My daughter turns six later in the month, so to celebrate we had a big gathering of friends and family over the weekend. Thankfully no injuries on the bouncy castle (this time!).

Naturally the conversation turned to the recent election, but also the potential impact on farming from the National Environmental Standards released earlier in the year, especially given the election result and a continued swing to the Left.

I won’t begin to go into the detail of the standards, nor the potential options to manage and mitigate the potential impacts (nor our respective political views!).

What I would like to do is talk more broadly about what we at NZAB are seeing as the key themes in this space, and the potential impact on farming businesses and their ability to access capital going forward.

What is ESG? (Environmental, Social, Governance)

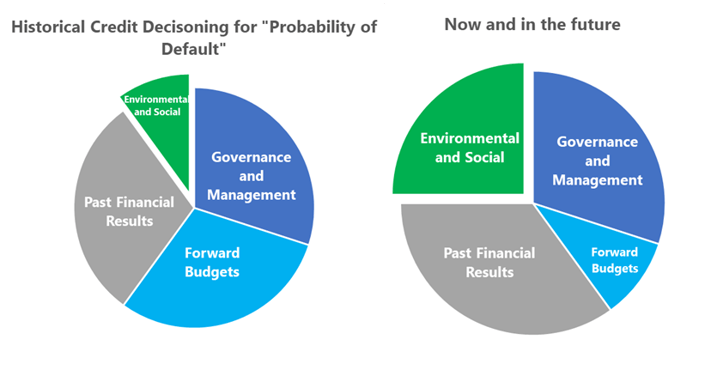

You will have no doubt seen or heard this acronym in the last while. Environmental, Social and Corporate Governance refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business. For investors, bankers, regulators and governors of businesses across all sectors, it is an increasingly important aspect in how they assess the future performance of companies (return and risk).

We’re seeing the impact of this already in loan pricing

In September 2019, Synlait Milk accessed a $50m loan from ANZ Bank that has its pricing linked to the ESG policies and performance of the company. This is a clear demonstration of how Bank’s are looking to incentivise good performance in this space, on the basis that it knows that key risks are being managed, but also that the business may reap economic benefits.

Similarly, the Auckland City Council has gone to the market recently, raising $500m via the issue of a “Green Bond” – essentially accessing funding on a long-term basis that is allocated to council projects with an environmental or sustainability focus.

The world is awash with so called “green money”. This pool of relatively cheap and long-term funding looks set to continue to grow.

Consumers are already valuing products that have great ESG fundamentals

You don’t have to go too far in the media at the moment to find examples of companies looking to leverage what they are doing environmentally to help appeal to consumers.

Recent examples include Fonterra’s Carbon Zero Milk; Anchor with plant based milk bottles; Southern Pastures purchasing Lewis Road Creamery outright as it looks to leverage its 10 Star Values Program; Bostock Chicken and its Bio-degradable Meat Packaging - the examples are endless and show the value consumers are starting to place on good practice in this space.

These are positive innovations and reflect a focus from NZ producers on meeting consumer needs, whilst hopefully driving higher returns within the farm gate. We are well placed as a sector to take advantage of these changes in consumer preference, the rewards represent the carrot rather than the stick.

So what about ESG in the Banking Sector?

As illustrated via the Synlait example, Bank’s are starting to put a much greater focus on both their clients, and their own, environmental and social policies.

We see this focus continuing to grow, and recent conversations with the Banking market suggest a much more detailed and objective approach to how they assess their clients performance, policies and practices in this area. We are also hearing the murmuring of increased pricing for those that don’t meet minimum outcomes (and conversely reduced pricing for those that do).

We also see a degree of anxiety as they too work through the impact of changes that will come from the NES and how they will impact both viability and security assessment in the farming sector. Another potential impact is that a bank may unilaterally sensitise your performance down if it thinks your current performance is not sustainable within currently NES level. If you can’t prove that your system is within it that will happen!

Bankers hate uncertainty, and right now we have plenty of that!

Its here, so as a farmer you need to answer these questions before they’re asked. Or worse still, you may not even be afforded the opportunity to answer it unless you are proactive with it.

The last 10 years has seen significant progress made across the sector as farming businesses have improved environmental practices and invested significantly in the management of their environmental impact.

We also have a much greater understanding of things like nutrient base lines, farm environment plans and the management practices that drive good outcomes.

That means that most businesses have little to worry about. But when it comes to dealing with the Bank, that doesn’t mean you can make assumptions around the Bank’s understanding of your environmental status and your ability to continue to operate the way you are currently.

So taking a good, structured and proactive approach to educating the Bank is critical. When was the last time you took your Banker through your FEP? Can you honestly say your Banker understands your current nutrient and environmental status? Have you articulated to them how much time and effort you put into managing key elements of compliance and what that investment means for your business?

Every interaction with the Bank is an opportunity to educate, to help grow the Banks confidence in you. Your environmental management is no different.

For businesses that will have some adverse effects from policy changes, are you in control of these? Have you started to form a view of what the impact may be on your business operationally and environmentally? Is additional investment going to be required to manage and mitigate these changes? Who do you have in your team advising and helping you? And what is the impact overall financially?

Having answers to these questions, or a plan to develop the answers, is critical. Without that, you run the risk of your Bank making assumptions, and likely developing a strategy for you predicted on a worst case scenario. That’s going to have a tangible impact on both your access to capital, but also pricing and conditions.

What is NZAB doing to help farmers in this space?

At NZAB, we are putting a much greater focus on working with our clients to understand and articulate their environmental and sustainability status. That means working with our clients to develop a clear picture that can be communicated to the Bank, but that also helps shape ongoing strategy and investment plans.

For most, that’s simply articulating in a structured fashion what’s already happening, emphasising the level of control and demonstrating clearly how the good environmental policy and practices will help support the financial position of the business going forward.

For others, its working through a clear plan to assess and interpret the current position, develop a clear picture of the potential impact of changes, and a detailed strategy as to how the business will manage that change. And a clear communication plan to the Bank that ensures they are always informed and have confidence that the right process is being followed.

This is not an area to leave to chance. At a minimum, this is about ensuring the Bank has confidence in what you are doing and isn’t left to make assumptions. At best, this is an area that if done well you can leverage – for better returns, better access to capital and better terms and conditions.