Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

Kiwibank has been nothing short of a success.

It was initially set up in 2002 as a brainchild of the Alliance MP Jim Anderton, who was in a coalition government with Labour at the time, with a purpose of establishing a locally owned bank with profits that stayed in New Zealand, rather than headed overseas.

A quick tour of its history shows that from day dot, it launched over 200 branches nationwide, partnering with (and ultimately owned by) NZ Post. By 2008 it had grown to 600,000 customers, campaigning on “joining the movement” (i.e., away from Australian owned banks) and winning new customers on stronger customer satisfaction.

It continued to grow and in 2016, NZ Post sold 47% of it to NZ Super and ACC. Fast forward to 2022, and the entire business was purchased from the syndicate by the New Zealand Government for an estimated $2.1bn.

As of June 2023, Kiwibank has total assets (loans) of $29.7bn, giving them a 5.62% share (on a "dollars lent” basis) of all New Zealand main bank lending. It also continues to head in the right direction, up from 4.39% five years ago. That’s impressive growth.

Profitability is OK, but not as good as the Australian banks. Return on equity of 6-7% lags the main other banks who typically average about 12-15% (Return on equity (ROE) is the ratio of profit after tax to average equity).

Interestingly, their net interest margin is slightly higher than most banks at 2.5%, meaning they’re highly effective at using deposits to earn income (the net interest margin (NIM) is the ratio of net interest income to average interest-bearing assets, where net interest income is income received less income paid).

Why their profitability of their business lags versus others (on a ROE basis) is probably due to the operating expenditure being much higher at 65% of total income, versus their peers at 40-50%. This may be symptomatic of a growing business and a larger number of smaller accounts.

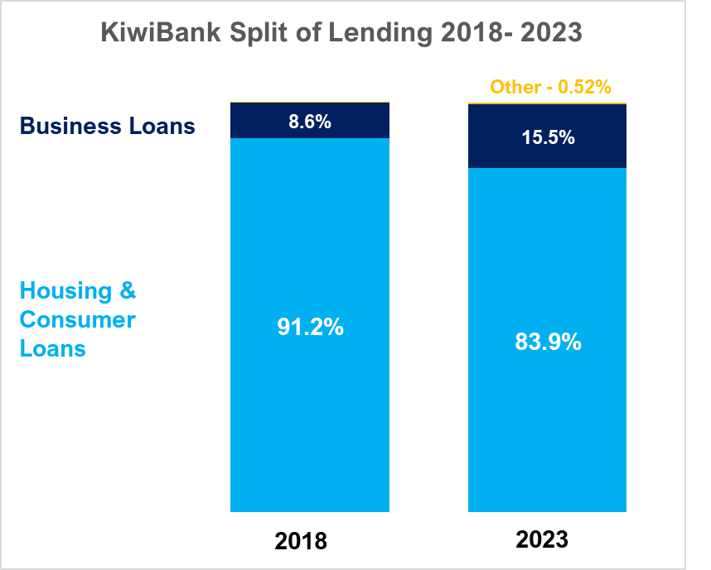

Home loans are the biggest part of Kiwibank, but Business banking is rocketing up.

Below is the makeup of Kiwibank’s assets (loans) – from five years ago until today.

Kiwibank has been nothing short of a success.

It was initially set up in 2002 as a brainchild of the Alliance MP Jim Anderton, who was in a coalition government with Labour at the time, with a purpose of establishing a locally owned bank with profits that stayed in New Zealand, rather than headed overseas.

A quick tour of its history shows that from day dot, it launched over 200 branches nationwide, partnering with (and ultimately owned by) NZ Post. By 2008 it had grown to 600,000 customers, campaigning on “joining the movement” (i.e., away from Australian owned banks) and winning new customers on stronger customer satisfaction.

It continued to grow and in 2016, NZ Post sold 47% of it to NZ Super and ACC. Fast forward to 2022, and the entire business was purchased from the syndicate by the New Zealand Government for an estimated $2.1bn.

As of June 2023, Kiwibank has total assets (loans) of $29.7bn, giving them a 5.62% share (on a "dollars lent” basis) of all New Zealand main bank lending. It also continues to head in the right direction, up from 4.39% five years ago. That’s impressive growth.

Profitability is OK, but not as good as the Australian banks. Return on equity of 6-7% lags the main other banks who typically average about 12-15% (Return on equity (ROE) is the ratio of profit after tax to average equity).

Interestingly, their net interest margin is slightly higher than most banks at 2.5%, meaning they’re highly effective at using deposits to earn income (the net interest margin (NIM) is the ratio of net interest income to average interest-bearing assets, where net interest income is income received less income paid).

Why their profitability of their business lags versus others (on a ROE basis) is probably due to the operating expenditure being much higher at 65% of total income, versus their peers at 40-50%. This may be symptomatic of a growing business and a larger number of smaller accounts.

Home loans are the biggest part of Kiwibank, but Business banking is rocketing up.

Below is the makeup of Kiwibank’s assets (loans) – from five years ago until today.

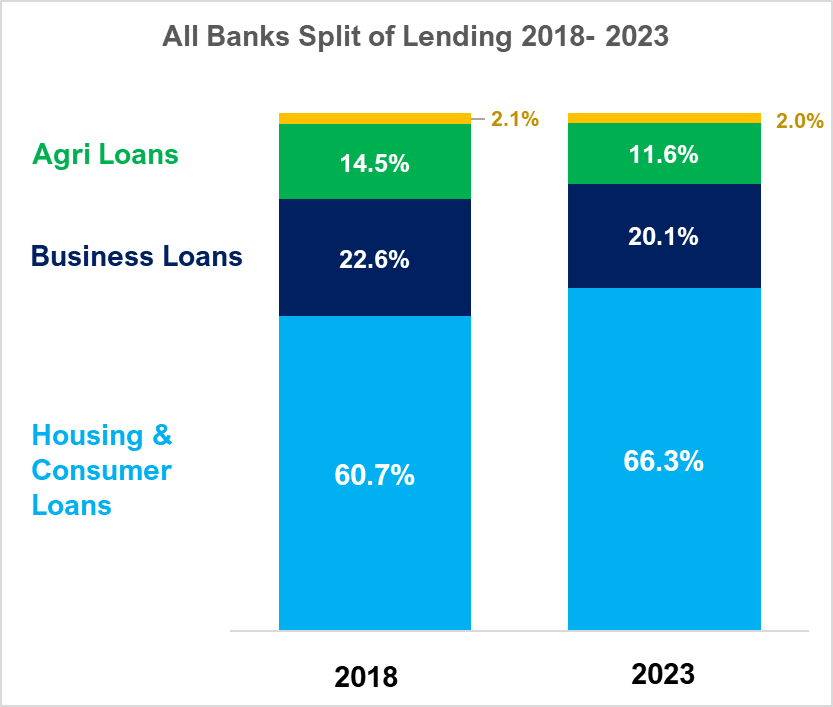

In short, they are still significantly overweight on home lending, still have proportionally less of their lending to kiwi businesses and most notably, have no lending (bar $15m of loans) to New Zealand Agri.

So why is this?

One of Kiwibank’s stated ‘Purposes’ is “to help Kiwi’s focus on what really matters to them by supporting two million Kiwi to take action to secure their financial future” and “to ensure Aotearoa is a better place for this generation and the next”.

There is no argument that providing funding for Kiwis to buy a house is important, plus their clear push into Business banking is supportive of that.

Home lending is an easy place to make money. The RBNZ capital rules mean less of the Bank’s own capital needs to be deployed when lending to this sector, and its really easy to originate and manage loans. So, on this basis alone, it’s the quickest way to make money in the banking sector. And the wider market is proving that - with Agri and Business loans making up 37% of all lending five years ago but dropping back to 32% today.

Of the $550bn deployed by the main Banks, that diversion of lending from Business and Agri to Home lending over the last five years is $27bn- ironically (and perhaps coincidentally) the same size as Kiwibank.

But do we really need a New Zealand government owned bank providing the majority of their scarce capital into providing more home loans?

Its generally accepted now that the more capital that goes into the banking system, the more of it ends up in the home loan sector, by virtue of the lower capital input, lower costs of management and less expertise required to manage it.

Not only are the main Australian banks swinging more to the home loan sector like never before, but so are alternate lenders as they scale into this perceived easier place to make money.

What’s the lost opportunity?

We’ve talked previously how the Agri banking market, on a contribution to GDP basis, is underbanked in New Zealand to the tune of $5-10bn. Business banking is likely to be even larger.

More capital into agriculture and business supports business growth. This in turn stimulates job creation, community development and overall prosperity. It also makes New Zealand more resilient by fostering innovation and competition, increasing product variety and quality for consumers. Ultimately it means our GDP grows.

Given our offshore investment settings are relatively restrictive versus our peers, this should be of particular concern to New Zealand.

What could be done differently?

You can’t fault Kiwibank for chasing profit, I’m sure its part of its current mandate as an investment vehicle for the New Zealand government. Also, greater profit means greater retained earnings meaning more capital to leverage against for future growth.

But why do we want that growth to simply be another cog in and already over bloated, well serviced and competitive home loan market?

If Kiwibank was instructed to match their rivals with the same portfolio mix as the average New Zealand Bank, this would mean $1.5bn more to the business banking market and $3.3bn into New Zealand farming. It’s not as simple as this as those areas would require more bank capital than home loans, meaning you wouldn’t be lending dollar for dollar - but the point still remains.

What about the big kahuna?

Another way to look at this is to sell the entire Kiwibank Home loan book (or even the entire bank) and use the freed-up capital to lend solely into business and agriculture. With $2.5bn of equity capital, (and reflecting the higher capital requirements of Agri and Business banking), this would probably mean it had the ability to lend a further $12bn + into New Zealand Agri and Business.

That pivot into more agriculture and business lending would have multipliers of New Zealand GDP growth attached to it. It would also be self-perpetuating with business confidence. A strong New Zealand led message that we want to support New Zealand Business and Agri, leading to more businesses wanting to start or expand – would result in genuine incubator of New Zealand growth for the future, whether it be domestic sales or export earnings.

So, are we prepared to be bold about how we support growth in the future?

Who is NZAB?

.jpg?width=540&height=360&name=NZABStaffGroups55%20(1).jpg)

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz