Do you have a farming business who has growth aspirations but you’re not sure how to fund this?

Are you a large farming business looking to exit some or all of your assets but want to leave some of your exiting capital in the sector, in a business and sector you know?

Do you have some capital, but not enough and want to make some bigger leaps in the farming sector?

Maybe you’ve got a farming business but feel that your current capital structure isn’t match fit, suited to your business needs or doesn’t allow you to sleep at night?

Are a wholesale investor and you want to invest directly into a farming operation and enjoy returns from both profit and capital growth?

Or, maybe you’re a wholesale investor and want a fixed return by advancing a loan to a first mortgage backed by land?

Are you interested in short- or medium-term loans with enhanced returns where the risk return equation is compelling?

In our last article we wrote about the key drivers of success including the need for deeper capital markets to support and encourage greater prosperity in New Zealand. We received lots of feedback on this article which demonstrates just how real these needs are.

(If any of the above examples resonate with you, click on this link and fill out the form and we will be in touch).

So, what is NZAB’s role in meeting these needs?

Since we started back in 2017, we’ve been on a mission to help farmers get back in control of their banking.

This means that we work hard to understand their businesses deeply and help them act with confidence so they can focus on what they’re good at, which takes the worry out of the rest.

For the most part, that means working with the farmer and their bank to ensure both sides get what they need.

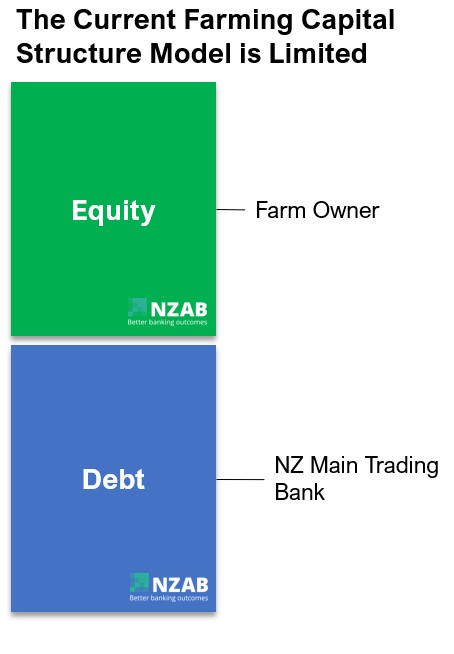

However, increasingly we are finding more and more need for non-bank funding solutions. This ranges from equity capital to private debt and everything that sits in between.

As good as New Zealand banks have been at providing debt capital, its simply not enough to cover the entire spectrum of needs of the Agri sector.

The current regulations in the banking sector have prompted banks to simplify their credit criteria and, as a result, limit the level of risk they are willing to undertake. Consequently, when farmers make a lending request, it often feels like trying to fit a square peg into a round hole. This mismatch can lead to fluctuations in credit appetite and a wavering of confidence within the industry, ultimately impacting returns and asset values.

Whilst there is significant capital in New Zealand and around the world the spectrum of currently available funding solutions for New Zealand Agri is actually quite limited. The reality is that our capital markets in Agri are thin and underdeveloped.

This does not imply that the banks are not excelling at their job; on the contrary, they are doing an exceptional job despite the challenges they face, such as balancing portfolio weightings, meeting shareholder equity return expectations, and navigating the cyclical nature of farming economics..

However, the sector needs other sources of capital alongside this to thrive.

There are lots of sound economic situations that don’t fit a typical debt criterion.

Think a young farmer trying to get into farming with a huge amount of talent, but not enough capital to get into an operation of scale.

Or a mature farming business that has a great balance sheet and is still paying back principal when their personal needs might be dictating otherwise.

Or how about a high performing and established business that wants to continue to expand on the back of their management capability but has to wait until their debt reduces or asset values change to access more capital for growth.

We also see lots of ‘start up’ businesses that need time for permanent crops to establish or markets to develop.

Fortunately, there are abundant reservoirs of capital, both domestically and internationally, that are either unable to access debt and equity investments in the agricultural sector or simply lack a comprehensive understanding of its potential. Among these sources are individual investors, funds, and other organized pools of capital that have yet to fully embrace the exceptional growth opportunities presented by agriculture, despite the undeniable strength of food-driven demand and its profound impact on the sector's economics.

New Zealand Agri presents a well-established and secure lending market, boasting a track record of profitability and minimal bank losses. Supported by robust food-based fundamentals and reliable trading partners, this market offers a compelling opportunity for lenders.

Behind these loans lie robust asset securities that appreciate in value over time. It's clear why five renowned banks with exceptional ratings have invested over $60 billion in this sector. The reason is simple – it has consistently demonstrated its potential as a lucrative and secure avenue to allocate capital.

The reason for the other pools of capital not playing in the Agri sector isn’t one of poor investment quality. It’s due to “access” and “understanding”.

“Access” is an issue simply because to get to the transactions you must have access to farmer relationships at scale and have the ability to turn production into risk scoring. Not easy to achieve unless you know how.

On the “understanding” front again it’s an issue of visibility as all of the understanding of the credit risk in the Agri sector has been held by the banks. The banks have built considerable systems over time that assess and benchmark farmers credit risk.

No outside provider has been able to examine properly the actual credit metrics of the sector which has led to thinking that the sector is “too hard to lend to”.

But it doesn’t have to be!

From scratching the surface, to a whole new market.

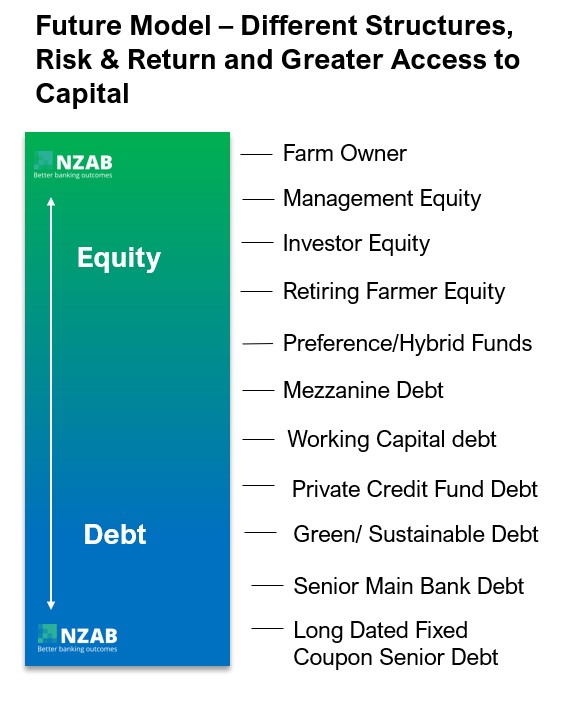

We are proud to look after more than $2bn of New Zealand farmers’ debt across New Zealand with our front-line relationship teams. During our time we have uncovered many opportunities that don’t fit within bank criteria and we’ve begun developing a network of alternative funders and investors to support or replace Bank capital depending on the need. We see this as an expanding opportunity. The knock-on effect of enabling these transactions to occur is significant.

We currently have extensive relationships with all major banks and other mainstream debt funders allowing us to offer farmers the simplest, most cost-effective, and highly compatible funding options. However, we recognise the potential for even greater opportunities by complementing this funding with a more substantial pool of capital.

To date, we have successfully facilitated the placement of over $375 million in non-bank equity or debt capital into the New Zealand Agri sector. Our advanced systems and streamlined processes enable us to offer investors the essential access and understanding required to close deals. This unique proposition sets us apart in the New Zealand market, providing unparalleled opportunities for growth and success.

So, we are launching a platform that allows us to match farmers’ capital needs with those of the investors.

This means broadening the horizons of the investor and funds market so they can understand the relative risk and returns in the Agri sector. Turning lambing percentages, feed eaten, trays produced, nutrient regulations, past and future financial performance and resourceful people into credit risk that’s easily understood and is invest-able at scale.

If we want to continue to enjoy a sustainable, growing, efficient and relevant farming sector in the future we need to keep innovating the way in which we get capital into the sector.

So back to the start - we want to hear from you.

Maybe you’re a farming business who has growth aspirations but you’re not sure how to fund this.

Maybe you’re a large farming business looking to exit some or all of your assets but want to leave some of that exiting capital in the sector, in a business and sector you know.

Maybe you’ve got some capital, but not enough and want to make some bigger leaps in the farming sector.

Maybe you’re a farming business but feel that your current capital structure isn’t match fit, suited to your business needs or doesn’t allow you to sleep at night.

Maybe you’re a wholesale investor and you want to invest directly into a farming operation and enjoy returns from both profit and capital growth.

Maybe you’re a wholesale investor and want a fixed return by advancing a loan to a first mortgage backed by land.

Maybe you’re interested in short - or medium-term loans with enhanced returns where the risk return equation is compelling.

If any of the above examples resonate with you, click on this link and fill out the form and we will be in touch.

We look forward to sharing opportunities with those that have already expressed interest.

*Please note, that any eventual investment will only be open to those who meet minimum investment thresholds or those that qualify as either a wholesale or eligible investor as per the Financial Markets Conduct Act 2013.

Drop us a line at any time - whether you want to chat more about your own success, access to capital or maybe you’ve also got your own pillars of success to share. Please feel free to reach out on 0800 692 212 or info@nzab.co.nz

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz