Information only disclaimer. The information and commentary in this email are provided for general information purposes only. We recommend the recipients seek financial advice about their circumstances from their adviser before making any financial or investment decision or taking any action.

We’ve dived back into the RBNZ data to see all the main bank movements over the last six months - all the changes in lending, who’s winning market share and who’s losing it in both the Agri and Business Lending Sectors.

In this Issue:

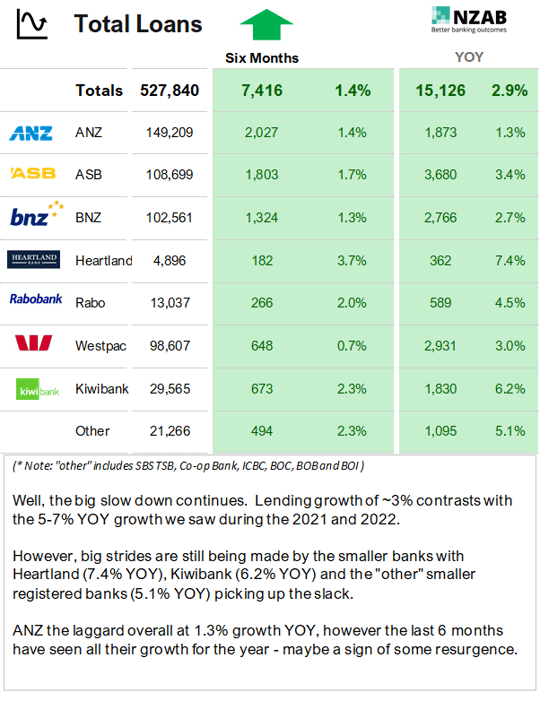

- The big slowdown in credit growth continues with half the lending growth over the last 12 months than we saw in 2021 and 2022.

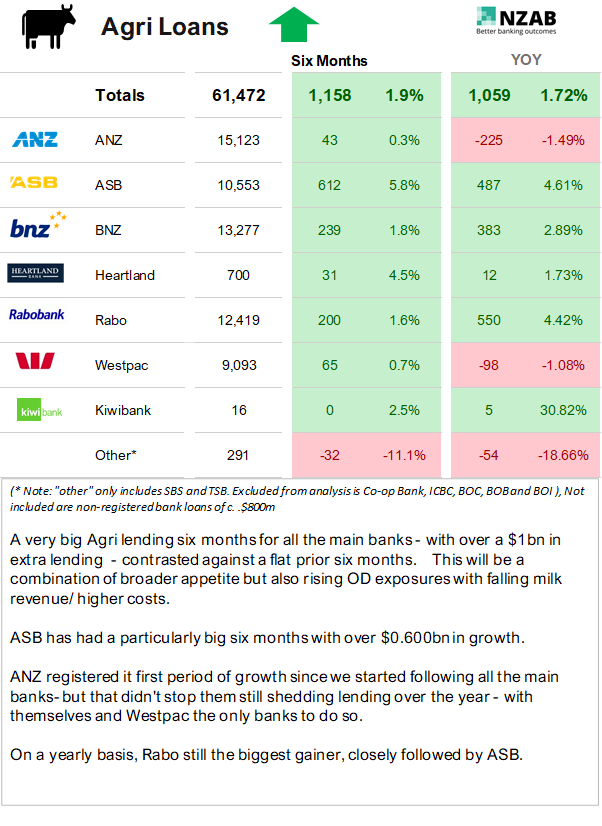

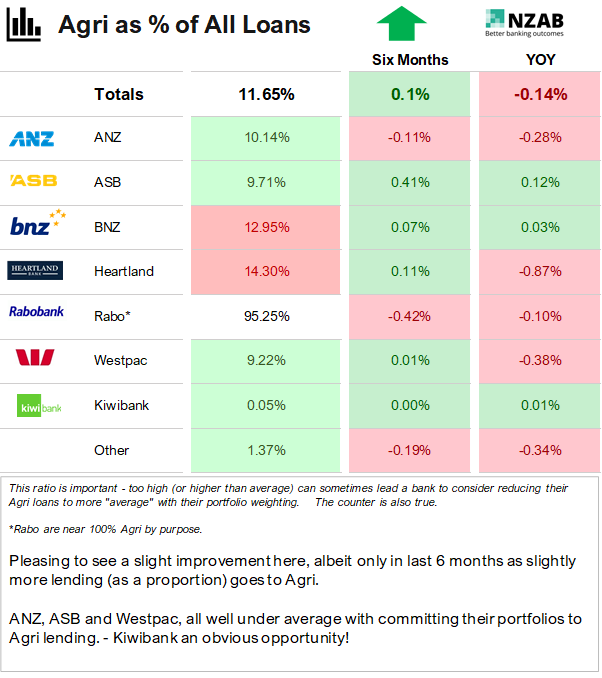

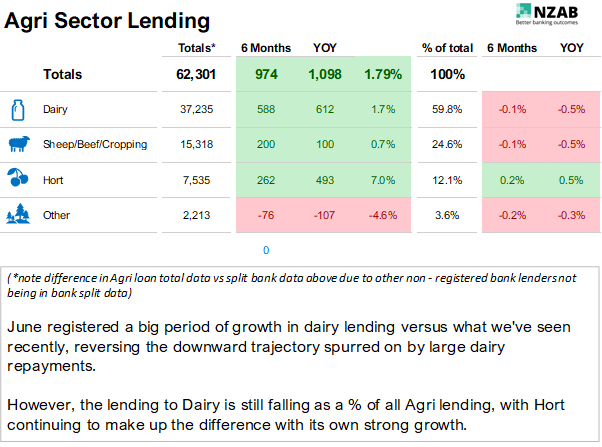

- A turnaround for Agri lending with over a $1Bn in new lending to the sector over the last six months on the back of stronger bank appetite, but also the build up of overdrafts with falling payout and increasing costs.

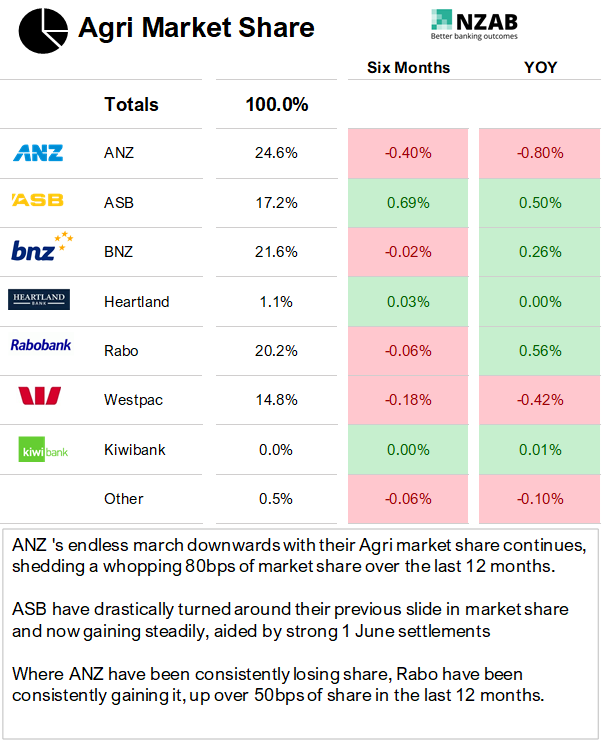

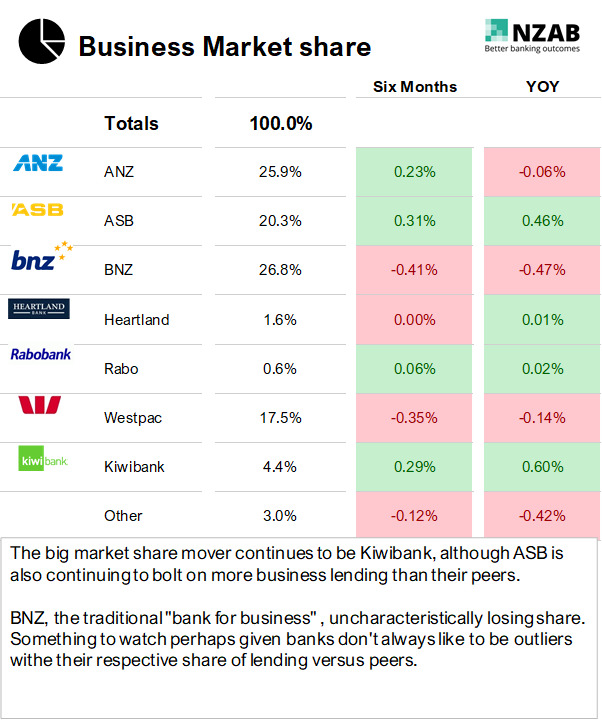

- ASB and Rabo continue to grow their market share strongly, with ANZ's endless march downwards continues, shedding a whopping 80bps of lost market share over the last 12 months.

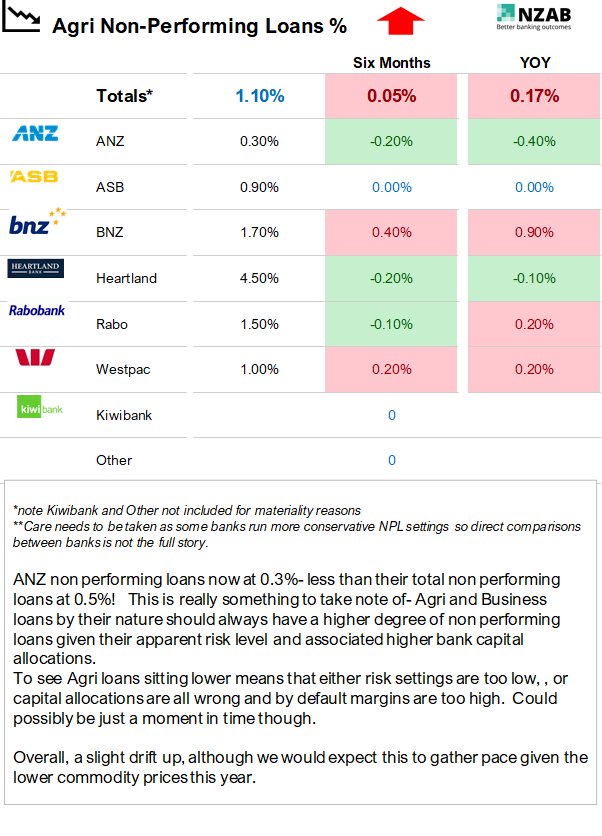

- And on performing loans still quite low, a sign of relatively good credit in the sector. However, we would expect these to grow significantly over the next 12 months. There's now also one bank whose non-performing loans in Agri are actually lower than their total book as a whole, this could be a sign of too weak credit appetite or are they simply are well prepared?

As always, please sing out if you have any questions or would like to use the data in your own presentations or engagement with customers.

Who is NZAB?

.jpg?width=540&height=360&name=NZABStaffGroups55%20(1).jpg)

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz