Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

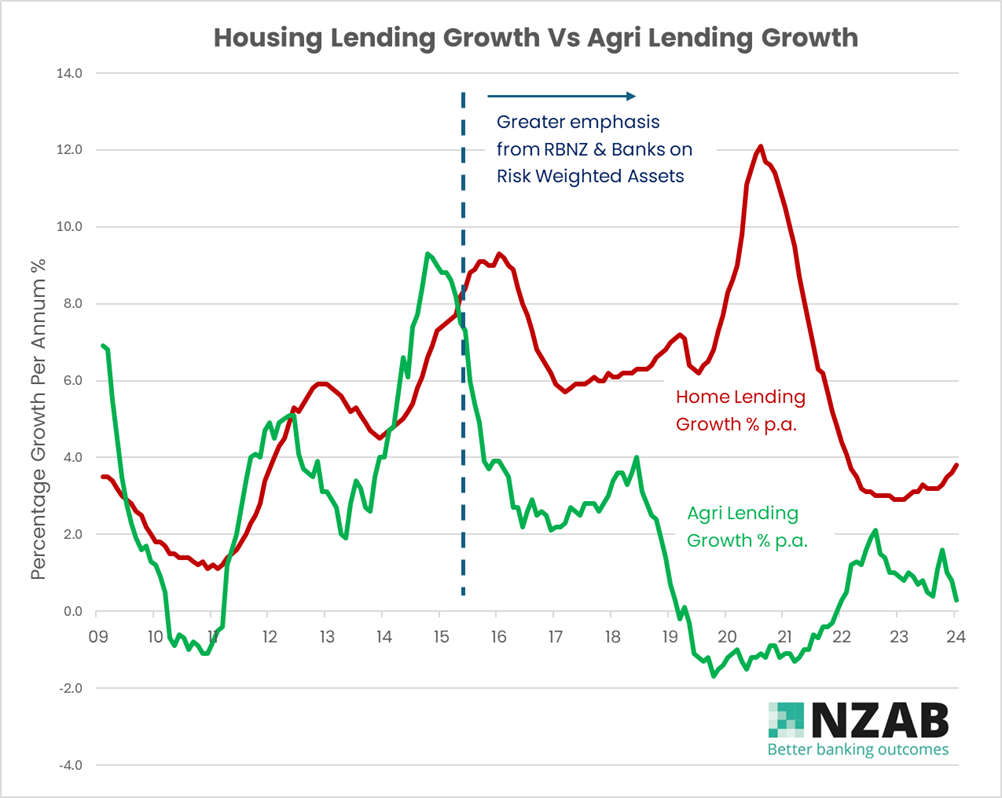

With the ongoing Inquiry into Rural Lending, one of the central themes from both the RBNZ and the Banks is that Agri Lending is ‘riskier’ than Home Loans so therefore a higher margin needs to be charged to justify the lending.

Two things have now happened over the last 10 years. Firstly, the Banks have increased the price of their loans, but perhaps more importantly they have also reduced the risk they take at the same time.

Let’s unpack that statement a bit more.

A Bank considers two main factors when looking at a loan. Firstly, what is the likelihood that things will go wrong (i.e. default) and secondly, how much of the loan that they will be able to get back if things do go wrong. When a loan does go wrong, the Bank assesses how much they might lose on the loan, and this is referred to as a ‘credit impairment allowance’ or an ‘individual provision’.

Now, it’s very important to note that an individual provision (an ‘IP’) doesn’t necessarily turn into an actual loss, the Bank just thinks it might.

From experience, banks prefer to budget or ‘provision’ a higher number than they actually do lose, as they don’t like surprises.

Banks don’t publicly report the actual losses they make so we can only use the IP data as a proxy for this detail. However, it was telling when Antonia Watson, CEO of ANZ, was asked at the banking inquiry how many defaults they were running in their Agri loan book. Her answer - “Just two” – in over $15bn of loans.

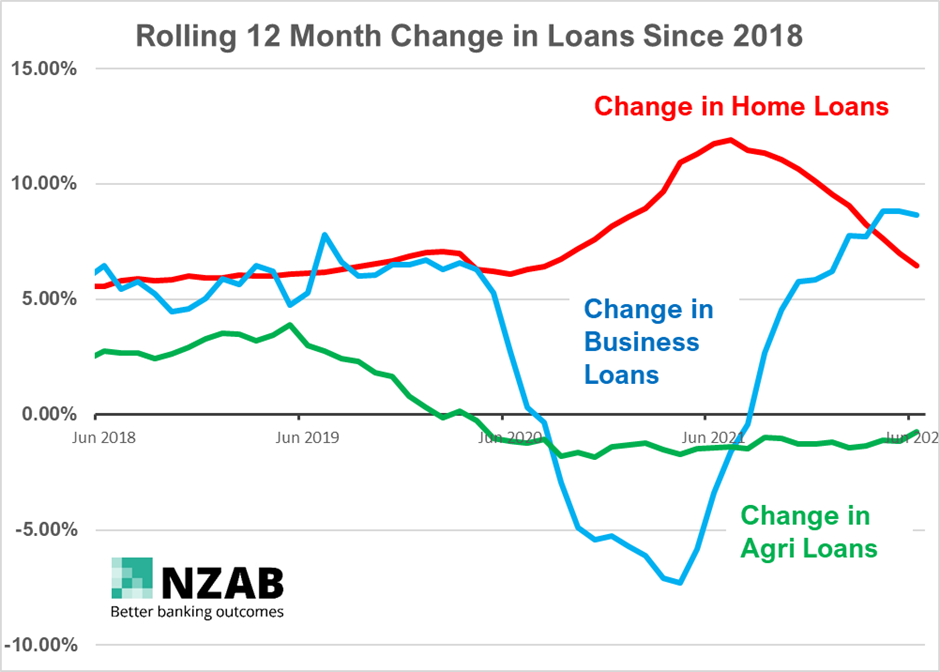

So, let’s look at the data. The graph below shows the level of total annual bank Agri IP’s (Main banks + Rabobank + Heartland) as a percentage of their total advances since 2018.