Plan Early – Next Year’s Payout is a Guessing Game with Serious Implications

While the continued fight against Covid-19, the economic down turn and the relentless drought conditions are taking up much of our focus at present, for our ever important farmers the game must go on.

With that said, it’s that time of the year where we need to be starting the process of setting budgets for the next financial year - and the question on everyone’s mind will be “what figure do we use for payout”?

On top of our usual considerations when addressing this question, we need to take into account the significant change happening in the world right now, as this could obviously impact payout.

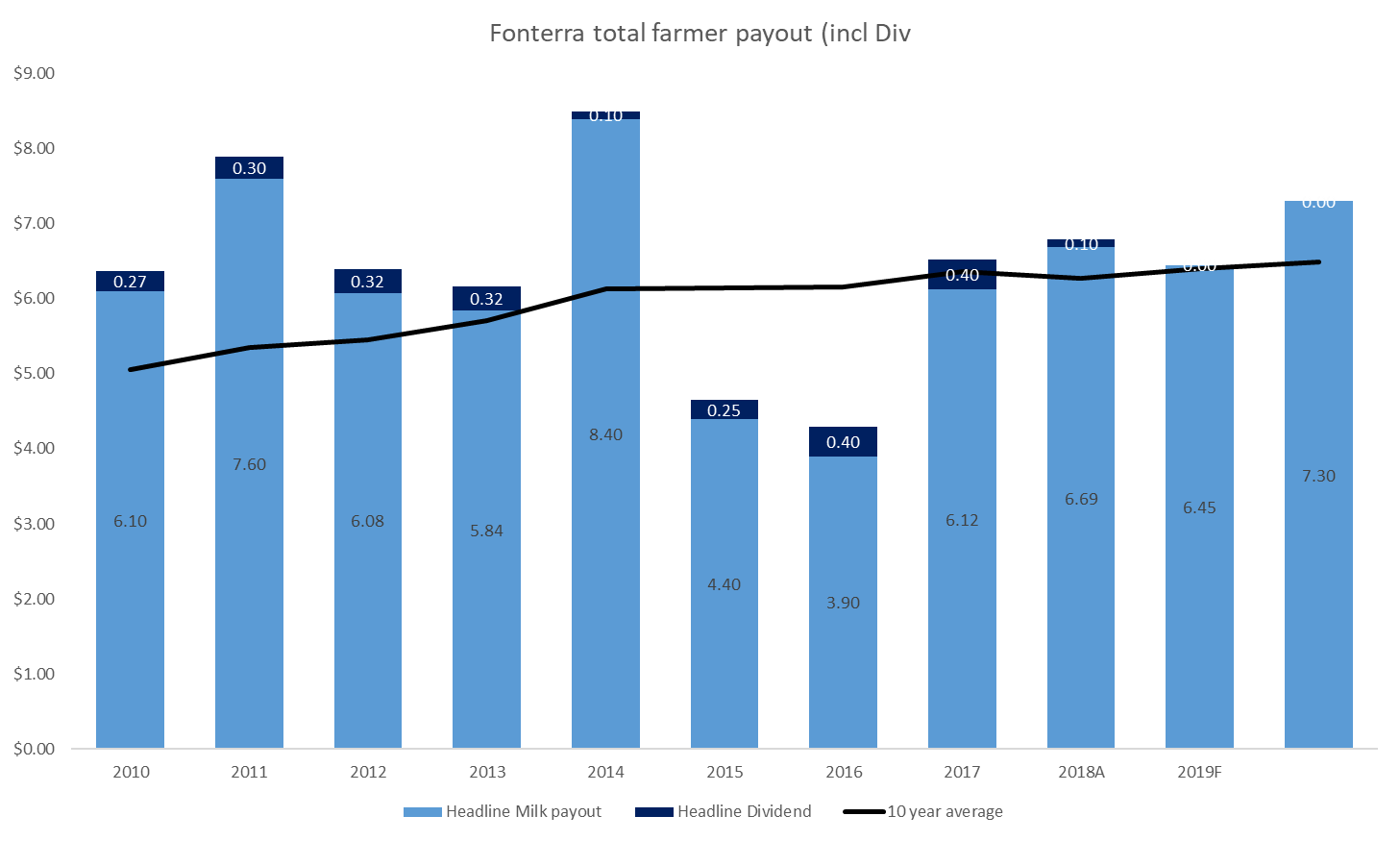

As a starting point, the above graph shows the last ten years of payout for a full shared farmer, with the trend line through the top reflecting the rolling 10-year average. Currently this sits at $6.28 milk price with a 22c Dividend - making the average return $6.50.

It can also be helpful to consider the predictions of other current market participants, for example Rabobank was indicating a payout of $5.60 and NZX had theirs at $6.49 (bearing in mind they both noted the high level of volatility in their predictions).

Yes, we do need to start somewhere, but after being in this industry for a long time, I can assure clients that the variation between opening forecast and what actually eventuates is significant. Put politely, it’s is a guessing game – and now more than ever that is the case.

The usual pitfalls of not conducting a sound budgeting exercise will become a lot more damning in this current climate. Working capital availability is by no means guaranteed. Fail to budget realistically and you will be faced with an unexpected working capital deficit and a situation where it’s too late to be instigating expenditure cuts. This can all eventuate in covenant breaches with your bank and an unwelcome review of your facilities.

Last year we advised customers to set their budget at the current 10-year average at that time (in April 2019, this was about $6.22 for milk only). This was despite the current forecast at the time being $6.75 (mid-point) and growing. The result was a sea of green with variance reporting plus good decision making on debt repayment and capital expenditure (i.e restrained, but with trigger levels for more as payout certainty increased on the upside)

This year, we were considering taking a similar approach (using the 10 year average), but ensuring there is a greater level of buffer, after allowance, for compliance capital investment or repayments.

BUT considering the current climate, a more conservative $6 is what we consider to be an appropriate starting point for now.

Milk Payment Cashflow Details Matter.

Given that typically 80% of this is paid in the “Advance to May”, this means $4.80 plus the deferred from this year – currently c $1.70 left, which gives us an overall “cash” payout of $6.50.

With the high level of uncertainty at present, our early budgets must be living documents with flex to shift with whatever the economy throws at us.

Remaining poised to respond to a change in this year’s forecast (FY 20) as well.

Some commentators are expressing the possibility of something lower than $7.30. We would advise the assumption of a c. 15c retraction in this (so say $7.15). This will directly impact FY 21 cashflow, as opposed to this year, making the deferred payments less (say 1.55 now) and overall payout more like $6.35 total.

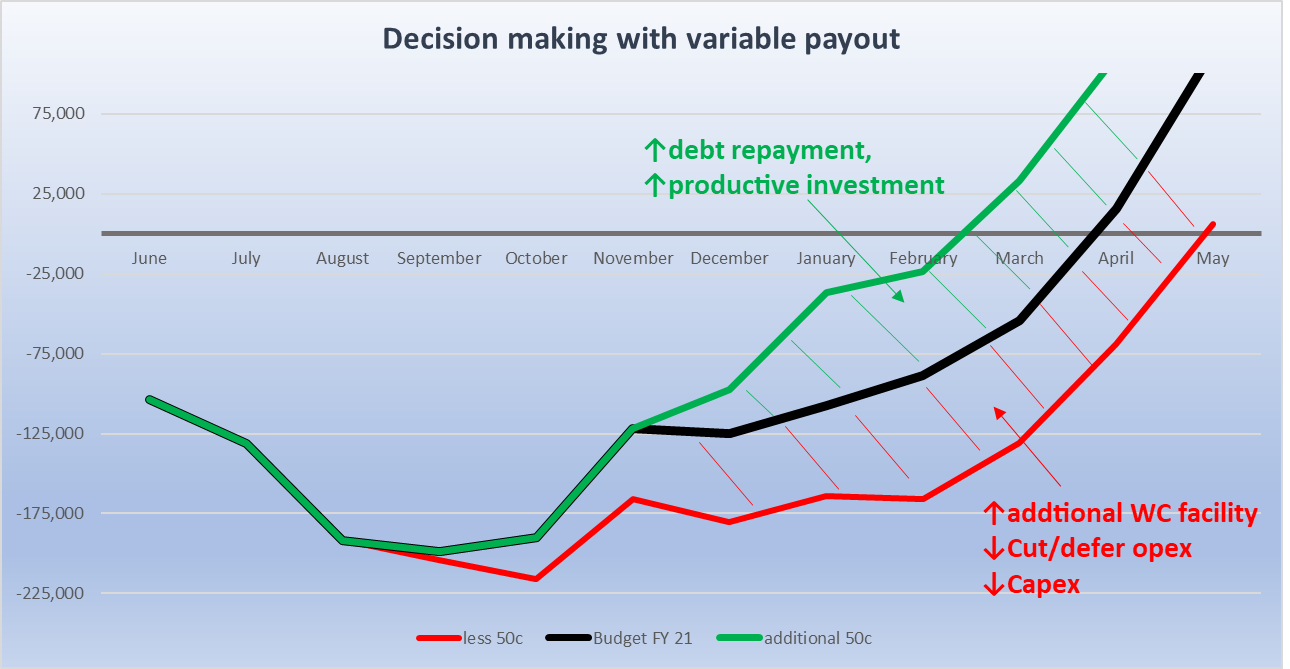

Understand what a change in payout means in real dollars and have operational and capital responses pre-planned.

As mentioned earlier, this could very easily impact payout so we need to prepare accordingly.

This starts with a best effort at understanding the size of the potential impact.

We will be running at least one other scenario at 5.50 (meaning $4.40 advance to May) and then another of $6.50 ($5.20 to may) which will then allow governance to make decisions. These decisions will be wide ranging but will ultimately fall into two categories to ensure working capital is sufficient:

- Operational changes or deferments (where possible)

- Capital re-allocation or requests for further capital .

Examples of this are structuring amortisation to be later in the year, or deferring R&M/capex on the same basis. For others it might simply be getting additional working capital limits in place now.

Above all, keep our eye on the prize

Ultimately, if payout does fall substantially this year, let’s take heart and maintain

perspective. Experience and trends have shown us, despite any significant events such as the one we find ourselves in at present, payout still follows a very consistent flat trajectory over a 10-year average.

Whilst dairy payout is only one variable in the budgeting process, it’s an important one at that.

We can’t change the environment in which we operate, but we can change how we respond,

The key is to make sure you can weather the likely volatility so you can benefit on the upside as well.

Forewarned is forearmed – and we are here to help you navigate any storm we may endure.