In our last article, we talked about the evident return of bank credit appetite in the Agriculture sector, a welcome development for farmers as capital availability is important for both increasing productivity and confidence in the sector. Both are good things, and they encourage further investment plus ensure that talent is attracted to the sector, critical for future success.

In this article, Scott Wishart and I came together to collaborate on a new article to broaden the discussion and talk about the observed credit cycle in agriculture – what causes it and what to look for.

This is important to understand as these cycles are much shorter than the investment period of a farming business. In other words, it’s not uncommon to see less than 3-5 years from peak to the trough of a credit cycle - yet the investment in farming is generational and needs to outlive both the top and the bottom of these peaks.

The causes are not always the same either. Sometimes it’s due to the lack of sustained profitability in the sector, other times it might be a generalised credit crunch. Sometimes like we saw in 2016 onwards, it was increased regulatory capital requirements making agriculture loans less profitable.

In other times it’s sector weighting versus other sectors in that bank, or even at the parent bank. An example of this that we’re seeing playing out right now is where one sector (housing) is becoming “full” for the bank and where another sector (agriculture) has loans that are getting repaid faster than they are growing creating a positive supply gap of credit.

Learning how to spot the early signs of change and what drives these changes is critical when making your investment decisions. Sticking to rigorous behaviours with business management and decisioning is key.

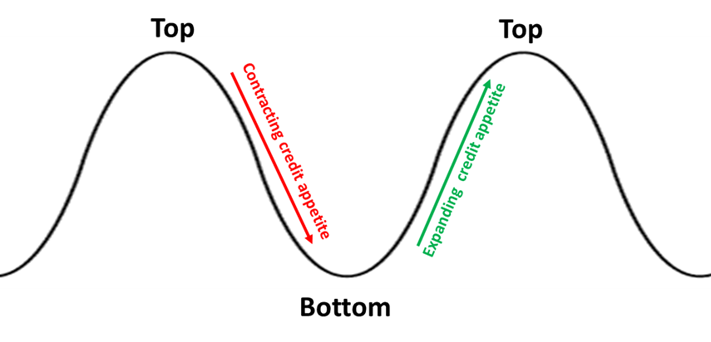

The cycle can be best represented by a sine wave as follows:

The Bottom

Starting at the bottom of the credit cycle, this is where we have the least amount of credit appetite amongst the banks. We last saw the very bottom of this in 2015 to 2016, although it lasted a lot longer this time going right through to about 2018 before we saw some green shoots. We saw another period like this post GFC, although it didn’t last as long.

Things that were evident during the bottom of the credit cycle:

- Credit ratings have dropped significantly, a by-product of the poor actual and forecast results of the time.

- Regulators and shareholders get alarmed at the swing in performance of their agriculture lending books, questioning lending parameters. This leads to them being reset at levels much lower than 5-year averages. Wholesale negative credit overrides become commonplace for the entire lending book.

- Banks effectively become “shut” with very few or no banks taking on any new customers. Existing customers at some banks may have credit rationed.

- Simple loan rollovers can be very difficult affairs with a greater bank interest in “secondary exit” (primary exit is where farmers repay over time from cashflow, secondary exit is typically more immediate by way of an asset sale).

- Solving cashflow problems can now become a “farmer problem to solve, not the bank” leading to triggering of those secondary exits. More farms come to market.

- There is low enthusiasm from banks and their representatives for any customer expansion with active discussion about sitting tight or retrenchment.

- Farmers and other investors may get interested in acquiring bargains, but there is little or no capital to support.

- There is little or no pricing competition and interest margins expand, with banks quoting scarcity of capital and “needing to get a return”. Pricing becomes very aligned to risk metrics.

- Banks start wanting to “syndicate” or “sell down” large single exposures so they can lower their risk to a single large farming group.

- Banks seek to put more customer lending onto amortisation terms and seek maximum repayments from free cash.

The Top

Conversely, at the top of the cycle, we see much different behaviours in the market

The top of the cycle is something we observed at a couple of different points – 2013/14 was a large peak and so was 2006-2008. Both were driven by record pay-outs at the time, but interestingly were preceded by significant credit growth, not retraction, as we have seen over the last few years.

- Lending parameters increase to be more accommodative and are at maximum levels.

- Credit ratings are very strong, a result of near-term performance.

- All banks are now in the market looking for new customers – amplified by the resultant customer attrition which then results in more competition.

- The competition will drive margins to contract with better pricing for farmers, including contributions to customer’s costs when changing banks. Farmers tend to shop around more.

- An expansionary mindset from banks and their representatives is evident when assessing customer investment decisions, including proactive discussions about expansion strategy.

- Banks want to hold more of the overall lending to a farmer, refinancing other liability positions and increasing large single exposures.

- There are more interest only loans and flexibility about repayment terms.

- Land values are lifting and the market is relatively liquid due to more participants with more backing – both farmers and new investor entrants. Investors can sometimes start feeling like “they’re missing out”, driving prices higher.

Being at the top or the bottom is one thing but being ahead of the curve is probably more important, so working out what’s going on before anyone else is a useful thing to know.

Here are some of the "canaries in the coalmine"

If we’re at the bottom, but trending upwards, these are the signs of the first green shoots:

- One or two banks will gather support to invest capital back into the sector and support purchasing of distressed assets.

- Budgets are improving, and bankers will want to re- risk rate customers off these, but there will still be a push back from credit / regulators to use recent historical performance.

- Slowly but surely the flywheel will start again, and capital will begin to flow.

- Profit margins start to recover on the back of lifting commodity prices, but costs remain low and this means some very good profits emerge.

- Frustration grows with banks not supporting opportunities given things look more positive.

- Frustration lingers for farmers who have been under pressure to sell given improving performance.

- The liquidity of the land market increases with a market found.

We’re at the top, but trending downwards

When things turn for the worse they can turn quite quickly, so have a look out for these early warning signs:

- There is an increase in credit requests for working capital, however they are usually supported on the basis that a plan needs to be developed to protect business if the drop in profit is prolonged.

- The credit ratings models used are slower to adjust downwards given reliance on recent positive performance and historical numbers.

- Banks start to mention the need to start repricing, but still have residual appetite from competitors for 'good deals'.

- Oversight from regulators and bank leadership starts to pick up but often only with a focus on largest / worst performing exposures first.

- Bank leadership starts to talk openly in the market about resilience and capability of farmers to trim their budgets and right size business performance.

- Farmers can often think that any upcoming downturn will be brief or won’t eventuate.

- Farmers may remain with high expectations that bank will fund cashflow gaps, particularly on the back of equity gained on the last cycle.

- SQ metrics will begin to change and could be quickly, and business will be re-viewed against those lower metrics - even those with recent lending decisions made against higher metrics.

So where are we now?

I don’t think we are at the top of the cycle yet and importantly, we don't believe the peak will look like it was last time, but we are climbing towards it. Most of the observations about the top of the cycle are starting to play out in the market, albeit at levels seen below prior peaks.

The settings now have the right level of tension in them – with enough market competition and enthusiasm for sensible lending choices.

But whilst the wave is likely to be less peaky this time, it will still be a wave.

So What?

As sure as night follows day, the credit cycle will again fall the other way. We’ve seen it before in agriculture and we’re currently seeing it in housing.

Whether it be up or down, you can quite quickly see how a bank’s view of the world starts to become your own. If you let this occur, it may cut short your full potential at the bottom of the credit cycle or suffer the consequences of extending yourself too far at the top.

It's not wise to rely solely on your bank’s own parameters or enthusiasm (high or low) for executing your investment decision, as they are representative of, and biased towards the lending appetite it currently has or hasn’t got.

Ensuring that your business is set up for both growth and sustainability to meet a range of criteria is critical- not just those at the top nor bottom of the cycle. This includes making sure your business is strong enough to meet multiple lenders criteria at different levels and have necessary buffers in your system, whether it be stress testing your investment decisions, having plenty of cash reserves or having significant unused facility headroom.

That way you’ll never be forced to make decisions in your business that will ultimately hurt your business.

When you keep your business in a shape for all seasons, you’ll find that banks will generally be competing for your business, whatever the market and you’ll enjoy the best interest rates and conditions the market can offer.

Andrew & Scott

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz