Now is the time to revise your cashflow forecast for the remainder of the season.

Now is the time to revise your cashflow forecast for the remainder of the season.

If you are a follower of our insights, you’ll know how important it is at the start of the season to meet with the bank and present your budget together with the key strategic initiatives, for the year ahead.

Being nimble and responding to change in the assumptions that made the original budget, is equally important.

Being better informed about where your business is right now, and what that means for the rest of the season leads to better on-farm decisions. This leads to better and earlier decisions around both “defensive actions” or “investment thinking”

Keeping in mind your original budget is locked and loaded, necessary changes for the remainder of the Financial year can be made in a “Revised Cashflow Forecast”.

When is a good time to review? - All the time!

We’re always reviewing clients forecast based on changes to performance or external factors and checking the impacts of those changes on the cash position of the business, and ability to meet obligations. However, now is probably one of the most important times to look at it.

Your original budget is likely to be based on Fonterra’s opening forecast of $6.15, with a production curve similar to last year, interest rates possibly higher than they are now.

Payout is now $6.80, Canterbury’s production has had an excellent start to the season, but a difficult October, interest rates continue to fall, and the budgeted export heifers may not go. There’s a lot to think about.

A Case Study: Pro-active forecasting leads to higher farmer confidence and better bank discussions.

Below is a recent example of a Customer’s revised cashflow completed after a thorough diagnostic on the remainder of the season:

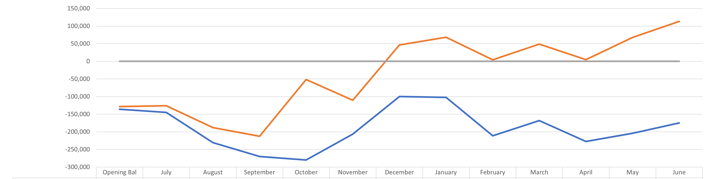

The blue line shows the budgeted cash position throughout the season and the orange shows the reforecast cash position.

As you can see, we were predicting a pretty difficult year, running close to the overdraft limit and managing cash was going to be crucial.

Four months into the year and the Customer is performing exceptionally well. Costs are well controlled, interest is down and production is up. Stock income is also well ahead of budget. Add to this the increased payout, filtered through to a much higher advance rate to May and our revised closing cash position is a whopping $288k better than budget. Even better the customer is out of overdraft and into credit.

Now it looks like the Customer is going to have one of the best years he has ever had.

This information enables the customer to make much better on-farm decisions. We can now have a progressive conversation with the bank around increasing principal payments and we can think about capital expenditure outside of the budget, as we know with greater confidence that we will have the cash to fund it.

The biggest factor though, is that the customer is sleeping better at night.

Happy Farmer, Happy Bank, Happy Days!

But, watch out for some common mistakes.

If you are looking at revising your cashflow, be aware of the common mistakes we have seen the odd farmer make.

Fonterra’s changing payment structure. FY20 Final was paid in September – make sure it’s not also forecast in Oct.

Be honest with your production and build in some buffer for uncertainty – it’s currently raining here but it was bloody dry before that!

Be aware of delayed or deferred expenditure (that you haven’t spent yet but had budgeted to by now), and “double-counting” stock sales.

In addition, make sure you give your accountant a copy and ask if your tax-planning needs to change.

A good place to start is a thorough look at your actuals to budget performance to identify variances and assess any trends emerging.

At NZAB, we believe information is power and is the key to making excellent on-farm decisions.