Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

We thought we should follow up on an article we wrote recently about the banks subsidising their shrinking home loan margins by expanding Agri and Business margins to maintain (and even grow) their profit. Indirectly, those actions lead to a profitability drag on the Agri and Business sectors – all to the benefit of ensuring that home loan activity remains more buoyant, which is an easier place for the banks to lend.

The article was featured in The Farmers Weekly with some comments from banks offering divergent views on this.

We were then fascinated to subsequently see two main banks, when reporting their results, talking about the intense competition driving home loan margins in New Zealand to unsustainable levels.

One direct quote was that ‘pricing conduct in the New Zealand home loan market is “difficult to reconcile” and offers “unsustainable returns’

Also, “[the] margin on new home loans is currently less than half of what [the bank] gets in Australia”.

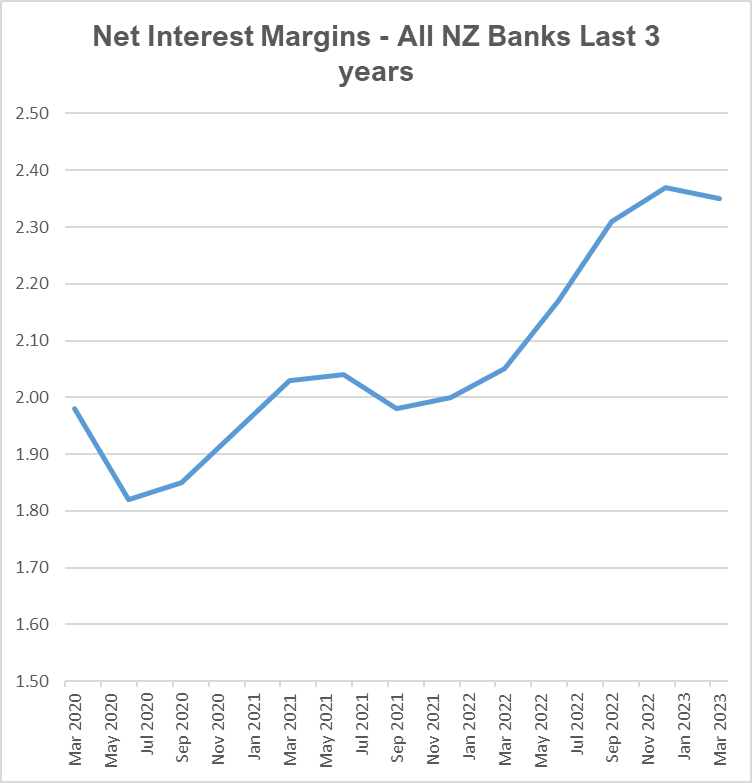

What’s really interesting is now taking those comments in the context of overall bank margins in New Zealand. See the graph below, which is taken from RBNZ data showing the total “net interest margin” for all banks' loans over the last three years. This is the combined margin for all lending that banks do – Agri, Business and Home Lending.

So, we have margins at the highest levels we’ve seen since 2015, yet, we have the main banks saying that their home loan margins are being unsustainably squeezed? It’s not hard to conclude which sectors (Agri & Business) are then doing the heavy lifting to maintain those high overall margins.

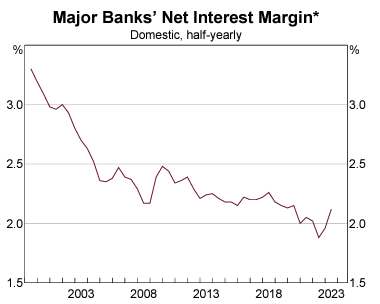

A quick look across the Tasman at the Australian banks net interest margin confirms two things (see graph below, source, RBA).

One, their overall margin is lower (currently at ~2.15 vs NZ 2.35) and two, given their sentiment about home loan margins in Australia being “double” what they achieve in New Zealand, it’s easy to draw the conclusion that the margin on their Business and Agri customers in Australia must be much lower than New Zealand as well.

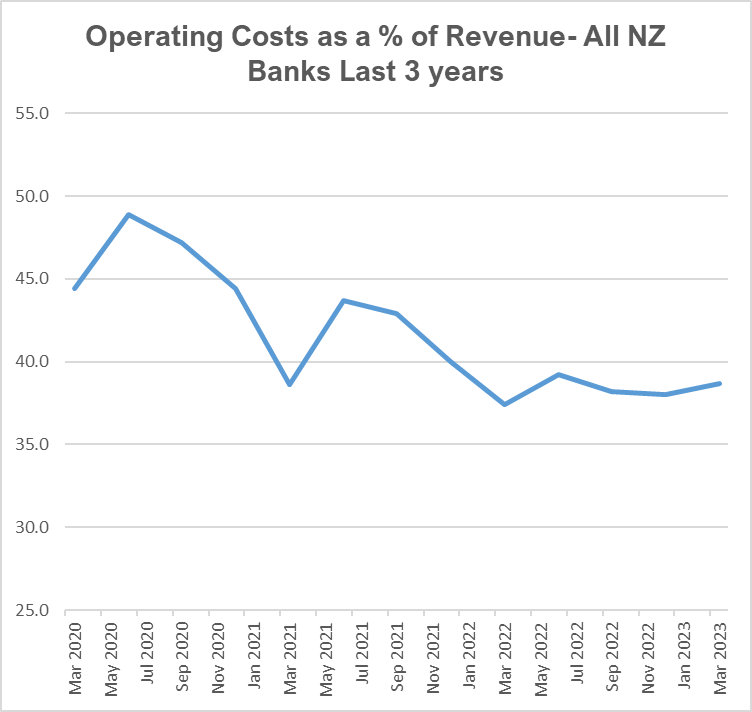

Revenue is only one measure of bank profitability, but a quick look at the New Zealand banks operating costs also shows the profit margins are widening as well with operating costs % at all-time lows versus total revenue.

So what does all this mean?

The fact that banks are profitable should not be a source of distaste. The stability of their profit enables strong lending ability and their own ability to weather stress in the economic cycle.

Also, I don’t know if calling for regulation to prevent this margin shuffle happening is the right thing to do. It rarely works in practice.

The most direct thing that a farmer can do is to do the same thing that the home loan market is doing, encourage competition.

Those farmers that present their strategy and their credit well to a bank and actively engage in creating a market for their loan see benefits over those that don’t.

All bank’s are still very active in the market for rural lending. After all, Agri lending in New Zealand has a history of low losses and the margin returns are pretty compelling.

Don’t be the farmer that sits on the side taking what you’re offered. Get your business into the right shape and present it in a manner that multiple banks would want to chase. That doesn’t mean that you should need to change banks to achieve this, but it does mean that you might need some help on how to navigate this or how you might improve your business over time to get there.

We’d love to help. We’re all about better banking outcomes, so if you want to review your business to understand where you might sit, drop us a line today on 0800 692 212, email us directly, or fill out this form and we’ll be in touch.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz