Last year we introduced our new analytics platform with some early insights as to what was going on with cost inflation in the dairy sector. That was really exciting for us and our clients as it provided real time information that could be used to understand what was going on and what was likely to happen next. It also proved useful for the banking sector and we had many positive and constructive meetings with banking teams where we collectively worked through understanding the information and planning to support our mutual clients.

Last year we introduced our new analytics platform with some early insights as to what was going on with cost inflation in the dairy sector. That was really exciting for us and our clients as it provided real time information that could be used to understand what was going on and what was likely to happen next. It also proved useful for the banking sector and we had many positive and constructive meetings with banking teams where we collectively worked through understanding the information and planning to support our mutual clients.

After a good break over Christmas, one trend is now undeniable. Cash is disappearing. If you haven't yet revised your cashflow this season or found that your plans for tax, principal and business investment have had to change then you are certainly in the minority!

So, what's going on out there? The following charts are what we are seeing as things change on a monthly basis.

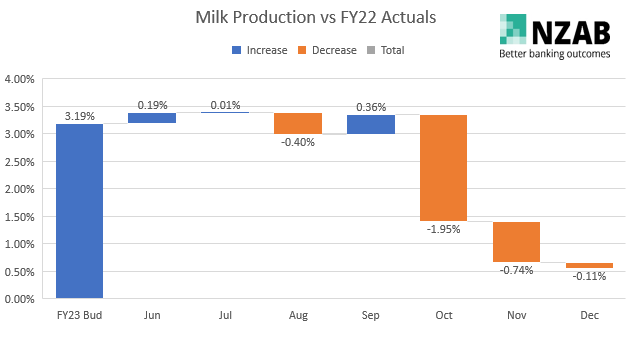

Production is down on forecast:

Our budgets for this year were on average a little over 3% up on last year's actuals, which is natural given last year was challenging in some areas, so production forecasts were back to more 'normal' levels. Unfortunately, we are seeing more of the same challenges this season too. The impacts of the wet and cold spring weather have caused significant revisions to milk production already, with the trendline heading back towards last year's actuals.

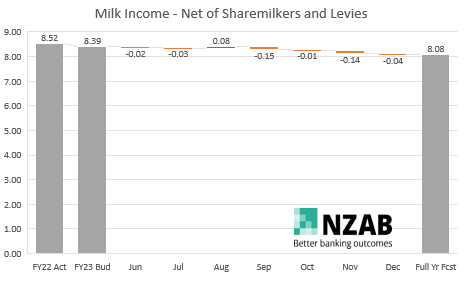

Payout is also down on forecast:

The above payout numbers are effective 'cash' received, not headline payout (i.e. final from last season plus advance to May) and is also net of sharemilker costs and other levies, so they won't look like the payout schedule, but do reflect what actually turns up.

When budgets were being set, we were in a different world. The FY22 final payout was looking like $9.30 and all indications were for an advance based on a $9.50 payout. Noting that at that point, the futures for FY23 were trading between $10.00 and $10.30. We are now down to a $9.00 payout with futures currently trading at $8.50.

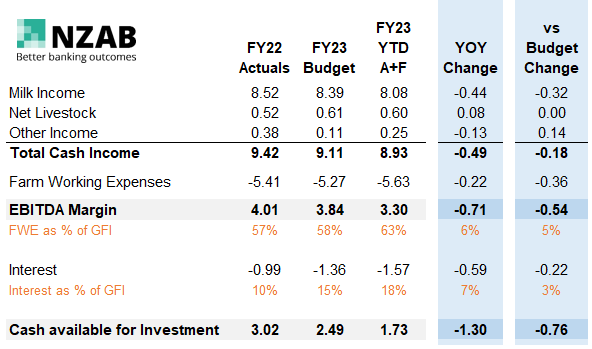

The impact on cash so far in the season of the payout revisions alongside production impacts is that we are now 31c down on budget, and 44c down on last year.

Any further changes to payout from here will continue to impact these variances.

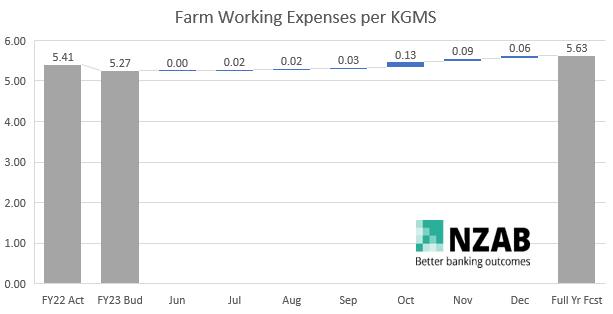

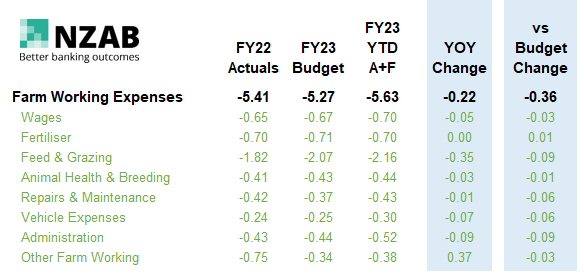

Farm working expenses continue to rise:

After concluding FY22 at a record $5.41/KgMS, a robust budgeting process led many farmers to seek reductions in key areas of expenditure. There was also a 'dilution effect' in the budget by the forecast increase in production against largely static costs in dollar terms. However, the combined impacts of lower production, increased supplement usage in the early part of the season and further inflationary impacts have led expenses to rise significantly again.

The data shows that the increase in farm working expenses is across most categories, but YOY feed and grazing costs are up significantly already.

Another interesting trend is the increase in Administration costs. Further analysis shows that the variance in this line is made up mostly of bank fees, particularly undrawn overdraft or facility fees. Not all banks charge these, but those that do are clearly adding real cost to the business. Something to keep an eye on.

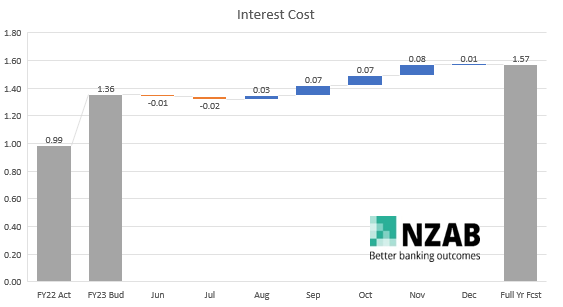

Interest Costs are heading for the moon:

This well publicised trend has been evident for a while now, but the real increases are substantial. Budgets tried to anticipate how much rates might lift, but as the graph shows these rates have been continuing to trend upwards beyond these levels. Interest is now $0.58/KgMS higher than last year.

Despite Cash revenue remaining at historically high levels the available cash for FY23 is now forecast to be one of the lowest in recent years. The combination of reducing milk price, high costs and high interest rates have taken the shine off what was otherwise looking like a good season.

Final Thoughts:

1) Cashflows are being reforecast. It is important to ensure that these reforecasts include the possibility of further downside and uncertainty in terms of timing of stock sales and feed purchases.

2) Overdraft limits may need to increase. Particularly for those who reduced their limits to avoid undrawn limit fees. These discussions are now likely to be more challenging as the request to increase will likely be accompanied by a deterioration in cashflow vs budget. Consider more permanent or long term increases in order to ensure available cash into the coming season.

3) Principal payments are being unwound. Last year the underlying debt reduction was around $1.70/KgMS, and budgets this year were for a further $1.35. The above impacts could see these principal payments need to reduce by as much as $1.00/KgMS.

4) Tax payments need increased focus. Many farmers are making significant terminal tax payments from FY22 and as a result the provisional tax payments for FY23 are material also. It is critical that the revised cashflows are reviewed by the accountant to ensure that any appropriate adjustments to provisional tax are made.

5) Start planning for FY24 now. It is critical that the impacts of this season are flowed through into next year in order to put this season into perspective.

6) Keep this year in perspective. Our long term (Stress Test or SQ) models show that businesses remain resilient and have banked significant gains in the balance sheet since the last downturn, so let's not lose sight of this.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz