Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

Foreign direct investment (“FDI”) into New Zealand agriculture has been a political hot potato since it became a significant election issue in 2017, leading to material changes in OIO regulations, materially restricting FDI into New Zealand farmland on the back of it. The regulations enacted at the time had the effect of restricting any investment into New Zealand land that was >5ha in size, with exceptions carved out for minority stakes in entities that hold land (<25%) and also those that deliver significant economic benefit to New Zealand (something that has been subsequently difficult to obtain as an exception).

However, the majority of economic data suggests that foreign direct investment (FDI) is advantageous to those countries that receive it. FDI promotes efficiency by enabling the allocation of resources to their most valuable purpose and introducing innovative technology and managerial methods that stimulate competition for resources, increase business revenues and enhance productivity growth.

In short, it creates more economic prosperity.

With the imminent change of government, plus the growing need to ensure New Zealand remains a high value economy in the future and funds all its necessary infrastructure upgrades, the discussion on FDI is about to amplify.

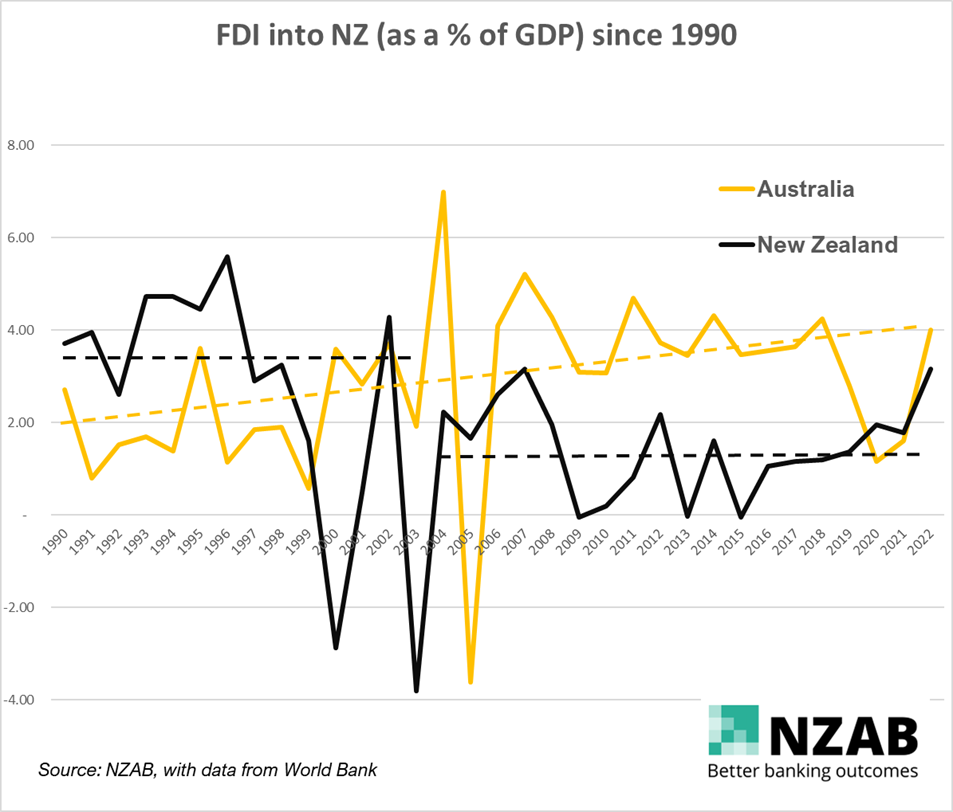

Let’s start this discussion with a graph. Below is all foreign direct investment since 1990 into New Zealand as a percentage of GDP compared to our nearest neighbour, Australia.

It’s a bit of a noisy graph, but it’s a clear game of two halves. From 1990 to the early 2000’s, New Zealand was the recipient of significant amounts of FDI into New Zealand, but since the early to mid-2000’s we have clearly stepped back versus our neighbours.

And these numbers are significant.

Since 2010, Australia has averaged FDI of 3.36% of their GDP and we’ve averaged 1.74%. Putting that into real numbers for the New Zealand economy, that is the difference between receiving a further $145bn of investment over that period (at 3.36%) versus the amount we actually received - $75bn (at 1.74%).

That’s a net “lost opportunity” of $70bn of investment into New Zealand.

New Zealand is well known to have a shallow capital base and having a more open investment setting can become economically self-perpetuating - lowering the perceived risk premium that New Zealand has traditionally had to bear. Investment settings that are more “open” typically result in asset values correlating more closely to productivity changes as capital is allowed to follow the sectors that are performing better (or in the case of poor performance, away from that sector). In other words- those industries that are doing better, get more capital chasing them.

More capital into New Zealand at lower risk premiums also has a spin-off benefit of ensuring that New Zealand interest rates don’t get too high versus its peers.

The converse is true too – when an industry has restricted access to investment capital, business growth has to come from either retained earnings (fine, but not that quick) or by debt via the established channels (New Zealand main banks).

However, when it come via NZ main banks, recent history has shown this has a tendency for their capital to directed to places where it is easy to place debt, i.e houses.

This creates a distorted flow of capital as the asset classes go up (or down) in value based on where that capital is allowed to participate - not based on whether it’s a good place or not from an economic perspective.

We’ve seen that play out in New Zealand with our pandemic housing bubble, all at the expense of further investment into New Zealand business and agriculture.

The restriction on FDI into New Zealand farming comes from a fear of loss of control.

The arguments against foreign investment into New Zealand normally fall into one of a few categories:

- Loss of control: When foreign investors acquire significant stakes in New Zealand farming businesses, there is a fear (perceived and real) of losing control over the important decision-making processes. This can create fear of the potential impact on the direction and priorities of the farming operations, including environmental and sustainability practices.

- Profit repatriation: Foreign investors may prioritise profit repatriation, meaning that a portion of the profits generated by the farming businesses may leave the country, leading to an impact on the local economy and reduce the reinvestment of profits within New Zealand.

- Competition for resources: Increased foreign investment in the farming sector may lead to intensified competition for resources such as water, land, and other inputs. There is a fear that this could potentially have an impact on local farmers who may then find it difficult to compete for the resources themselves - effectively becoming "priced out of the market"

- Impact on local communities: In some cases, foreign investment can lead to changes in the structure of farming operations (forestry investment a case in point), which can result in the displacement of local workers, reduced employment opportunities within the sector and the breakdown in the fabric of some of our social communities.

However, we need to have a mature conversation about this - there are plenty of regulatory settings that sit in between “nothing” and “everything” when it comes to investment into New Zealand Agriculture businesses.

1. FDI provides access to capital and resources that can significantly boost agricultural revenue generation.

Offshore investors bring in financial resources, advanced technology, and management expertise, which can enhance the efficiency and competitiveness of local agricultural businesses. This introduction of capital can allow for further modernisation (i.e land use change) of farming practices, the adoption of innovative technologies, and the expansion of agricultural infrastructure. These advancements can lead to increased productivity, higher yields, and ultimately higher revenues.

2. It helps to diversify New Zealand's agricultural sector into new markets with higher value products

Further investment, and particularly where it brings in new markets and experience, can result in a wider and higher value range of food products that can be grown and developed thus reducing the country's reliance on traditional products. This diversification can actually enhance environmental sustainability and reduce vulnerability to market fluctuations, climate change, and other risks. Offshore participants often bring knowledge of global market trends, facilitating the identification of new export opportunities and the development of niche agricultural products, which can stimulate economic growth.

3. It can add a further shoulder to increased productivity. New Zealand is a world leader in productivity, but with the exponential increases in scientific development, we’d be naïve to think we will remain the most efficient when it comes to transformation of physical resources into greater revenue streams. Offshore investment can promote knowledge transfer and technological innovation. The right investors bring with them expertise and experience gained from operating in different agricultural systems.

4. FDI can stimulate research and development (R&D) initiatives. Successful companies at scale tend to invest in R&D activities to improve their products, processes, or market competitiveness. This investment in agricultural R&D can have spillover effects on the broader sector, encouraging the development of new technologies, innovative farming techniques, and sustainable practices. This can strengthen New Zealand's position as a leader in agricultural research and innovation creating further revenue opportunities as we export those newly created products and services to the world.

5. It can contribute to regional development and job creation. Investments in agricultural operations, where there is a revenue enhancement can often generate more employment opportunities, both directly and indirectly, in rural communities. New Zealand's agriculture sector is primarily located in regional areas, and foreign investment can revitalise these regions by creating jobs, improving infrastructure and supporting local businesses.

6. FDI can also facilitate international market access and trade. Foreign investors often have established networks and market connections in their home countries or other international markets. Their involvement in New Zealand’s agriculture can provide local producers with access to new markets, distribution channels, and export opportunities. This can be particularly advantageous in regions where there are trade barriers or limited market access. By leveraging the global reach of foreign investors, New Zealand agricultural products can gain exposure to a wider customer base, leading to increased exports and higher revenue.

Whatever settings we choose, they need to be simple, and of a sufficient time horizon so that it encourages investors to place capital with a “generational” mindset.

We’ve seen the impact of previous settings creating market distortion - up and down. The significant tightening of overseas investment in 2015 versus the relaxed attitude to offshore forestry investment over the last few years are but a few cases in point.

New Zealand needs to create a consistent and enduring framework so that investors feel comfortable that New Zealand is a sustainable place to invest AND have the ability to extract their capital, if they wish to. Fear of subsequent policy changes creating regulations that results in their capital becoming “captive” will detract from investment in the first place.

The default mindset cannot be one of the fear of “selling the family silver” but needs to be one of genuine partnerships. In other words, working towards the equal pairing of great New Zealand farming, processing and marketing talent, with offshore business and investors that have the same or enhanced attributes.

The exciting thing is that there is significant capital offshore that is ready to participate in New Zealand agriculture as long we create an enduring and modern investment environment and connect them with the right pathways for investment.

This article is not designed to champion the sale of farming assets to offshore buyers.

It’s to start a conversation about what the right settings are for sustainable long-term players to partner alongside New Zealand farmers to grow our farming businesses in a highly competitive, ever changing world market and environment.

Our current settings are not correct. At this rate, New Zealand Agri Inc can only hope to achieve the future revenue growth via the growth in retained earnings or increased debt funding. We all know that won’t be enough, nor will it be sustainable.

A very simple, yet highly effective shift would be to increase the maximum offshore ownership in NZ farming companies to 50%. Sophisticated offshore investors would be very interested in the genuine partnership that metric (50%) provides for as opposed to the “minority” 25% setting.

To finish this article, I’d like to showcase Ireland. Whilst we think Australia might be more accepting of foreign investment than New Zealand at ~4% of GDP, Ireland is next level. They have accepted a staggering >20% p.a since 2010. Their GDP is now at an extraordinary NZD$175k per capita versus ours at $80k.

There will be all sorts of positive and negative implications of that level of FDI, but it’s hard to argue about the correlation between that and economic prosperity.

Who is NZAB?

.jpg?width=540&height=360&name=NZABStaffGroups55%20(1).jpg)

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz