Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

Let’s be honest, last year was a bit tough.

Expectations of dairy payout dropped to very low levels, lamb prices kept going lower than expected and interest rates went higher on the back of inflation that was stickier than ever. On top of that we started the year with a devastating cyclone that ripped the heart out of a major horticulture area, and we had a government that very few farmers thought was in their corner.

It wasn’t just farming either – homeowners and business owners alike all got a collective feeling of malaise as recession started to spread its tentacles. Confidence surveys in both farming and non-farming sectors alike plumbed new depths.

But, for this article, it’s a new year and let’s sweep the broom a bit for 2024, because there’s some things that farmers can start feeling more optimistic about as we head into the year.

1. Interest rates have leveled off and look likely to fall.

It’s hard to imagine that a little over 12 months ago (pre-xmas 2022), we were at an OCR of 3.5% which was then lifted to 4.25% in Dec 2022. Very few (read: nil!) commentators were predicting that we would end up as high as 5.5% before the job on squashing inflation appeared done.

But the story has changed.

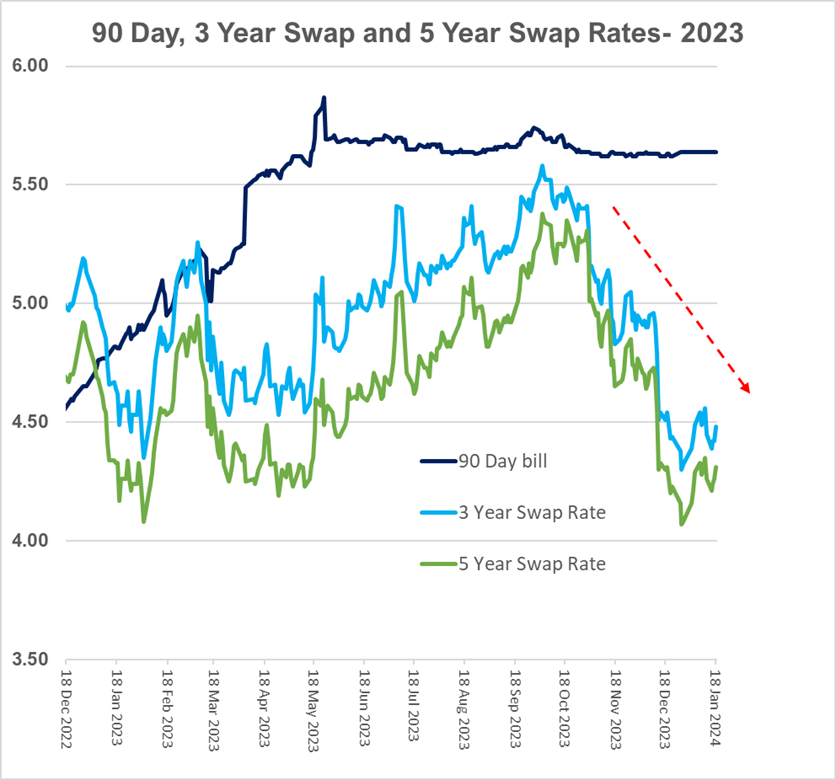

Fast forward to December 2023, and the market finally started to get the data it was looking for - with a surprise negative GDP result for the previous quarter, wage inflation appearing muted and price tracker indexes that make up inflation falling sharper than expected. All of this lead to swap rates taking a large and sustained drop. (Swap rates are typically the underlying instrument for fixed rates. As well as being the driver for your fixed rates, they generally tell the story of where the market thinks interest rates will go mid to long term [among other aspects such as offshore activity]).

Furthermore, most bank economists are now coming out with refreshed “OCR Call Changes” (this is economist speak for, “despite telling you we were pretty firm on something last year, we now think it’s quite different”). These updated views now start predicting OCR cuts from the middle or later this year. ANZ, who was one of the hawkish (i.e suggesting rates would stay higher for longer) has now significantly revised their forecasts to suggest the first OCR cut will be in August with an aggregate 2.0% of cuts to follow in the following 12 months to August 2025 to land at a neutral OCR of 3.5%

You can never accurately predict what’s going to happen, but for now, it appears more likely that a farm borrower may see their floating rates fall this year, or be able to fix in now at lower rates than their current floating rate.

2. Falling interest rates aren’t just about some interest cost relief, they also have an impact on investor flows of capital.

Over the last 1-2 years, more money has been flowing to safer fixed interest type investments (e.g. Bank term deposit, bonds) because with higher interest rates it’s much easier to get a decent rate of return in those easier investments.

However, when rates drop, investors start seeking other forms of investment to achieve their target returns. This means more investment into things like equities and property - this can mean higher asset values or more sales activity in property markets, including farmland.

This renewed investment won’t just be about more outright purchasing either - it’s likely to encourage other investors looking for a stake in the Agri Sector.

This will also extend to offshore investment into New Zealand farming - right across the supply chain. The current government has shown a strong willingness to engage more readily with foreign investment, in the knowledge that it not only brings much needed capital, but also access to new supply chains, new product development, better technology, and greater trade access.

3. Dairy Payout is up and looking stronger for next year.

It was only back in October last year that we were still thinking a $6.75 mid-point payout for the year – we’re now sitting at a mid-point of $7.75 with dairy auctions continuing to rise.

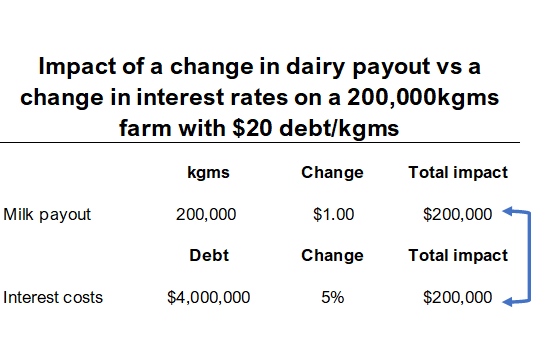

$1/kgms never sounds like a lot but it’s a massive shift. To put it in context, if you had a business with $20 debt per kgms, this is the cash equivalent of a drop in your interest rate from 8% to 3%!

None of this is to say that a $7.75 payout is a good result, but it does highlight the importance of the shift. Furthermore, spot milk prices via the last auction are now ~$8.50+ so this will have a positive impact on the latter part of this plus next season.

4. Low lamb prices and high interest rates have collided to make a lot of pain, but history tells us they are cyclical.

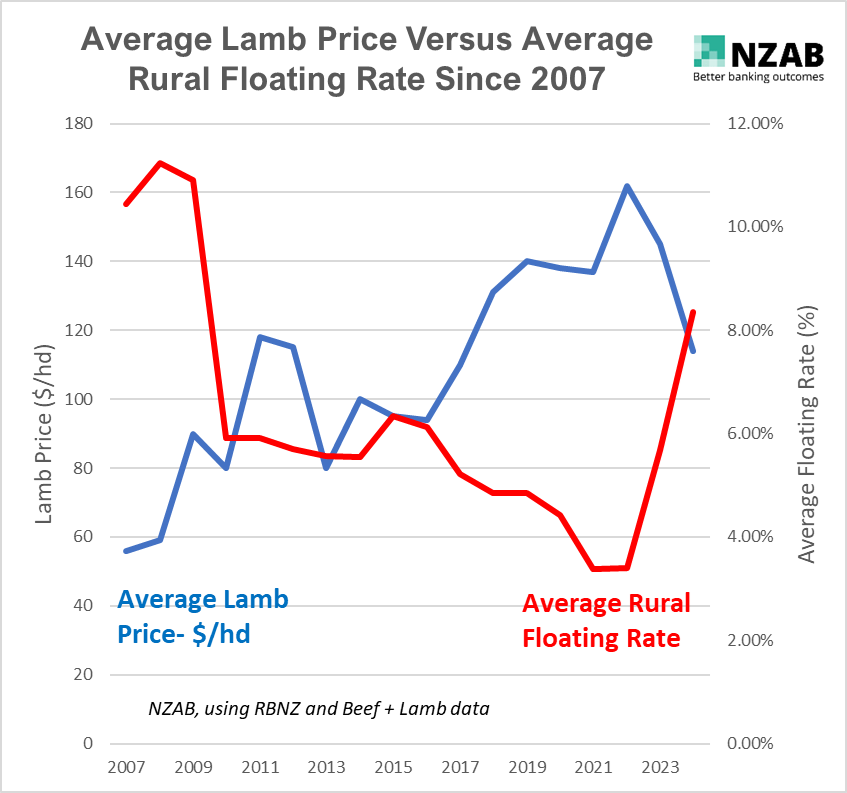

The next graph tells the story succinctly – a plunging lamb price with interest rates going the other way has meant absolute cash misery for our sheep and beef farmers.

But a quick look back over almost 20 years of data shows we have had these pain points before.

2007 and 2008 with an average lamb price of $50-60 and an interest rate of 10.5-11.25% anyone?

Or how about 2013 when the lamb price came off its peak from two years earlier and dropped from $118 to $80?

Recent supply (large Australian lamb kill) meeting slowing demand (Chinese buyers muted) are the big impacts this year, but we have seen these supply and demand influences before, and they do unwind, good and bad.

Following that 2012/13 low of $80 per lamb, when lamb dropped 32% over two years, there was an extended period where lamb prices grew over 100% (on average 8.0% per annum) until 2021/22 to be over $160.

The drop that we’ve just had over the last 2 years is 29%...

5. Bank appetite is the strongest that we've seen since before the infamous “dairy downturn” in 2015/16.

It wasn’t that long ago that there were only one or two banks “in the market” for new customers.

Now all banks have a healthy appetite for new lending (as long as its “in the box” - see this article for how we see banks facing into 2024 with their activity). This is the result of two things: Firstly, other sectors of the economy (particularly house borrowers) borrowing less than normal, meaning that banks can’t achieve their typical growth parameters from home lending alone. This pushes more appetite into the Business and Agri sectors. And secondly, this is because of the strong past debt repayment completed by the Agri sector (particularly the dairy sector) in 2019-2022 meaning the balance sheets are a lot stronger.

Good bank competition = more competitive bank margins- but only if you know how to present your business well, know how to navigate the various banks and have appropriate credit risk.

6. Non-bank capital availability is stronger than ever with a number of new participants providing debt and others looking to join.

Make no mistake, the area of non-bank debt capital in Agri still has a long way to go. However, NZAB was involved in numerous non-bank debt transactions last year where the lender was not one of the main 5 banks that lend to Agri. In 2023, we have placed debt transactions with alternate lenders, private investors, offshore entities and plenty of vendor and family type arrangements.

Despite very low losses, alternate lenders have traditionally had difficulty lending to the Agri sector due to a lack of understanding or a lack of access to transactions. With NZAB’s reach across New Zealand and being able to describe the customer strategy, metrics and risk more clearly, new lenders are now enjoying the stable returns that Agri has to offer.

The “so what” of all this is that there is more capital coming to the sector – this new capital may not be directly competing with the banks, but it stokes bank’s appetite alongside.

Expect this area to grow substantially in coming years as more alternative funders look to place capital in New Zealand’s strong agriculture sector – right across the credit risk spectrum.

7. Young farmers are still buying farms and NZAB is proud to have supported a number of new young farmers into the industry last year.

Despite some of the headlines about how difficult it is to get into farming, NZAB has been helping New Zealand young farmers get into farm ownership at even greater levels than previous, with good support from local banks.

Our focus is not just getting the capital for the new farm owner but starting well before that. Helping them build a multiyear strategy to get to this important milestone, getting them bank or investor ready at the penultimate stage and providing them with the necessary motivation and mentorship to achieve this goal.

Then, as the opportunity begins to present itself, we present their business in the right manner, linking them up with the right banker and bank or alongside, introducing them to a like-minded investor.

Some of the best success stories are where we’ve devised some clever yet simple lender and vendor loan structuring and lease solutions so that both the departing farm vendor and new farm purchaser get what they want.

In an upcoming article, I’ll be getting some of our Client Directors to share some case study stories so that others can learn from this.

8. Government strategy and regulation is more pro farmer.

Whilst it's very early days with the new government, they have set out a clear and credible plan to get farming back on track and restore farmer confidence. Most pleasing is that the new coalition government consulted deeply with farmers themselves with coming up with their policies. New policies have a strong focus on reducing regulatory burden, including a more workable approach to freshwater rules, review of the methane reduction targets to better focus on warming outcomes and being generally more business friendly.

Of note, 10 of the 122 MPs are listed as having had farming as their occupational background before entering Parliament, in a bounce-back to a level not seen since two decades ago. The number reached an all-time low in the previous Parliament, with just three percent. A further 35 have a business or management background.

Notably, five of the newly elected MPs have been in senior or executive positions within Federated Farmers, the country's advocacy organisation for farmers. There's a former president of the Feds' national body, two former regional vice-presidents, and two former Meat & Wool Chairmen.

9. Farming businesses are lean and farm inflation is under control.

After two years of 15% p.a + farm inflation, costs have finally turned downwards, although largely on the back of lower fertiliser and feed costs that can be volatile.

A necessary rigour with lower commodity prices and high interest rates is a line-by-line examination of the cost and conversion ratios in the farm business to ensure that they remain profitable (or minimise loss) during this period. In the last 12 months we have observed a laser like focus on farm costs from our farming clients from governance right down to on-farm operational culture among the working team.

Whilst our farming businesses have excellent accountability for cost control, it is natural that there was slippage during times of high commodity returns – this doesn’t just happen with on farm decisions, but also at market level among competition for farm supplies.

However, when the commodity prices turn back up (or further up), our lean and efficient farming businesses are exceptionally well placed to drive excellent profit margin on the back of the processes and cultures created during these times.

So, let’s go glass half full for 2024.

If we chose to go glass half empty, there are still plenty of negatives to focus on and we should all remain vigilant to (and plan for) the risks – both up and down - and the potential impact they might have on your business. Additionally, plenty of sectors are still facing tough conditions and every situation is different.

But all of the above nine things will have an impact on one thing - confidence.

Confidence drives spending and investment. With new investment comes more productivity. Productivity generally creates more earnings which creates New Zealand wealth.

At farmer level, this is not just about higher profits or enterprise values but might mean the difference between a farming family being excited about the next generation getting into farming or not. Or it might mean the difference in the number of new farmers getting into ownership.

Or, just as valuably, it might simply be the difference between a farmer having unbearable stress or simply that same farmer being able to get up in the morning with a spring in their step.

NZAB is better placed than ever to help farmers with access to better bank or non-bank capital at competitive rates.

Our purpose is to help farmers achieve easier, more suitable and more competitive access to bank or non-bank debt or investment capital. We want our farmer customers to have confidence and control in their business enabled by stable and competitive capital that is perfectly matched to their own business strategy, people, and resources.

As we go about this mission, we’re expanding the Agri capital markets, connecting farmers with new investors and new debt lending participants alike so that the sector can access multiple types of capital at a competitive price.

We’re now right across New Zealand, we know every bank inside out, every non-bank lender who has appetite for New Zealand farming (including those that are about to enter) and have a database of investors that are interested in Agri.

Go to our website at www.nzab.co.nz for more, fill out this form, or call/email us direct on 0800 692 212 and info@nzab.co.nz

Who is NZAB?

.jpg?width=540&height=360&name=NZABStaffGroups55%20(1).jpg)

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz