The economic world has been in a state of flux over the last 12 months with significant changes in both product prices and the cost of production.

In the agriculture sector it has been no different with large cost increases in FY 22, but correspondingly large lifts in product prices as well. You can see a bit more about the FY 22 year in review from our own dataset in this article.

In FY 22, we extracted actual data from our New Zealand wide customer database which showed operating costs had a significant lift from the year before of around 15%, well above the NZ CPI rate for the same period of 6.9%.

But that change in cost didn’t stop at the end of FY 22.

This week, we’ve surveyed our Client Directors across New Zealand to see where their customer budgets are landing for FY 23. As you might expect, that range is relatively significant, from $5 per KgMS to $7.20. However, the average is landing at $6.25 per KgMS before depreciation.

So whilst the dairy sector is “enjoying” record payouts, the devil, as they say, is very much in the detail.

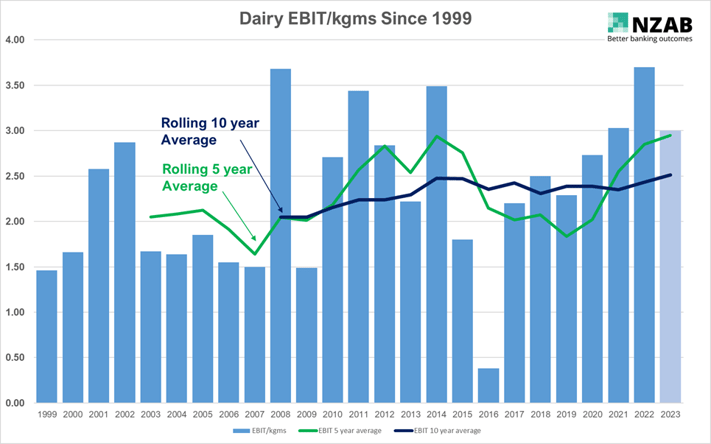

To add some further data to this anecdote, we’ve put together the graph below which examines how dairy EBIT per KgMS has been trending over the last 20+ years. The data is sourced from Dairy NZ’s economic data since 1999 to 2021. For FY 22 we’ve used our own data set and for FY 23 we’ve used a $9 cashflow payout less our surveyed average cost of $6.25 above (plus an allowance for depreciation).

Definition time first

“EBIT” stands for Earnings Before Interest and Tax, and after Depreciation. Put simply, its your income, less your farm working costs (but not interest) plus a further deduction for depreciation to allow for capital replacement.

The EBIT includes other income as well such as stock, dividends and sundry income. You could argue that should be stripped out, but then again, the cost base also reflects the derivation of that income. In any case, its been relatively consistent during the period. The data from Dairy NZ also includes an adjustment for wages of management and depreciation, as does the NZAB data.

It’s a pretty fascinating data set. Here are some observations:

The 10-year rolling average has been relatively consistent at between $2-$2.50 and importantly, trending up. When you look at dairy with a mid to long term mindset, it is a stable and growing business to be involved in.

When you look at it as a 5-year business, the returns are more volatile ranging from $1.60 to $3, but only moves about 50c per KgMS away from that long run average. Not really enough to call the industry volatile.

FY 22 EBIT looks like it will be similar to the record year we had in 2008, although it took over $1.50 per KgMS more on the top line to match it.

However, FY 23 at a similar payout of $9 per KgMS is now only looking as good as the current 5-year average (albeit that 5-year average is now at levels not seen since 2013). That said, its still well above the 10-year average. Change in interest rates aside, this year’s payout (if it holds at $9) should still represent an “above average” margin.

If we get to $9.80 or above, we’re back into matching last years margins, noting that they are some of the best ever.

We’re now 4 years into an “above average” margin environment for dairy.

The counter to all of this is that a new “average” payout (average being matching the current 10 year margin) is around $8.25-8.50.

So what’s the rub?

1. Gross margin calculators anyone?

EBIT analysis, rather than total payout is important data when considering forward profitability, investment decisions and milk hedging policies. The further we are away from the long run average (up or down) is an important consideration when making (and then executing) risk management policies and making investment decisions.

Couple this with our further comments below about costs moving further, we need to be constantly analysing and reviewing our margins, including taking forward looking views on the drivers of margin when making decisions.

2. Farm yields provide strong support for land value shift

Given farm asset values for the better part of the last 10 years (up until last year) have remained flat (see this article here for how land value has shifted over time), the sustained profitability of the last period has finally shifted asset values up in the last 12 months. That said, farm yields on this basis still remain elevated versus long run averages. Its understandable we’ve now seen asset value increase and if anything, it’s been slow to budge higher (largely due to a subdued debt capital market over the last 5 years which is now de-shackling somewhat).

3. Will costs move further?

Our budgeted data has increased from last year factored in, but that doesn’t mean we won’t see further increases on top. There is still pressure on labour, logistics, grazing, feed and fertiliser.

However, having been in this sector for over 20 years now, to think that costs won’t change in response to payout would be flying in the face of history. There have been seven different years since 1999 where costs have gone back year on year. Also, the lift in costs that we’ve seen over the last period is not the largest lift (as a %) that we’ve seen in the last 20 years.

We’ll explore some of that data in upcoming articles.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients. Whether that is better interest rates and terms, ensuring you get the debt capital you need, or managing your bank relationship on an ongoing basis, we have you covered.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz