With the RBNZ recently sharing updated bank metrics for the period ending 30 September 2022, its time for us to dive back in and see what movements are afoot.

Welcome to the latest edition of our NZAB Bank Dashboard.

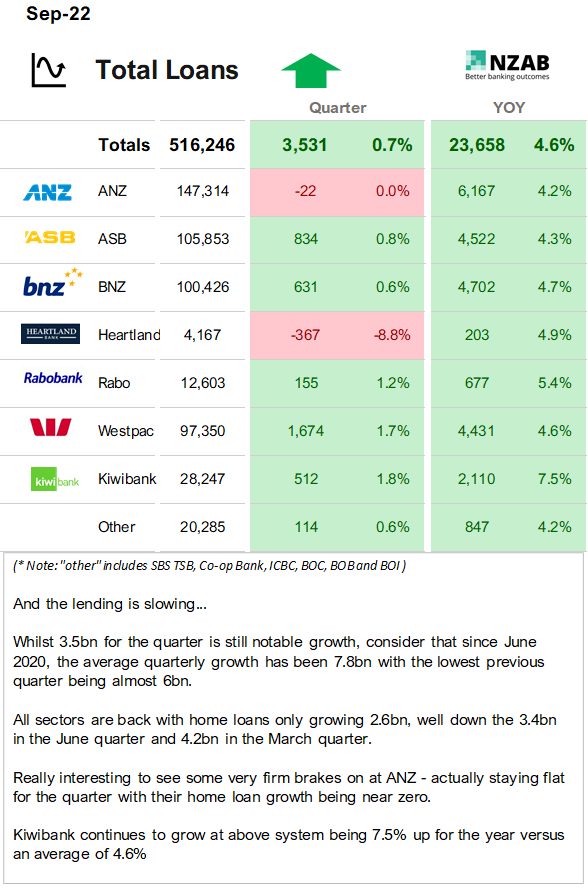

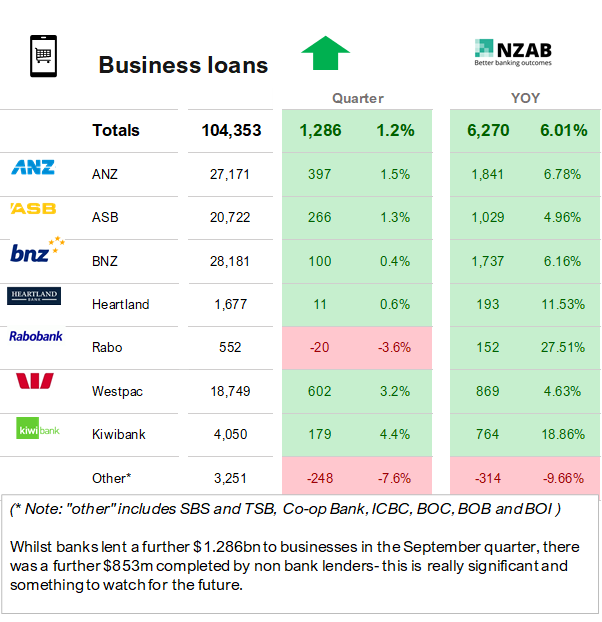

For the first time in a long time we're starting to see some slowing in all sector credit growth with the September quarter being the slowest growth in new lending since the June 2020 quarter.

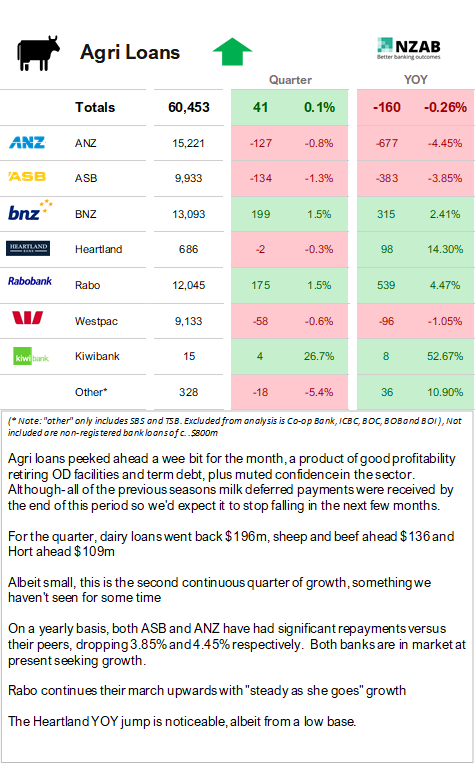

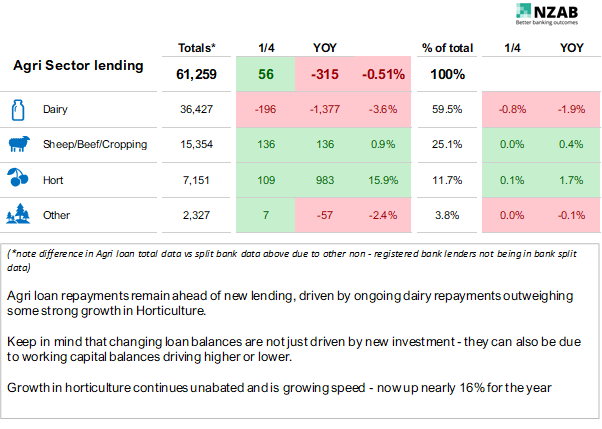

Whilst the growth has slowed; it was nevertheless up with $3.5bn up for the quarter and $23bn for the year. Very interestingly, ANZ, the largest lender in NZ, recorded none of that growth in part due to much less home lending and their agri book retrenching almost 5% for the year. Overall agri loan growth is largely neutral with ongoing dairy repayments outweighing some strong growth in Horticulture (nearly 16% up year on year).

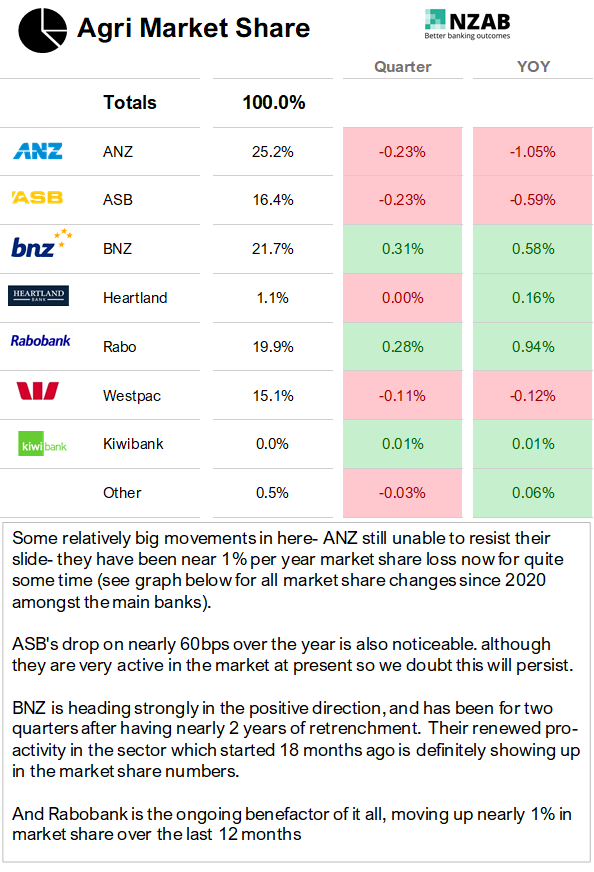

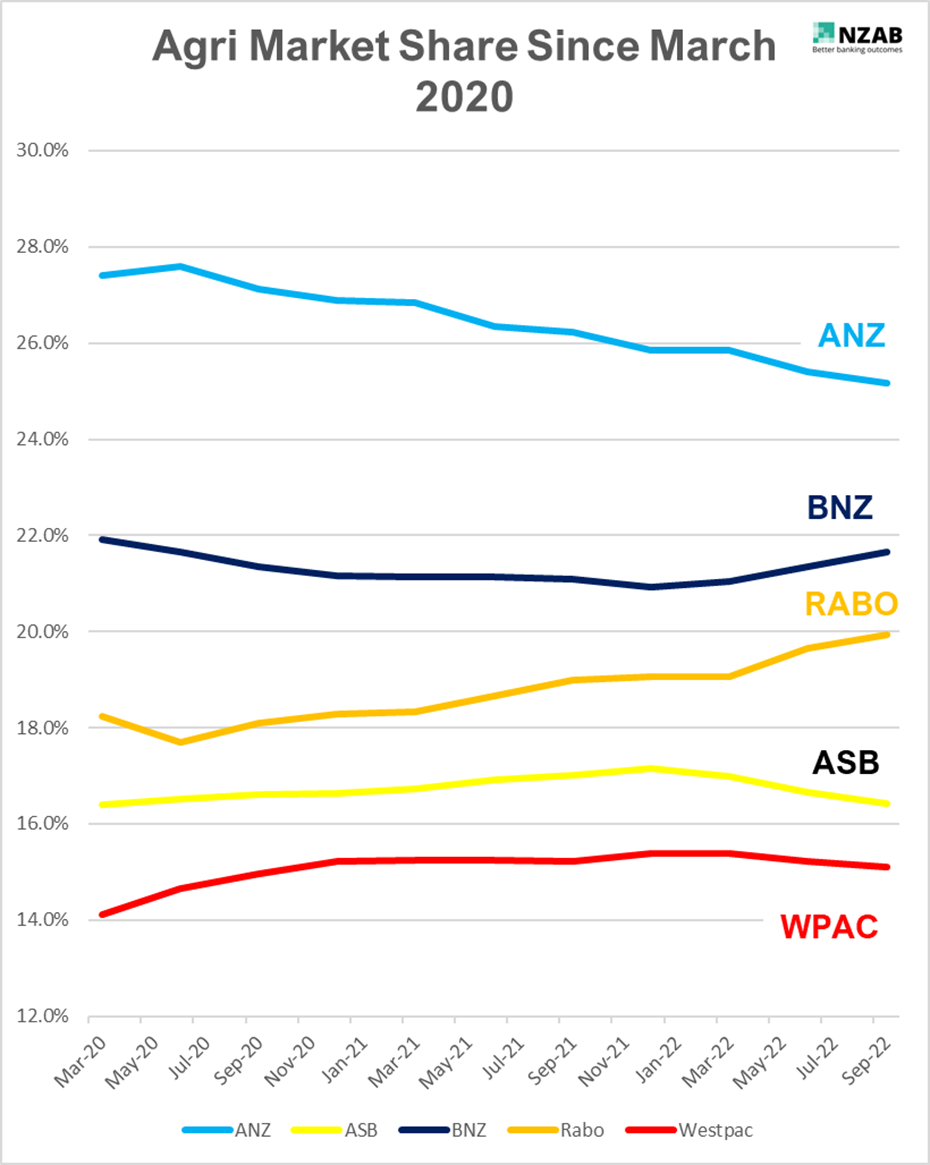

Whilst ANZ agri market share continues to slide unabated, at 1% per year, ASB also lost ground, shedding almost 60bps of market share for the year ended September.

On the flipside, BNZ gained what ASB has lost- gaining 0.58% market share and Rabo gained what ANZ lost- at 0.98%. These are quite big movements indeed and are likely to drive a lot of activity at market level as all banks continue to compete for new business in the sector.

As always, if you have any questions, please contact us directly.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz