Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

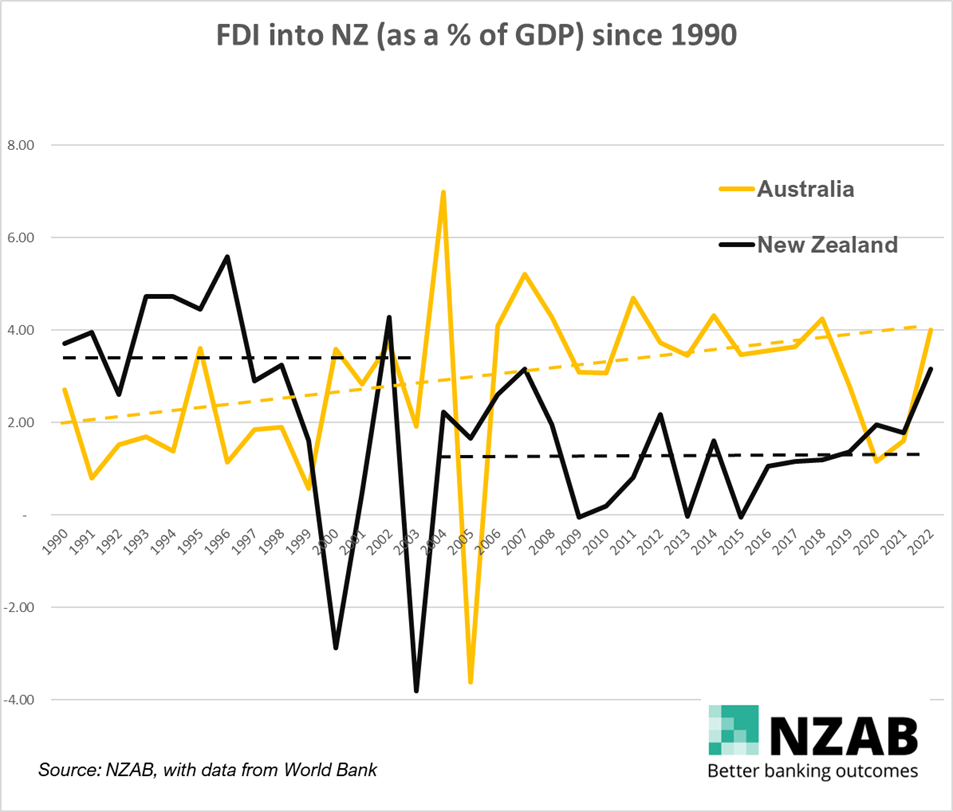

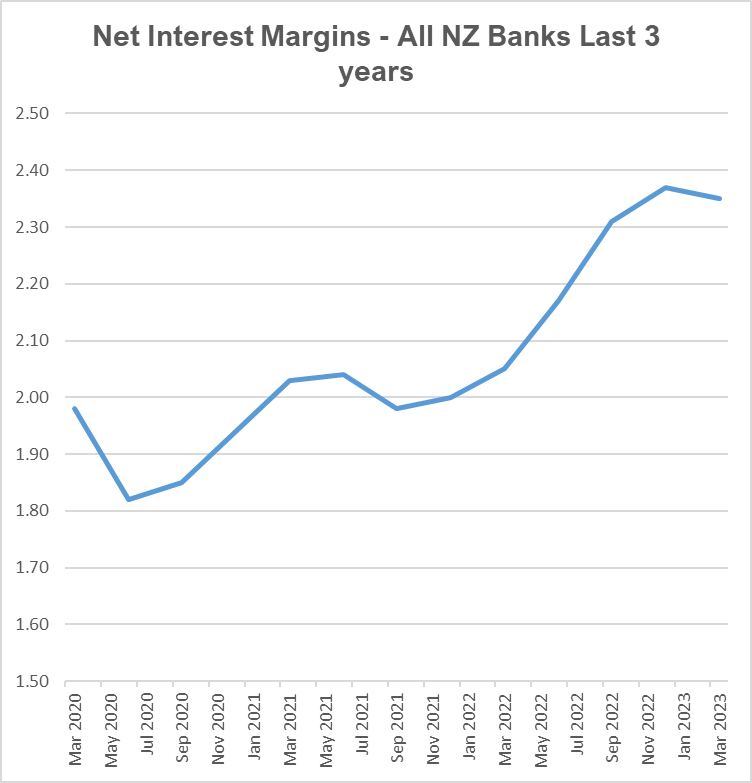

A few of the main banks have just finished their full year reporting releases and their profits are again hitting high levels on the back of record net interest margins and lowering operating costs.

The New Zealand divisions are all performing handsomely on the back of the ongoing expansionary lending to the home loan sectors in the earlier part of the financial year plus record margins on the back of the open supply of cheaper funds.

However, it’s worth paying particular attention to the near identical messaging coming from the Banks about their first half performances being much better than the second half.

Here’s some statements they’ve made:

ANZ, in its press release noted that “it was a game of two halves. The good performance of the bank in the first half of the 2022/23 final year reflected the tailwinds of the Covid fiscal stimulus in the economy..” and “but in the second half of the year our performance slowed due to the more difficult environment NZ is entering”.

BNZ’s CEO Dan Huggins, who recorded a record rise in profit, noted that “BNZ's profit fell 12.5% in the second half-year versus the first-half to $704 million reflecting a broader economic slowdown in New Zealand” and “The second-half net interest margin dropped nine basis points to 2.36% from 2.45% in the first-half.

Let us interpret this for you.

Home lending growth has stalled, and deposit rates have climbed higher than expected, reducing the record margins banks were otherwise enjoying when there was excess cash floating around New Zealand, a result of the record stimulus provided by the government and RBNZ at the time. The Banks’ increase in profit is a result of extra lending volume multiplied by any additional margin increase between cost of deposits and return on loans.

We noted this starting to appear when we opined that Banks were increasing their business and agri margins at a greater rate than needed due to fixed rate home loans dragging on their returns.

At this point, it’s worth remembering how Banks think when it comes to setting performance targets for their profits for their upcoming year.

Typically, cyclical considerations (i.e higher profits at times where market conditions allow, lower profits when not) are largely ignored. Instead, a newly minted, higher profit target is sought for the upcoming year, regardless of how good the prior year was.

Typically, this “ask” will range between 5-10% increase on the prior year. This will need to come from either greater lending, better margins or lower costs. In most cases, all of these categories are targeted.

The Bank is a business and businesses increase profit by either selling more at better margins and at lower costs of operation. For Banks, this is largely a function of more lending growth (volume) x better lending margin (the gap between costs of deposits and lending rates) less business operating costs (people, branches and systems).

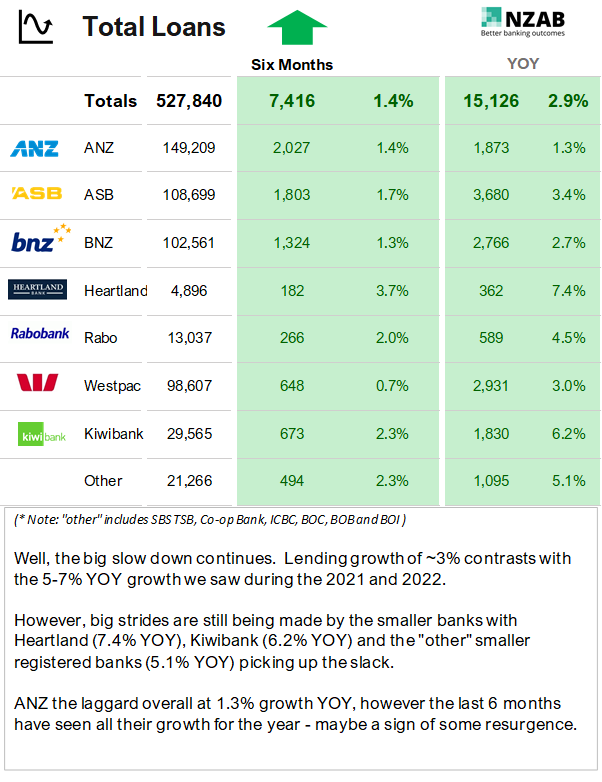

Now let’s overlay that with the current speed of the economy. The back half of 2023 has seen a sluggish economy with low lending volumes.

Flowing into at least the first half of 2024, the forecast is for more of the same with persistently higher interest rates continuing to stifle credit growth.

With this backdrop in mind, we see the following things becoming evident in the Agri lending market as we go through 2024.

1. New transactions or customers that fit neatly* (*see point 4 below) into Banks’ Agri lending appetite, and in particular those from new customers, will remain strong and possibly get stronger.

Despite much lower commodity product prices and much higher interest rates, demand for new Agri transactions will remain strong where they fit into tight banking criteria.

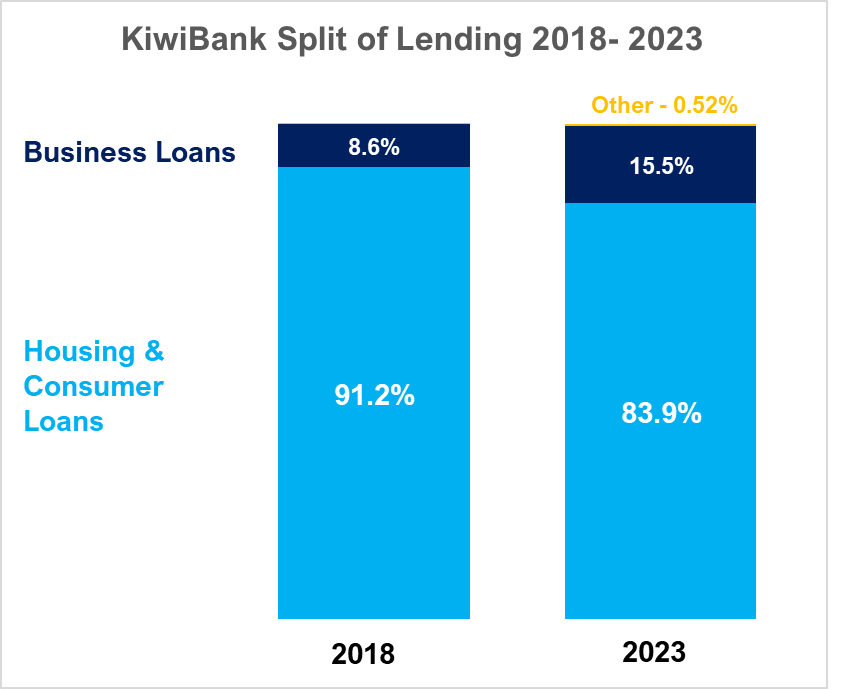

This is the volume part of the increasing profit equation, a simple rationale of needing to continue to grow the balance sheet against a backdrop of lowering demand. The need for volume will be exacerbated by low lending volumes in the housing market.

If the deal fits neatly into Bank criteria, expect to see most main Banks lining up to bank it, with strong appetite and with very strong competition with pricing.

2. Conversely, look for Banks to increase margin on existing customers, or be slow to pass on reductions in deposits costs.

This is where we will really see a two-step market.

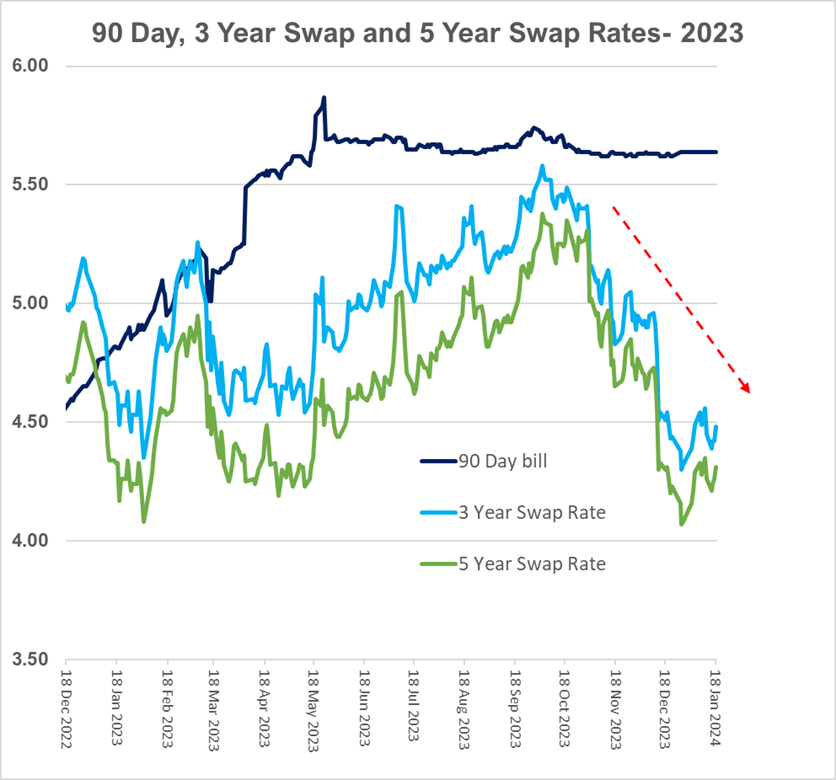

The need to deliver profits against a backdrop of low lending volumes means that there will be increased focus on the margin multiplier of the profit equation. This will be in the form of portfolio wide increases in margin for “funding” or “liquidity” premiums and will become more evident when underlying base rates (30-80 day bills and swaps) begin to fall.

Equally, whilst Bank deposit costs have been increasing for the last two years, these are now starting to reach their peak and will eventually start falling. How quickly or slowly this is passed on is a strong profit determinant for the Bank.

You will also see a stringent focus on “pricing to the risk curve” – this means that those customers that have higher credit risk will ultimately be charged more as Banks look closely at each customers’ credit rating and ensure they are getting an “efficient” return on their capital. This will feel particularly difficult for those customers who are already under profit pressure.

3. Look out for further Bank “head count” reductions to lower operating costs.

The final lever that Bank’s will be examining is their ability to earn the same, but with less operating costs.

Ultimately this means working their business towards a “lower cost to serve” with more accounts per bank staff member or a greater use of technology to make non-human decisions. Either way means that the average banker will be having to do more, with less.

Having the necessary time to understand your credit proposal will come under pressure, particularly if it’s not presented well or not perfectly “in the box”.

4. The “swift and easy” credit approval “box” will continue to get smaller, leading to the need to present transactions even more carefully and consider non-main Bank capital solutions.

This is the double-edged sword from the above point- less time from bankers to consider applications and in general, less desire to consider transactions that don’t meet strict bank underwriting criteria or spend time on transactions that have been prepared to a sub-par level.

More than ever, if a Bank does not show appetite with a transaction, it does not mean that the farmer's strategy is flawed, its just that the Bank’s credit underwriting criteria is getting tighter, or possibly the credit risk is not presented in the right manner. And that’s a very important distinction.

This will mean farmers will need to think carefully about how they present the transaction, plus consider other, more suitable forms of capital, including equity or non-main bank debt capital to better achieve or execute on their strategy.

So, what should you do with all this?

First, none of this is new, but here are some things that will become really important for you in 2024.

1. Ensure that your strategy and credit proposal is well presented.

The banking process is equal parts objective (financials, balance sheet etc) and equal parts subjective (judgement on quality of decision making, advisors, strategy, rationale for past performance etc).

Knowing how to present your business in line with how a Bank assesses credit risk is vital for a yes or no, plus also for how your credit rating lands. This is doubly important where bankers have less time to understand what you’re trying to achieve/ask for.

2. Create a market for your loan.

This doesn’t mean taking your loan to all the Banks and asking for the best rate. This means ensuring that your business is of a sufficient quality that multiple Banks would want to have you as a customer. In other words, create something that a bank would like to buy.

Don’t let your business get to a place where you are “marooned” with one Bank. But also, don’t worry if you’re in this camp - many farmers will be right now – but careful navigation around the current situation and creating a plan to move into a better level of credit risk over time is important.

3. If all of this feels like the Agri Debt market is pulling in different directions, all at once – you’re right.

The Agri market for banking requires a very specific set of skills to navigate successfully. 2024 may well throw up the most “imperfect market” for Agri loans that we’ve seen yet. The difference between yes or no, or the vast range in interest rate that the market will deliver will have significant ramifications on your business.

And if all of this seems a little too hard, drop NZAB a line.

NZAB was created to bridge the gap between farmers and their Bank.

New Zealand has some of the best farmers in the world. In a highly regulated and complex finance industry that continuously evolves, we ensure our farmers are informed and empowered to ensure they stay at the top of their game.

We’d be happy to show you why we’re the leading provider of Agri Finance advice across New Zealand. We use our scale, influence and experience to get our farmers the most competitive finance solutions they deserve.

Go to our website at www.nzab.co.nz for more, fill out this form, or call/email us direct on 0800 692 212 and info@nzab.co.nz