Predicting the future isn’t easy and “anyone that tells you that they know what’s going to happen is either lying or they don’t know what they’re talking about” (*Warren Buffet).

That said, how people feel about the future based on their observations right now is really interesting and it can tell us a lot about what will play out in coming months.

Survey’s are a good way of examining these trends

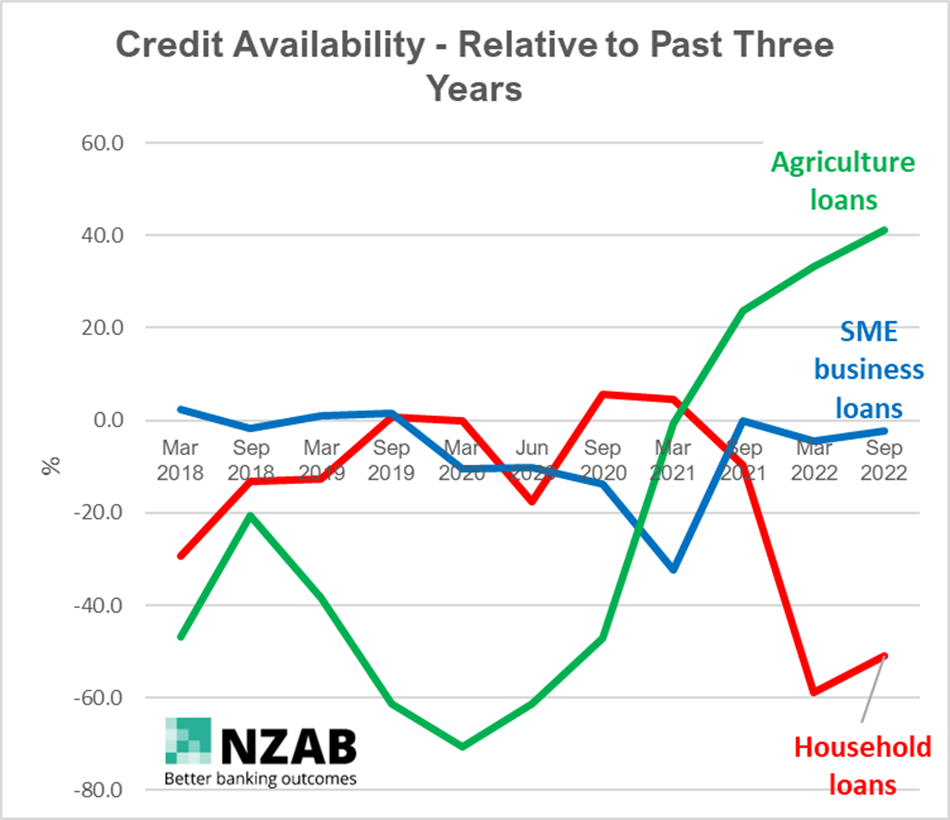

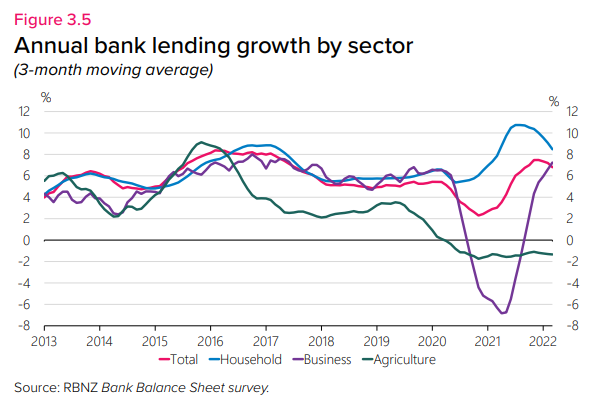

One survey we watch really closely is the RBNZ Credit Conditions Survey, published bi-annually.

This survey is relatively simple - the RBNZ asks banks what they expect both the demand and supply of credit in each of their lending sectors (residential, consumer, SME, Agri, Corporate) will be over the next six months and what they've observed over the last six months.

They are sentiment-based questions but given the banks do control the strings of sector capital availability, its pays to take notice.

There’s a bit of data in the survey, but the subset that describes things best is the rolling three year average of credit availability - in other words- how does credit availability stack up today verse three years ago as a trend line.

We’ve taken that data and put it into the graph below - the results are starting to show some very stark trends between the different sectors which are worth paying attention to.