|

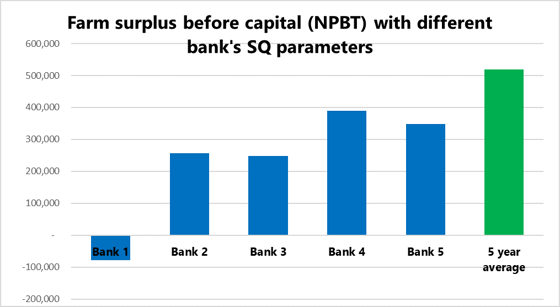

Status Quo (SQ) budget testing has been around for decades as a way for banks to assess viability for credit purposes. Some banks call it “Sustainable Year” and use it as a proxy to show a theoretical single year that smooths out the inherent ups and downs in farm production, expenditure and product prices. In layman’s terms – it's a snapshot of an “average” year which banks use to “stress test” a customer using the banks' own parameters for commodity prices and interest rates Each bank has its own SQ parameters, including their forecast for milk payout, other commodity prices and interest rates. But what started out as a way of measuring an average year for farmers, has over time turned into something of a ‘dial’. A dial banks rely on for turning their risk appetite up or down, and therefore deciding the amount they want to lend to a sector This all makes sense, right? – it’s fair enough that a bank can set its own parameters depending on how they see the risk in that market, that’s their prerogative. But what happens when the farmer takes on their banks SQ parameters, and models their own investment or divestment decisions solely from this? Well, therein lies the problem. Let’s illustrate with an example: Below is a graph depicting the farm surplus (before capital) that would be generated under the different bank’s criteria. The farm in question has $27 debt per kgms and an average cost structure.

|

|

|

As you can see, each bank has significantly different ways of looking at your business from a financial perspective. All of them vary greatly from market average as well. Now, just imagine you’re with bank 1. All you’ll be hearing about is how you’ve got too much debt, you need to get your balance sheet right, and until such time any new proposal you’re looking at is not supportable etc. On the flipside, if you’re with bank 4, you might formulate a view that is far too optimistic of the real world and therefore go ahead and make an investment decision that puts your business under stress down the track. You know your business best – so don’t just change your metrics to suit the bank's criteria You can quite quickly see how a bank’s view of the world starts to become your own if you let it, but this is a dangerous move to make; one that may see you cut short in your full potential, or suffer the consequences of extending yourself too far. The point is simple, you cannot rely on a bank’s own parameters for testing your business decision, as they are representative of, and biased towards the lending appetite it currently has or hasn’t got. We hear of plenty occasions where banks are saying to farmers “we need you to get your business to a position to meet our criteria.” This can sometimes lead to “encouragement” to divest assets, often at a very ill-opportune place in the market. But if your bank is making these assessments based on non-market based parameters – is that right? Back yourself, budget thoroughly and take control You should never expose yourself to be at the mercy of only one lender’s criteria. As we all know, that criteria (appetite) can shift at any one time. Make sure you get your business to a point where it can always meet multiple lenders criteria. That way you’ll never be forced to make decisions in your business that will ultimately hurt your hard won equity. ALWAYS present your own “SQ budget” A bank will typically extrapolate this year’s results with expenditure into their own “SQ budget” - so if you don’t do it yourself, your bank will do this behind the scenes for you. And reap the benefits that come with that When you do get your business in this shape, you’ll also find that banks will be fighting for your business and you’ll enjoy the best interest rate and conditions the market can offer.

|