Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

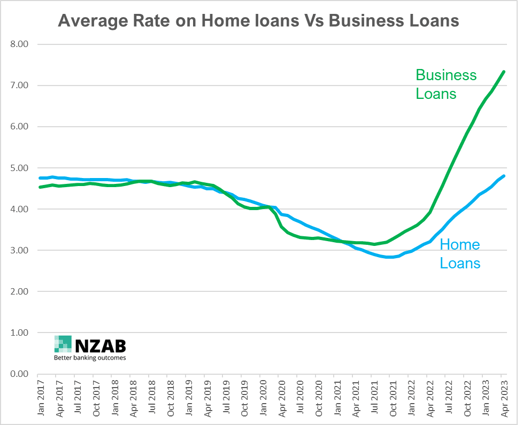

Take a look at the below graph.

The underlying data is sourced from RBNZ, and in particular data that compares the interest income earned by New Zealand banks on residential mortgage loans verse business loans. These values are represented as percentages of the value of their loans.

In other words, this is the average interest rate paid by the average home loan borrower verse a business borrower (which includes Agri).

Given we operate across all main banks, we keep a close eye on bank funding costs and the underlying drivers of such. And the growing gap in the cost between home and non-home borrowing is starting to really concern us.

Now, there are some factors to be taken into consideration first.

Business and Agri loans require more of a banks’ own capital when lending - so they typically need to charge a higher rate than home loans to get the same level of return, the result of RBNZ capital regulations requiring them to do so.

Also, the home loan market by nature has most of its lending fixed – this means that the average home loan rate in this data has a mix of rates that were fixed from lower times. Business loans in contrast, have a higher degree of floating rates. So inevitably the higher rates that we’ve faced will hit Agri and Business loan borrowers earlier before the home loans catch up when their fixed rates mature.

But, the current re-fix rates for home borrowers are between 6.0-7%, so if both Business/Agri and home loans were all re-priced today (business and Agri would also be higher than what you see on the graph as they also have some lower fixed rates still in play), that gap would still be 1-2%. Much higher than what we’ve observed in the past and much different to the near term data in the graph as well.

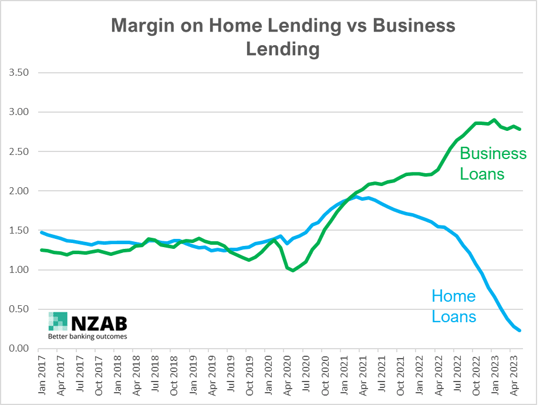

To really hammer this point home look at the below graph which shows the relative margin between the respective average home and business loan rates and the banks average costs of borrowing. To do this, we’ve taken the average costs of all bank deposits (again from RBNZ) and compared that to the average borrowing costs for each sector.

Its hard not to conclude that banks are elevating the margins for their business and Agri customers to keep afloat the home loan market, an easier place for them to lend and earn profit.

Keeping home loans lower than what they otherwise would be encourages relatively more activity in this sector. Conversely in business and Agri it extinguishes it. So in other words, it appears that banks are happy to lean on the business sector of New Zealand to keep home lending on life support.

Furthermore, because banks can’t shift the fixed rates on their home loan books (simply because they’re fixed and deposit rates have increased), it would appear they have shifted the missing margin onto their Business and Agri loans to preserve their profit. Bank’s may have some hedging in place to protect those movements but is unlikely to go as far as to close the difference in margin we’re seeing here.

We would expect the margin difference to settle down and compress again once all home loans come off their lower fixed rate terms – but is it right that business and Agri should make up the difference in the meantime?

So what can you do about this?

The good news is that farmers can still get very competitive rates in this environment.

Those farmers that present their strategy and their credit well to a bank, and actively engage in creating a market for their loan see benefits over those that don’t.

All bank’s are all still very active in the market for Agri lending. After all, Agri lending in New Zealand has a history of low losses and the margin returns are pretty compelling.

Don’t be the farmer that sits on the side taking what you’re offered. Get your business into shape and present it in a manner that multiple banks would want to chase. That doesn’t mean that you should need to change banks to achieve this, but it does mean that you might need some help on how to navigate this or how you might improve your business over time to get there.

We’d love to help. We’re all about better banking outcomes, so if you want to review your business to understand where you might sit, drop us a line today on 0800 692 212, email us directly, or fill out this form and we’ll be in touch.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz