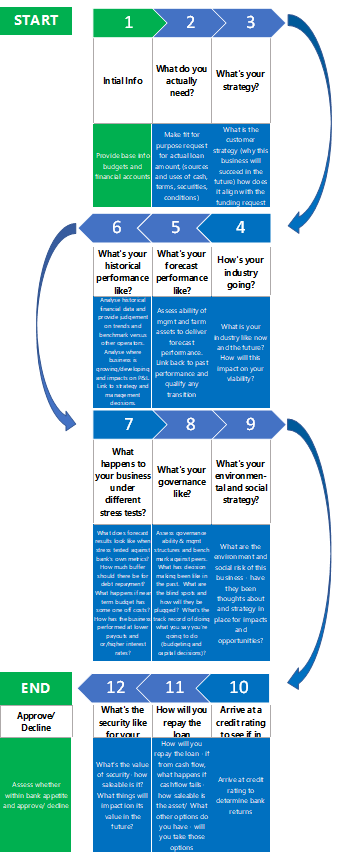

It might frighten you to think that there are at least 10 other steps that a bank completes, all before deciding whether or not to grant you that loan and also what the costs of that loan will be.

Lets take a closer look:

Step 2: What do you actually need? Make your request fit for purpose here for the actual loan amount, backed up sources and uses of capital, plus whether there is any uncertainty or buffer required here. What term do you need it for and what securities might be available?

Step 3: What's your strategy? Why your business will succeed in the future and how does it align with your funding request? What blind-spots do you have here that need plugging?

Step 4: What's your historical performance like? What trends are in your historical financial data and how do you compare versus other operators? What happens if the business has been growing or developing and this impacts on the historical P&L. How do these results link to your strategy and management decisions? What else is at play here?

Step 5: What's your forecast performance like? What is your ability (via on farm resources such as people and farm assets) to deliver forecast performance? How does this link back to past performance and if there are differences - why?

Step 6: How's your industry going? What is your industry like now and the future? How will this impact on the sustainability of your viability?

Step 7: What happens to your business under different stress tests? What does forecast results look like when stress tested against bank's own metrics? How much buffer should there be for debt repayment? What happens if the near-term budgets have some one-off costs? How has the business performed at lower payouts and or/higher interest rates? In behind this, what is your balance sheet like? If there was volatility of earnings, are there enough retained earnings or other liquid assets to support the business if required?

Step 8: What's your governance like? What has decision making been like in the past – in good times and bad? What are the blind spots and how will they be plugged? What's the track record of doing what you say you're going to do (budgeting and capital decisions)?

Step 9: What's your environmental and social strategy? What are the environment and social risk of your business? Have they been identified and a strategy put in place for limiting the impacts and maximising opportunities?

Step 10: What's the security like for your loan? What's the value of security- how saleable is it? What things will impact on its value in the future?

Step 11: How will you repay the loan? If from cash flow, how soon can you do this? What happens if cashflow fails-how saleable is the asset/what other options do you have - will you take those options?

Step 12: Arrive at a credit rating to see if in bank appetite and work out returns/ pricing: This is largely a bank activity, but is where it all comes together and ultimately how you are priced. Better in here means a cheaper rate, worse and you’re going to be asked to pay something higher.

Now, as you can see, there’s quite a bit in a credit process.

The outcome of that process is completely uncertain if the only thing you are providing is that initial base info.

Given that decision could literally mean significant future wealth accumulation or destructions, that’s a heck of a lot to leave to chance.

So back to those Chinese whispers.

What you’re telling your frontline banker (or as the case might be; not telling) is quite likely having a detrimental impact on the the success of your credit outcome.

You already run the risk of misinterpretation of your credit application given the number of hands it might pass through.

Making sure you control the information flow (via great presentation and articulation) of as many aspects of the credit process upfront is the absolute key to success here.

And the last thing you should be thinking here is “Righto, I understand this now – do it myself”

Since when did anyone cook like Gordon Ramsey by simply following his cookbook?

Get a specialist and get it done the first time, right.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for four years now and we’re right across New Zealand. For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz