Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

We’ve dived back into the RBNZ data to see all the main bank movements over the last six months (to December 2024) - all the changes in lending, who’s winning market share and who’s losing it - in both the Agri and Business Lending Sectors.

In this Issue:

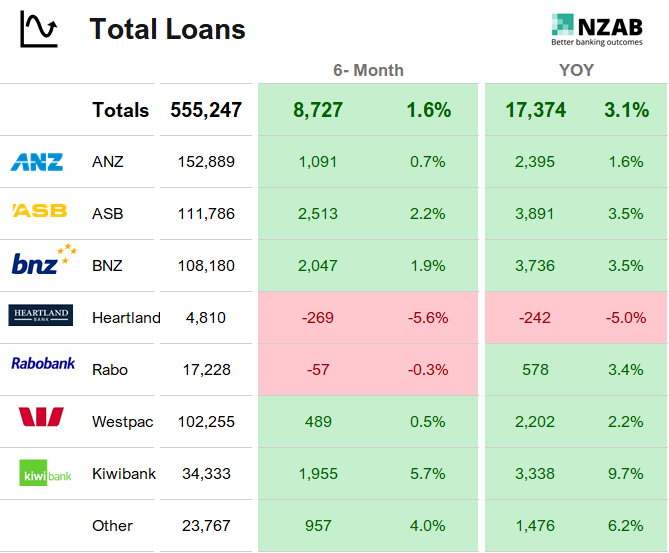

- Total loan growth over the last 12 months among the registered banks was ~$17.4bn - consistent with the prior period.

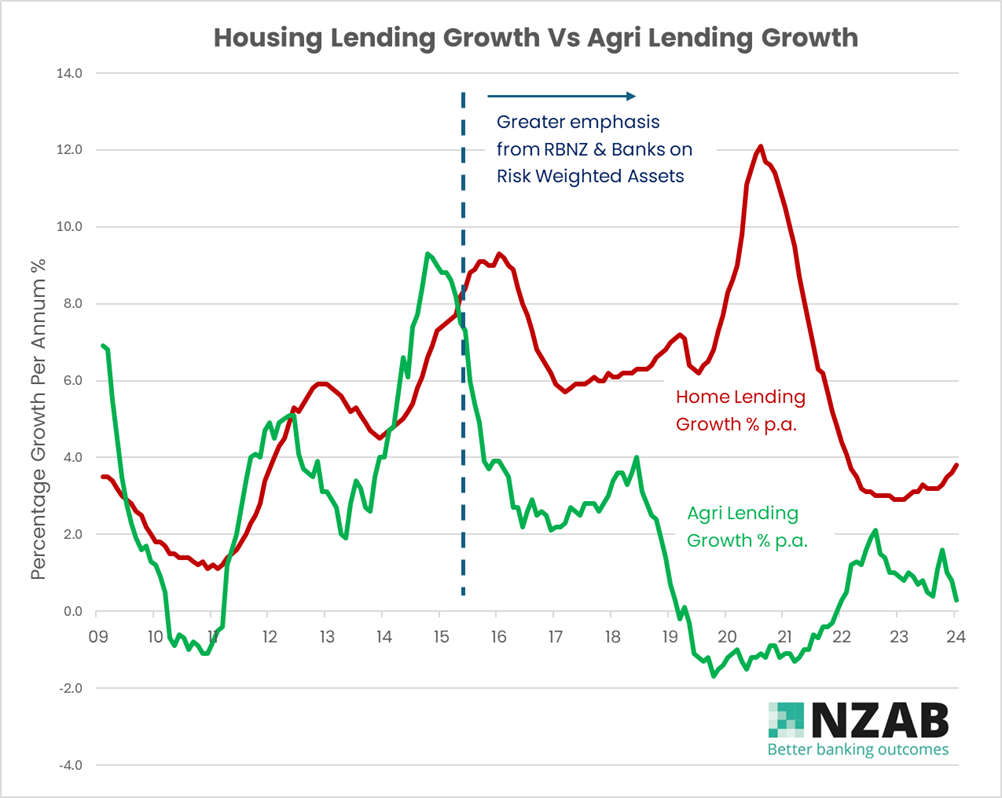

- However, of the $17.4bn, Agri lending was flat and whilst business went ahead $3.0bn,- this still means the vast majority of new capital went into the home loan sector once again ( +$14.5bn).

- ANZ continues to shed Agri and business loans - collectively they lent $1.3bn less to these sectors over the last 12 months (and $0.94bn over the last 6 months), whilst at the same time increasing home loans by $3.4bn.

- The four main Australian banks collectively lent $11.3bn to the home loan sector over the last 12 months, but only advanced lending to business and farming by $0.93bn.

- Rabo officially became the second largest Agri lender in NZ, surpassing BNZ and increasing market share by 74bps for the year.

- Dairy loans continue their ongoing repayment profile, reducing by nearly $400m for the year. We expect this to pick up from here with significantly more dairy cash coming in over the second half of the year.

- Agri lending provisions were largely flat over the year, continuing the ongoing low levels seen in this sector.

As always, please sing out if you have any questions or would like to use the data in your own presentations or engagement with customers. We would be happy to provide a digital version for sending.