Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

Last week we penned an article about how hard budgeting will be this year given the falling milk price, costs remaining stubbornly high and lots of macro forces that could pull both factors either up or down over the next 12 months.

Within that, one of our key points is that farm operating margins in any one year are very rarely “average”, they always shift from being great to being very poor. We went further and said that looking at those operating margins over a longer period of time (3-5 years) is critical when dealing with your own mindset and also that of your bank.

Reflexive decisions due to apparent near-term financial stress felt by farmers and/or their capital providers can have a detrimental impact on farmers mindsets. They can impact their confidence in their own well established and proven operating systems and their confidence to invest in productivity. Both farmers and banks know that margins can swing and things average out over a longer period, but sometimes it’s a good idea to put this topic up in lights and support with actual data to ensure stability with mid-term strategy.

With that in mind, this article summarises some actual dairy farm margin data over both the last two years and then against the last 20+ years to support that point.

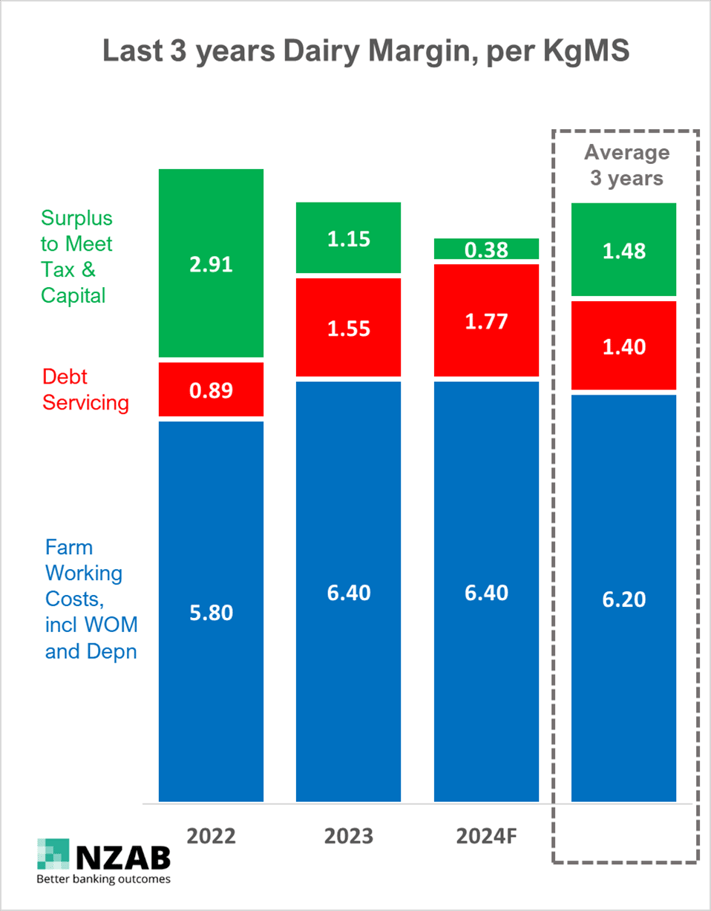

First up below is a bar representation of the last two years of average financial performance plus FY 24 forecasted and then all three years averaged in the final column.

It’s based on an average farmer with average debt, includes an adjustment/addition for Wages of Management (WOM) and also for depreciation. Debt servicing costs are based on the average floating rate during that time and the average debt level (Incidentally, the average 90-day bill across for the year ended May 2021 was 1.00%, over 2023 it was 4.16%, YTD).

For FY 24, we have allowed for $8/kgms for milk payout, deferred payments from FY 23 based on the current Fonterra schedule, average stock income and other income. We have not included the expected Fonterra capital distribution of $0.50-$0.70. Costs have been kept at last year’s level, we should be expecting inflation on some costs (labour, materials, R&M), but reductions in others (fertiliser, fuel and some feed). Debt servicing assumes an average 90-day bill rate of 5.25% plus an average bank margin.

The first observation is that FY 24 may be a very tight year.

This will be even tighter if payout finishes up at the lower end of some market commentary $7.00 – which would see a negative cash margin before capital and tax of about $0.40/kgms.

But, in the last article we talked about the importance of seeing the business through longer cycles. Farming is inherently cyclical and at times volatile.

Within this, the three-year average doesn’t look so bad.

Keeping in mind taxation would need to come off this (let’s say 30% and therefore $0.44), leaving $1.05per kgms, per year, to meet any debt repayments and additional non replacement capex or one-off drawings above WOM.

The average debt level at the end of March 2023 was ~$19.75/ KgMS. Assuming an interest rate of 8%, 20-year debt repayment equates to 43c/KgMS. So, after tax and 20-year debt repayment, this leaves a surplus of 62 cents, per year.

Not bad really.

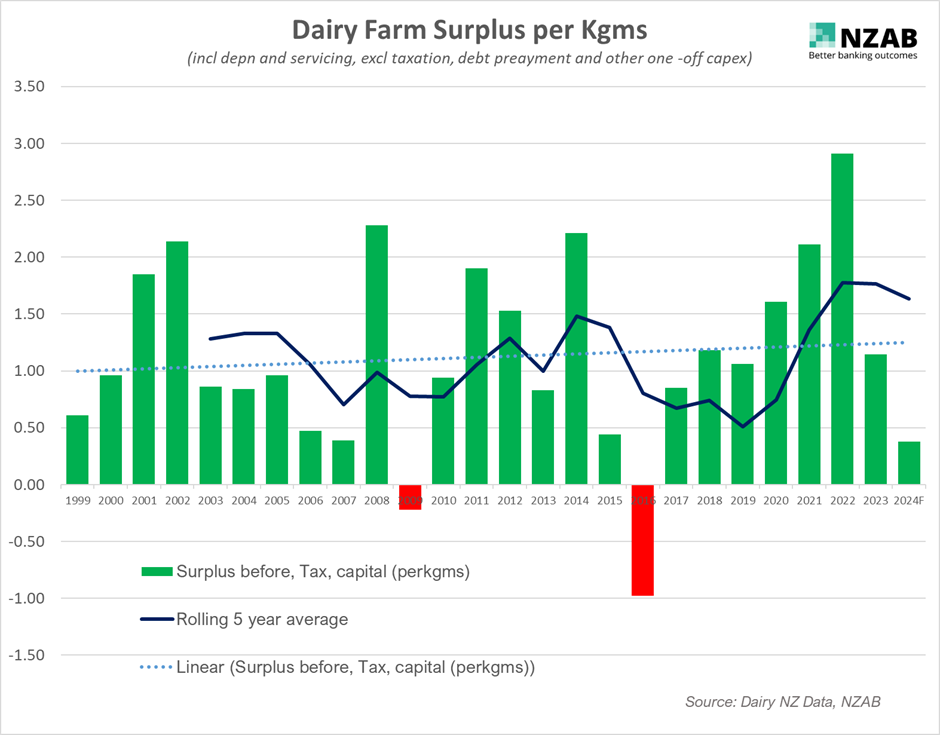

Even three years is a little short to look at this data, so let’s go back further to the same data set since 1999.

Take a look at the below graph for the same net margin after costs and debt servicing per KgMS over a much longer time period back to 1999. We’ve added a rolling five-year average and an overall trend-line.

So, looking at a longer period of time the current rolling five-year average for this net margin sits at > $1.50, slightly above the three year average in our first chart.

It’s still near all-time highs.

So, what’s the point of all these numbers? Well for us the key message is “don’t panic”.

Dairy farming is cyclical and at times quite volatile but has shown sustained profitability over very long periods of time.

As we said in the last article if the first cut of this year’s budget looks a bit sick, it’s not a time to throw the baby out with the bathwater and re-design your entire operating system. We have seen periods like this before and need to ensure both farmers and banks alike take a mid-term view with these periods.

To support this mid-term thinking, presenting historical, current, and future projections (beyond FY 24 and even an “SQ budget”) would be a really smart thing to do.

That said, during times of low margins, attention to detail becomes very important, so a highly detailed and line by line approach to how you set up your budget this year is very important.

Contact one of our experienced team on 0800 692 212 or click here to send us an email for an introductory chat. Having the confidence to act during times of uncertainty is critical. We’d be delighted to help you through this process.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz