Are you ready to weather the credit storm that’s coming? Getting your timing wrong with working capital can cost you a lot in capital loss, bottom line profit, or worse still, your farm. It really does pay to plan and prepare because the sooner you act the better off

you’ll be.

We have an analogy we often refer to here at NZAB:

“For some farming businesses just seeing the fire is not enough to take action, they have to actually touch it and get burnt before they really kick into gear and change”.

Unfortunately, and sadly, with this strategy - it’s often a case of too little too late. We’ve seen some sad stories that could have been preventable with the right level of planning.

With the implications of Covid-19 bearing down on us, now more than ever is the time to get prepared. The famous kiwi mentality of ‘she’ll be right’ will not wash at a time like this. Farmers must be proactive, not reactive. There simply won’t be the level of working capital availability we are used to, so rather than becoming a casualty of this, our advice to simple: plan early and review often.

Farmers need to be looking at their businesses very closely, understanding all of the layers and understanding all operational changes available to them, ahead of the game, so there is a very clear picture of the working capital required to sustain the business through this economic downturn, and equally an assurance that level of capital can be secured.

Whilst it pays to plan and prepare for the worst, it’s also important to have a recovery plan in place should things turn out not as bad as predicted so you are poised and placed to take advantage of any upside.

Turning the focus away from agriculture for a moment.

Our wider team have a number of non-farming business advisory and governance roles.

Some are in hospitality and tourism. This has given us first hand exposure to the revenue lines of these businesses’ being destroyed by Covid-19. But, in the face of that, we’ve also seen how agile they are to change, and how quickly they have faced their new reality. They have had to enforce deep seated change when their key metric – revenue – has declined rapidly.

The speed and magnitude of change has been astounding. They weren’t going to sit back and watch their businesses and livelihood crumble beneath them.

Like any business, these operators’ oxygen is profit. It is their life blood. It employs their people, it pays their own shareholder returns and creates enterprise value. The difference between them and our farming clients is they often don’t have the same tangible balance sheet items like land to fall back onto when times get tough.

Maybe that’s what creates and forces this culture of agility, efficiency, value, survival and velocity when their market goes against them.

So, in reflecting on this in tandem with the heart and soul of our business, our farming clients, it got me thinking - do we think and move at the same pace as these businesses I refer to above?

Our farmers too strive for profit, and they are forever required to adapt and change operations and budgets due to the unpredictable and turbulent nature of farming. One downfall we have been increasingly witnessing is a drop in the commitment towards a robust and multi scenario planning process, which is imperative for ensuring profit at all levels.

We believe this culture has been born out of an environment where access to capital (i.e. more debt) has been readily available.

This hard cold reality is this is a luxury we can no longer rely on.

Lots of farmers simply don’t have the wriggle room with their balance sheet retained earnings (or working capital limit runway) to be able to take this passive approach anymore.

NZ farmers are probably some of the most progressive farmers in the world, but how responsive are they really when their revenue declines?

Let’s face it, the majority of the farming population still complete their budgets for working capital calculation for their banks, rather than for governance decision making.

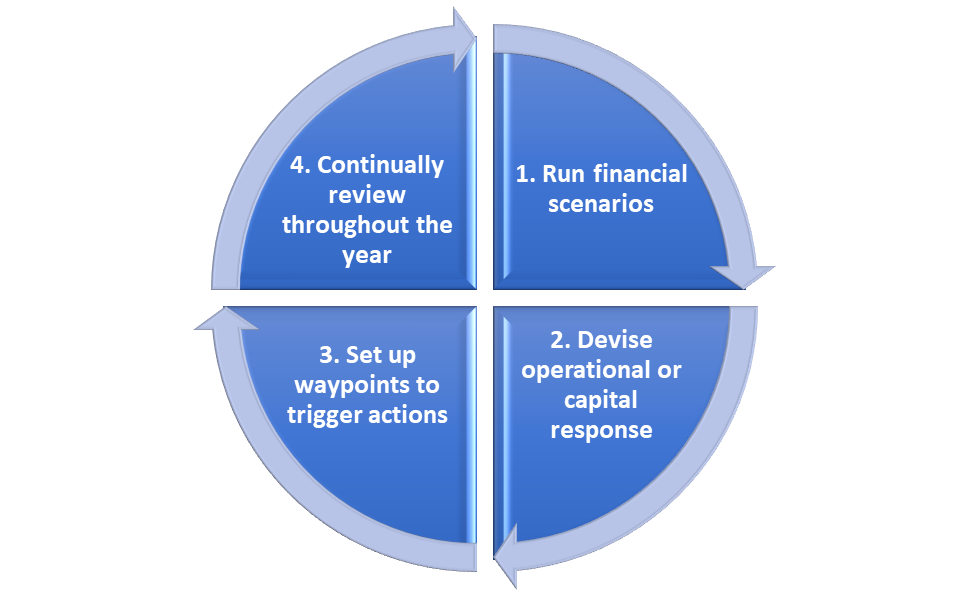

We think we should be introducing more governance agility to revenue change within farming businesses. And for us the message is: run more financial scenarios in your business and at lower levels than you even feel comfortable looking at.

- What are the outcomes of those scenarios?

- What do they mean to your business survival in 1, 3 and 5 years?

- What operational or capital change might come as a result?

Given we don’t know where our revenue in the farming year is actually going to land, a mixed approach is hands down the best option. There should be “waypoints” in the cashflow year so management can trigger any required operational or capital decisions, at those points, rather than leave it too late for you to do anything.

Prepare ahead and you CAN weather any storm. And if the storm doesn’t come, there is no downside, you’ll have a better business and be able capture further opportunity.

Most farmers have been here before, be it with the dairy downturn and/or the GFC. Some changed. A lot took on extra debt. Some didn’t survive.

Right now, the storm is building. Commodities are under pressure. Our key trading partners incomes are falling. Balance sheets don’t have the runway they are used to. Banks are reticent and cautious.

Let’s not fall into the trap of our default “she’ll be right” setting or unnecessarily admit defeat – dig deep into that passion for farming and determination to endure and let’s undertake the process of reviewing your business in full.

Here at NZAB we can help you identify your true working capital needs. We can help you model the different scenarios to make sure you have options ahead We can help weather this storm with you.

Now is the time for you to act before you may be acted upon.

Which one would you rather?